Recognising the impact of the COVID pandemic, the cost of living crisis and the ever-widening advice gap on financial wellness across the workforce, WPS Advisory were looking for a scalable technology-based solution to modernise financial advice, engage employees across different life stages and equip them with the tools and confidence they need to make smart decisions about their money.

Improving financial wellness and engagement for VOXI customers

Background

VOXI is a mobile network operator powered and run by Vodafone, offering its customers great value and recognising loyalty. VOXI Drop is an exclusive customer loyalty and benefits programme, with monthly rewards spanning beauty, tech, food or fashion products and more.

In 2022, we began working with VOXI to streamline the application process for their VOXI for Now social tariff, which offers anyone in receipt of government benefits unlimited calls, texts and data at a discounted rate as part of Vodafone’s support for people in financial difficulty.

The idea

With over half of Gen Z expressing concern about their financial situation, VOXI was looking for a way to reiterate their commitment to their customers’ wider wellbeing, provide a way to help them understand and manage their money, and for VOXI to understand more about the people that buy from them.

The solution

We built on our existing partnership to offer VOXI customers 12 months of free access to our award-winning consumer app through the VOXI Drop initiative.

The app allows VOXI customers to connect their different financial accounts (current, savings, mortgages, pensions, credit cards, investments, properties and more) to view their entire financial world in one place.

From there, they can utilise an ever-growing suite of tools to help them understand their money and reach their financial goals, including; Spending Budgets, Spending Analysis, Savings Goals, Rent Recognition, as well as an array of educational content.

The results

The response from VOXI customers and the market was fantastic, with recognition for VOXI’s dedication to helping their customers through the cost of living crisis.

Over 25% of licences were redeemed in the first week alone, and customers made quick use of the insights to help manage spending and set up savings goals, resulting in an average eightfold increase in savings pots within 6 months.

VOXI also receives anonymised, aggregated insights into the spending habits of their user-base, which they are using to support customer engagement strategies, and offer VOXI Drop rewards that are aligned to their customers’ interests.

“We’re delighted to build on our partnership with Moneyhub and underscore our ongoing commitment to supporting young people in navigating a challenging economic environment.

Now, more than ever, people need simple and effective ways to better understand and manage their finances. Paired with the unparalleled anonymised insights we now have into our customer-base and what matters to them, the rollout of this solution has proved to be a real win:win.”Scott Currie, Head of VOXI

Transforming pensions engagement through Mercer Money

Mercer understands the impact poor financial health can have on someone’s work life, and their retirement.

Mercer was looking for an innovative way to help support financial wellbeing for members of its Mercer Master Trust pension scheme.

It also wanted to make it easy for members to engage with and understand their pensions, and to view retirement savings in the context of their wider financial wellness.

Increasing credit scores and financial inclusivity with Loqbox

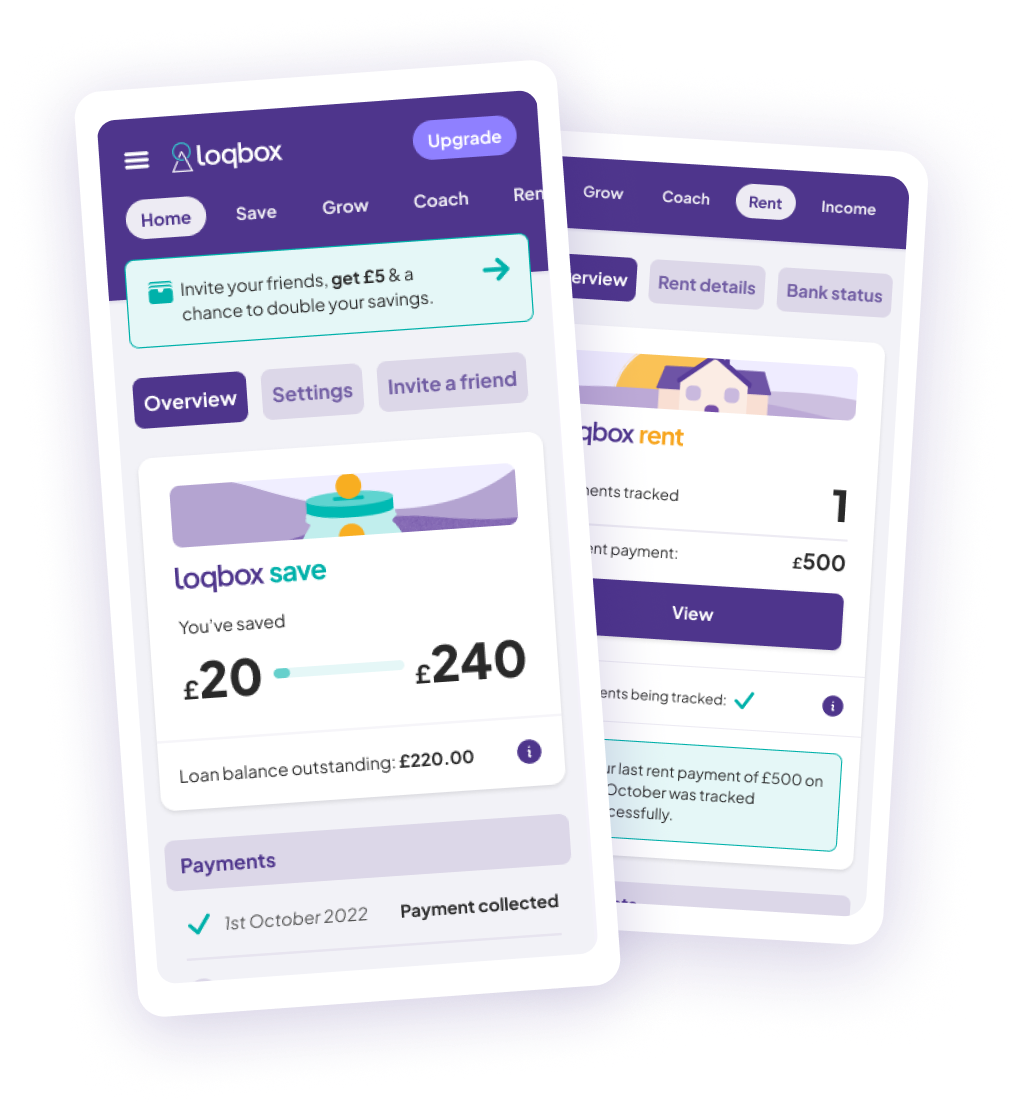

Loqbox is a financial wellbeing business that aims to give everyone the tools they need to live a richer life — both personally and financially. It’s here to help people build healthy, lifelong financial habits and improve their relationship with money. Their membership model offers innovative solutions like Loqbox Rent, which aims to help members build their credit scores by leveraging everyday financial activities, such as rent payments, so they can achieve their financial goals.

The challenge

The current credit scoring method is severely lacking. Over 5 million UK residents struggle with "thin credit files," and their access to financial products is often limited to more costly options. A failure to recognise regular rent payments as a measure of creditworthiness leaves many unable to prove their reliability to prospective lenders. For those renting who aspire to buy their own home in the future, this can make their chances of getting on the property ladder increasingly more difficult. Despite paying their rent on time and in full, this doesn’t contribute to improving their credit score when it comes to applying for a mortgage. With one in 10 people being put off applying for a mortgage because of their poor credit scores this poses a big problem to people’s home ownership dreams.

The solution

To help their users achieve their homeowning goals, Loqbox partnered with Moneyhub and Experian to launch Loqbox Rent. This feature allows Loqbox members to use Moneyhub’s Open Banking technology to accurately identify rent payments through its categorisation engine, allowing them to track and report anonymised rent payment behaviour to Experian.

A user can simply and securely link their bank account to Loqbox Rent, tell them the rent date and amount, and make payments as normal each month. This can help individuals boost their credit score and build their creditworthiness, meaning they can access fairer rates from lenders, which can save them £1,000s.

The results

Moneyhub and Loqbox have helped over 40,000 members with Loqbox Rent.

89% of Loqbox members who track their credit score, improve their score.

80% of Loqbox members felt better about their financial situation after using Loqbox.

9/10 Loqbox members recognise that taking charge of their finances has positively impacted other areas of their lives. 63% of members mention reduced stress, and 50% of members reference their mental health as an improved area.

Loqbox has achieved a 4.5-star rating on Trustpilot with over 18,000 reviews - “Since I started saving and my rent payments were reported to the credit agencies, I've seen an increase of around 100 points in my score.”

Hear from Sarah, a Loqbox Rent user, about how she improved her credit score with Loqbox.

“Being able to unlock the power of Open Banking in order to improve the financial wellbeing of our members has been revolutionary for those members currently renting but with desires to build their credit history. It's a very welcome additional tool to be able to offer our members." - Tom Eyre, CEO and Co-Founder of Loqbox

Nationwide deploys real-time savings account funding through Open Banking payments

Improving pension engagement and financial wellbeing with Scottish Widows

Building the UK's most engaging pensions app for Standard Life

“Developing the Money Mindset app with Moneyhub has been a game changer for us in the market. Pensions are one piece of the financial puzzle, and by providing a holistic view of their finances alongside educational content and tools, we’re empowering our members to make smart and confident decisions about their money.”

— Neil Hugh, Head of Workplace Proposition, Standard Life UK