Today, ground-breaking savings pilots have been announced to test new forms of flexible saving that are designed to fit with self-employed people’s often variable and uncertain incomes. Nest Insight, a public-benefit research and innovation hub, is collaborating on two research trials: one with Penfold, a fintech pension provider; and one with Moneyhub, an open data and payments platform.

BR-DGE and Moneyhub join forces to make open banking a mainstream payment option

Moneyhub partners with Expense Once for Open Banking-enabled card payment reconciliation

Moneyhub, the market-leading Open Finance data, intelligence and payments platform, is partnering with expense management software provider Expense Once to bring the benefits and efficiencies of Open Banking to the often cumbersome process of reconciling credit card payments.

World’s First ‘Retirement Modeller’ Calculates Pension Income From Current Lifestyle

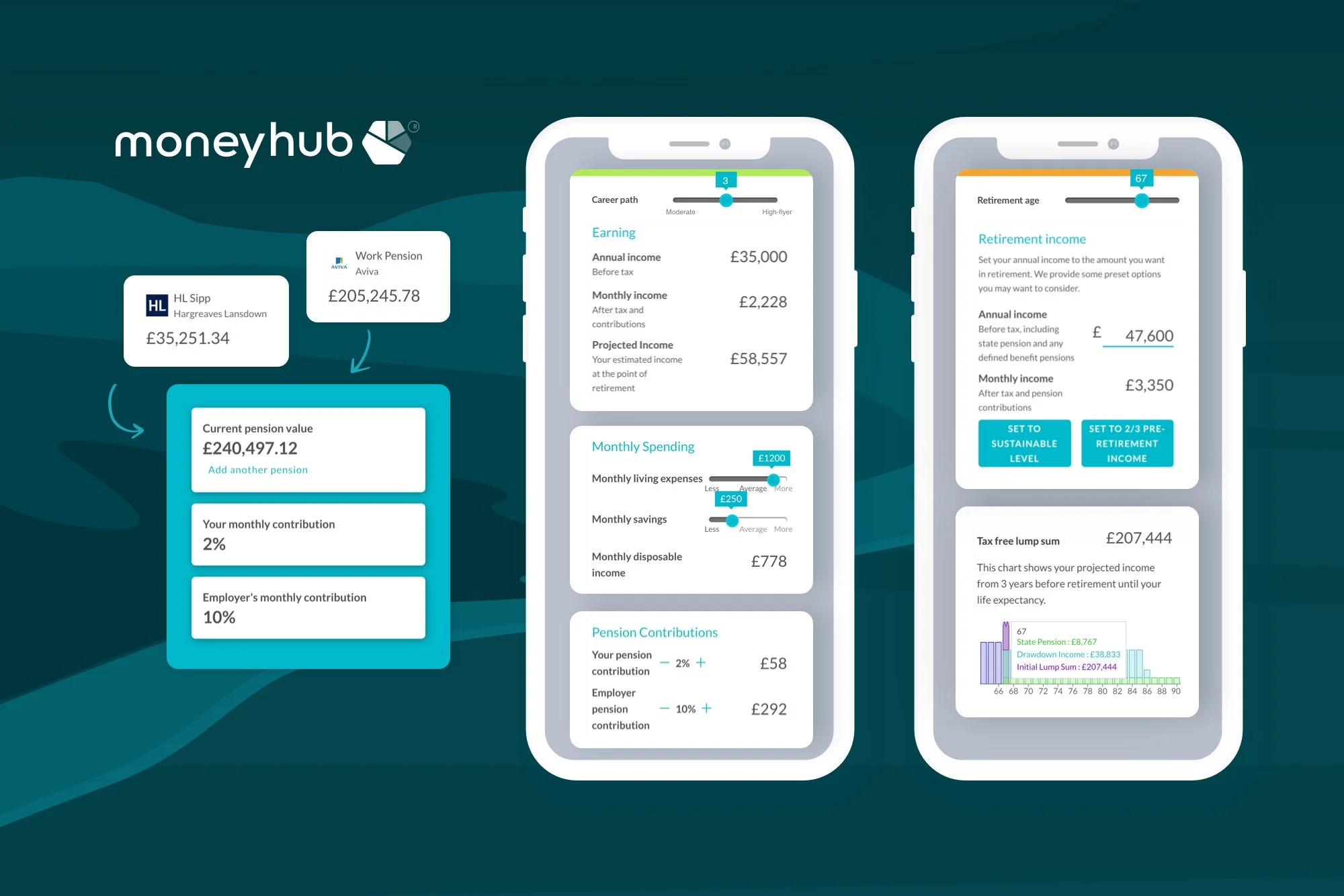

Moneyhub, the market-leading Open Finance data, intelligence, and payments platform, has launched a new “Lifestyle Retirement Modeller” which shows people how much income their pension will provide in old age and encourages them to start saving now. This feature is available to Moneyhub enterprise clients, who can customise it to their own needs.

Moneyhub partners with Otto to bring financial wellbeing to UK workplaces.

Moneyhub is partnering with financial health pioneer Otto to enable next-generation employee wellbeing benefits. Thanks to Moneyhub’s Open Finance connections to the largest number of financial services providers, as well as its smart analytics, users of Otto’s financial dashboard can now see the full scope of their finances, enabling deep insights that lead to greater financial health.

Moneyhub boosts senior team with industry experts

Moneyhub enables companies to optimise saving and investing with Challenges and Sweeping features

Moneyhub has launched an innovative new feature that makes it easier than ever for consumers to set personal financial goals and optimise their money. Wealth managers, pension providers and other financial services clients of Moneyhub can use these new 'Challenges' and 'Sweeping' tools to enable their customers to move, or 'sweep,' money effortlessly between their accounts

Moneyhub partners with Legado for secure Digital Vault storage

Moneyhub is partnering with Legado to provide Legado’s encrypted personal Digital Vault services to Moneyhub’s clients. Wealth management and pension clients that send out millions of account statements and policy documents to their customers each year by post, can now send the documents securely and electronically via Moneyhub.

TISA’s Open Savings, Investments and Pensions initiative partners with Moneyhub for Open Finance standards development

Moneyhub launches credit score-boosting ‘Rent Recognition’ feature

Moneyhub partners with sustainability data start-up Connect Earth to show carbon cost of spending habits

Moneyhub makes Open Banking Payments the default way to pay

Moneyhub sweeps industry awards, winning accolades for pioneering Open Finance strategy

Sir Peter Wood backs Moneyhub, the market leading Open Finance platform

Moneyhub becomes one of UK’s first TPPs to add Triodos Bank Open Banking connection

Moneyhub, the market-leading Open Banking and Open Finance data, intelligence and payments platform, is one of the first Open Banking providers in the UK to connect to Triodos Bank, the financial and banking service provider for savers, investors and organisations who want to change the world for the better.

Hometrack partners with Moneyhub to deliver streamlined income and expenditure verification for lenders, brokers and consumers

OneBanks partners with Moneyhub to help preserve community banking

OneBanks, the shared branch banking innovator, has today announced a partnership with Moneyhub, the market-leading Open Finance data, intelligence and payments platform, which will support its key ambition to preserve access to everyday banking services for UK communities impacted by bank branch closures.

Moneyhub technology supports Level Financial Technology with Capita employee wellbeing offering

Level Financial Technology, a financial health platform, has used Open Finance technology from Moneyhub, a market leading data and intelligence platform, to support their PFM app for 41,000 employees at business process outsourcing and professional services company Capita.

Over half of Building Societies see Open Banking as an opportunity

Over half of CEOs at Building Societies view Open Banking as an opportunity according to a new report produced by the BSA and Whitecap Consulting. Moneyhub, the market leading Open Finance data, intelligence and payments platform and contributor to the report has called for Building Societies to capitalise on the Open Banking opportunity.