Scottish Widows is a UK pension, retirement, and life insurance company that is a part of Lloyds Banking Group. It offers a range of pensions, bonds, stocks and shares and life insurance options to help people prepare for their futures.

The Challenge

With over 50% of the UK population needing to save more for their retirement and many people facing continuing challenges due to the cost of living, Scottish Widows recognised that they needed to make it easier for people to understand their finances. This has become especially crucial as achieving a sustainable retirement has become increasingly complex and out of reach for many.

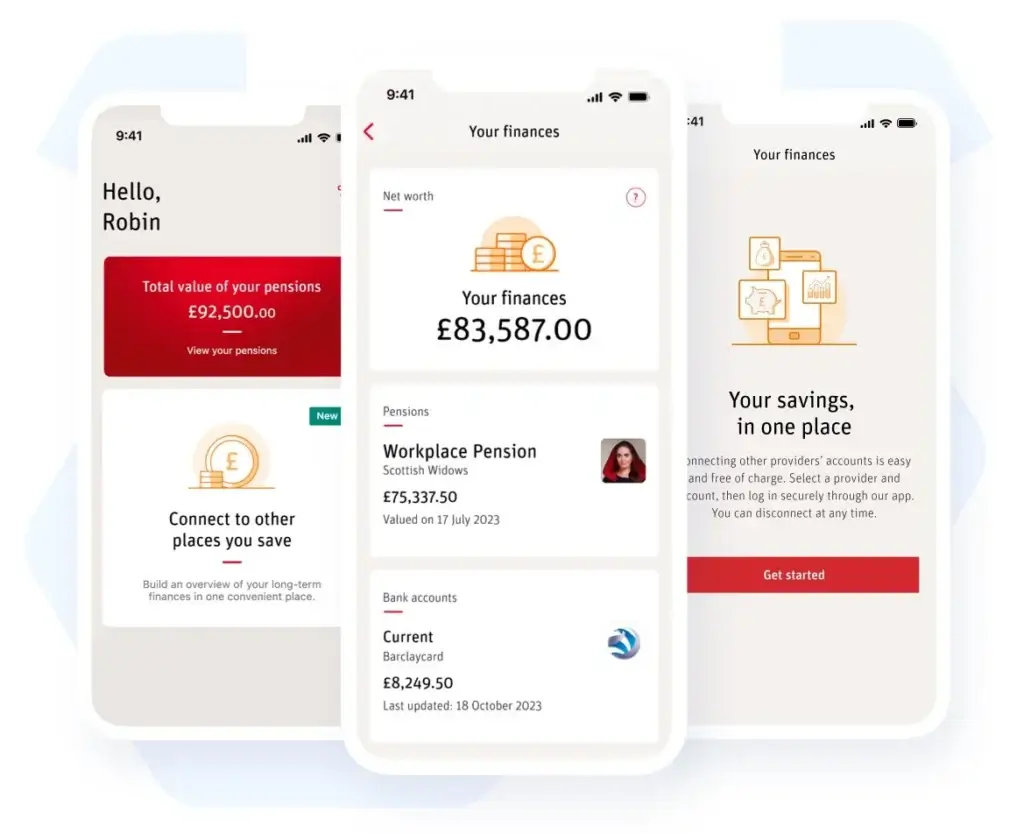

Scottish Widows wanted to transform how people manage their pensions and enhance their overall financial wellbeing. By enabling members to view all their finances in one place through the Scottish Widows app, the goal was to empower their members to manage their money better today and plan effectively for the future – so that no one gets left behind.

Building on their successful integration of Scottish Widows pensions into the Lloyds Banking app, where Lloyds customers view their pensions 250 million times a year alongside their bank accounts, they knew there was substantial value in offering their members access to financial insights within one convenient location.

The Solution

Scottish Widows integrated Moneyhub’s APIs into their app to offer Open Finance features to their users. This integration was strategically chosen to ensure users had a single centralised entry point to view all their finances in one place, offering a seamless user experience that encourages routine engagement.

Members can now access all their financial data, including pensions, savings, loans, mortgages, and insurance, across multiple providers, all from within the Scottish Widows app – in addition to its existing financial wellness content and features provided by BeMoneyWell.

Results

Since its launch in January 2024, the upgraded Scottish Widows app has improved financial engagement among its users:

- In the first month alone, 38,000 users explored the new features, and 6,000 went on to connect financial assets.

- These assets totalled over £600 million, connected within the Scottish Widows app.

- 66% are linked to people’s pension savings and investments, 26% to loans and 8% to mortgages from over 70 other providers.

“This initiative is not just about technology. It’s about empowering individuals to make better-informed decisions that guide them towards a more secure financial future.”

-Graeme Bold, Director of Workplace Pensions at Scottish Widows

Looking Forward

Scottish Widows is continuing to work with Moneyhub to develop its offerings. Later this year, they plan to introduce more advanced tools and features that simplify financial planning and promote transparency. The ultimate goal is to ensure that every customer not only understands their financial status today but also has a clear, achievable path to financial security in the future.

share

Categories