Loqbox is a financial wellbeing business that aims to give everyone the tools they need to live a richer life — both personally and financially. It’s here to help people build healthy, lifelong financial habits and improve their relationship with money. Their membership model offers innovative solutions like Loqbox Rent, which aims to help members build their credit scores by leveraging everyday financial activities, such as rent payments, so they can achieve their financial goals.

The challenge

The current credit scoring method is severely lacking. Over 5 million UK residents struggle with "thin credit files," and their access to financial products is often limited to more costly options. A failure to recognise regular rent payments as a measure of creditworthiness leaves many unable to prove their reliability to prospective lenders. For those renting who aspire to buy their own home in the future, this can make their chances of getting on the property ladder increasingly more difficult. Despite paying their rent on time and in full, this doesn’t contribute to improving their credit score when it comes to applying for a mortgage. With one in 10 people being put off applying for a mortgage because of their poor credit scores this poses a big problem to people’s home ownership dreams.

The solution

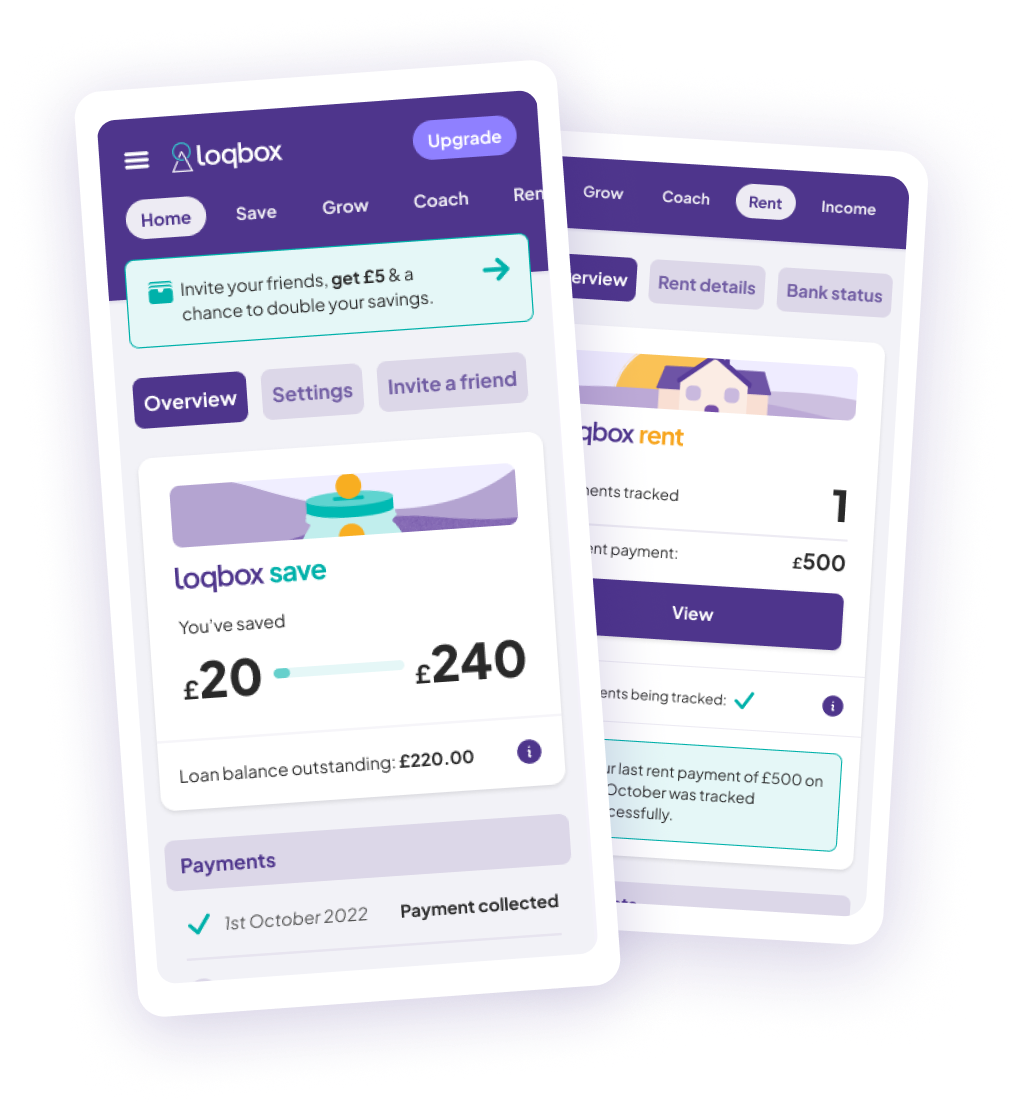

To help their users achieve their homeowning goals, Loqbox partnered with Moneyhub and Experian to launch Loqbox Rent. This feature allows Loqbox members to use Moneyhub’s Open Banking technology to accurately identify rent payments through its categorisation engine, allowing them to track and report anonymised rent payment behaviour to Experian.

A user can simply and securely link their bank account to Loqbox Rent, tell them the rent date and amount, and make payments as normal each month. This can help individuals boost their credit score and build their creditworthiness, meaning they can access fairer rates from lenders, which can save them £1,000s.

The results

Moneyhub and Loqbox have helped over 40,000 members with Loqbox Rent.

89% of Loqbox members who track their credit score, improve their score.

80% of Loqbox members felt better about their financial situation after using Loqbox.

9/10 Loqbox members recognise that taking charge of their finances has positively impacted other areas of their lives. 63% of members mention reduced stress, and 50% of members reference their mental health as an improved area.

Loqbox has achieved a 4.5-star rating on Trustpilot with over 18,000 reviews - “Since I started saving and my rent payments were reported to the credit agencies, I've seen an increase of around 100 points in my score.”

Hear from Sarah, a Loqbox Rent user, about how she improved her credit score with Loqbox.

“Being able to unlock the power of Open Banking in order to improve the financial wellbeing of our members has been revolutionary for those members currently renting but with desires to build their credit history. It's a very welcome additional tool to be able to offer our members." - Tom Eyre, CEO and Co-Founder of Loqbox