Moneyhub, the market-leading Open Finance data, intelligence and payments platform, has launched a new “Rent Recognition” feature which will drive financial inclusion by offering everyone a newer, simpler and fairer way of building up their credit score.

Until now, renters have not been able to easily prove they have made regular payments to landlords. This information demonstrates they can be trusted to meet financial commitments on time and can help to improve the credit score of young people or anyone with a patchy or non-existent credit history.

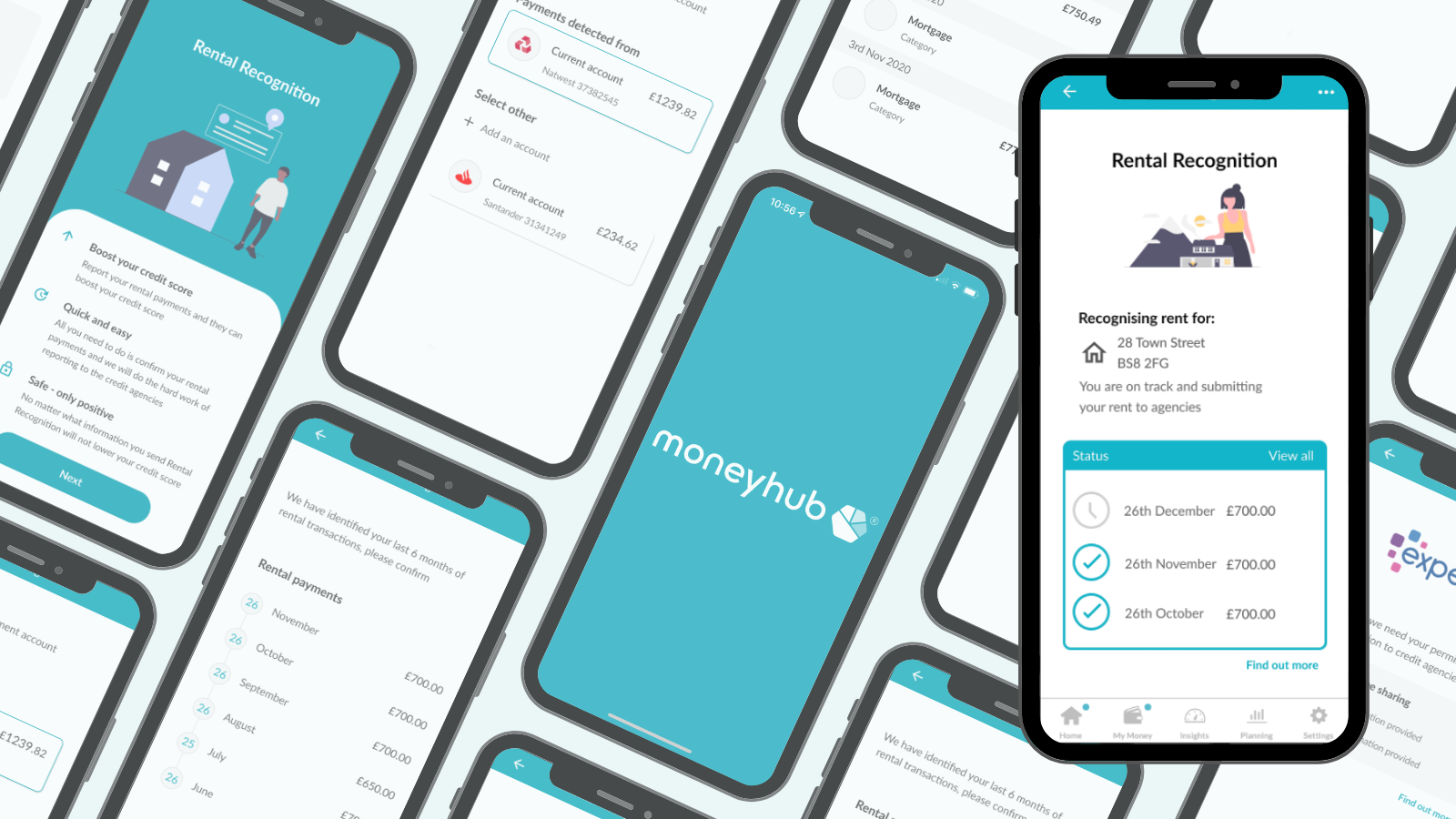

The new Moneyhub feature makes it simple to send anonymized details of rent payments to credit reference agencies such as Experian. While data can now be submitted to Credit Reference Agencies directly, Moneyhub’s Rent Recognition has the key advantage of only sharing the minimum amount of relevant data that will positively contribute to users’ credit score - minimising the data shared to protect privacy.

Rent Recognition is part of Moneyhub’s mission to improve financial inclusion and bring the benefits of Open Banking to as wide an audience as possible. Moneyhub clients can build Rent Recognition into their apps to offer customers the same credit score-boosting ability.

Moneyhub has also introduced a new Regular Recurring Transactions summary, which builds upon its Spending Analysis feature and shows details of scheduled payments. The extra visibility granted by this update will help users reduce cash leakage and control their finances to work towards goals such as paying off debts or saving for a mortgage deposit.

Dan Scholey, chief operating officer of Moneyhub, said: “We’re delighted to play our part in helping people improve or build upon their credit score.

“Enterprise clients who power their own apps with Moneyhub can now give their own users the ability to safely and anonymously provide details of rental payments to leading credit reference agencies. Consumers who use the Moneyhub app will also benefit from the same ability.

“Financial inclusion is a critically important issue which can seem like an intimidating or difficult problem to address. But we can start opening up the benefits of financial services to millions of people simply by allowing them to share information about the rent they pay every month.

“This small step can make a big difference in many people’s lives.”

There are 5.8 million people in the UK who are financially “invisible” due to “thin” or “non-existent” credit scores, according to a study from Experian.

The “Invisibles” of Britain find it difficult or even impossible to access credit and are often forced to pay more for basic services such as lending and utilities.

To improve financial inclusion, credit reference agencies such as Experian are now including “alternative credit data” which makes it easier for people to build a financial record which validates their identity and proves they are creditworthy.

Moneyhub’s Rent Recognition feature interfaces with credit reference agencies, offering them alternative credit data which can help formerly invisible people build up the financial reputation they need to access products and services.

Users of Moneyhub powered solutions can share details of their rent quickly and easily from right inside the app, whilst partners that have enabled the feature, such as The Big Exchange, can offer the same abilities to users of their own apps. Screenshots of the process can be found attached to this press release in the notes to editors section.

Users’ income and expenditure is not shared with credit agencies if they choose to enable Rent Recognition.

The Moneyhub Regular Recurring Transactions feature allows people to easily monitor where their money is going, helping them gain control and make incremental improvements to their financial position.

Moneyhub will alert users to upcoming transactions and warn them if they don’t have enough cash to cover the cost, before allowing them to sweep money from another account using the payment feature to avoid unnecessary fees which can eat into their savings or, even worse, increase their debt.

These features help to protect credit scores but, more importantly, will also unlock the money that typically leaks from accounts through unused or overpriced services and unnecessary overdraft or credit card fees.

Businesses that use Moneyhub to power their own apps can also offer the Regular Recurring Transaction feature to customers.

By helping people save for a first home or another milestone, businesses will benefit in the future by earning the trust which will encourage clients to engage with other products and services. Companies can also improve customer satisfaction by helping them make savings, avoiding expensive fees and improve their credit score in order to unlock access to lower-cost products and services.

Notes To Editors

About Moneyhub

Moneyhub is the leading Open Banking and Open Finance platform that uses the power of data, intelligence and payments to enhance the lifetime financial wellness of people, their communities and their businesses. Moneyhub’s APIs and white label solutions help businesses - both within and outside of financial services - drive customer engagement through hyper-personalised experiences.

The company takes consumer data security seriously and has been instrumental in the roll-out of Open Banking from its beginning. Leading the way in Open Finance since 2014, Moneyhub is authorised as AISP and PISP by the FCA, ISO-27001 certified, co-founder of FDATA and works on the Pension Dashboard and TISA Open Savings, Investment and Pension steering committees to put the power of data into the hands of those who own it: the consumer.

For more details, please visit https://www.moneyhubenterprise.com/