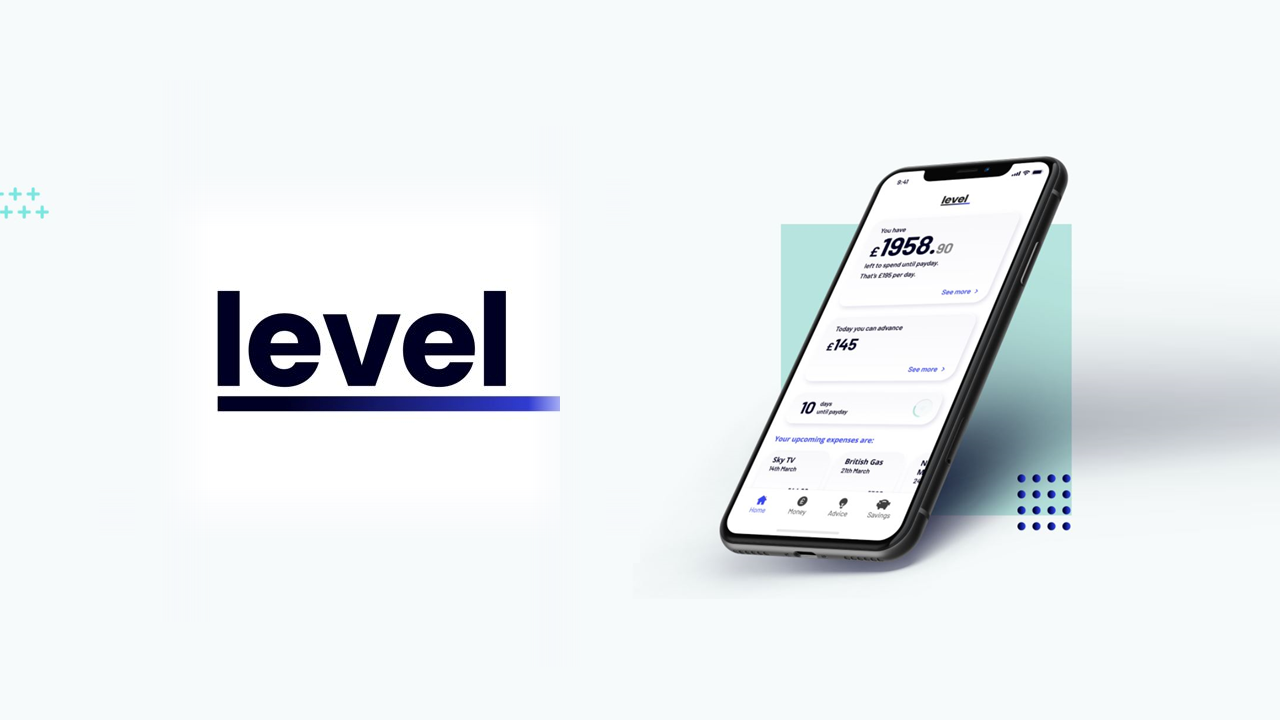

Moneyhub’s Data and Intelligence API powers Level’s personal financial management (PFM) app for 41,000 Capita employees

App gives employees budgeting tools, early wage access, automatic savings and advice to support their financial wellbeing

61% of employed UK adults say money worries are their biggest cause of stress; and its estimated that UK employers are losing around £15.2bn a year because of poor financial wellbeing

Level Financial Technology, a financial health platform, has used Open Finance technology from Moneyhub, a market leading data and intelligence platform, to support their PFM app for 41,000 employees at business process outsourcing and professional services company Capita. Level Financial Technology and Capita have also worked closely with The Behavioural Insights Team to develop this offering, using ‘Nudge’ theory.

Via Open Banking, the app gives employees the ability to keep track of their income and budget throughout the month, access salary advances and automatically save part of their monthly wage into savings accounts with high interest. It also provides financial education and advice from the Money & Pensions service.

Using Moneyhub’s Data and Intelligence API to build their PFM app, Level Financial Technology can ensure they have secure standards-compliant connections to all major financial institutions and aggregate all financial accounts for users.

Research has revealed that almost two thirds of employed UK adults (61%) stated that money worries were their biggest cause of stress and over a quarter (27%) feel financial stress on a daily basis*. As a result, it has been estimated that UK employers are losing around £15.2bn each year because of employees’ poor financial wellbeing**. As a result, Level’s personal finance app, supported by Moneyhub, will provide significant financial wellbeing benefits to both employees at Capita and Capita as an employer itself.

Stephen Holliday, CEO and founder of Level Financial Technology, said: “It is our belief that businesses must play a leading role in the financial health of their staff, and the pandemic has accelerated the need for technology that enables employees to improve their financial wellbeing.

We are delighted to have partnered with Moneyhub, bringing together our combined capabilities to meet the issues around financial health head-on. Moneyhub’s data and intelligence API has supported us in building our application that is being utilised by 41,000 Capita employees.”

Samantha Seaton, CEO of Moneyhub, said: “The Covid-19 crisis has put a spotlight on employee financial wellbeing, and in many instances, caused financial difficulties for many UK workers facing income reduction and unexpected costs. At Moneyhub, we believe in championing the importance of financial wellbeing and have developed Open Finance and Open Banking technology to do just that.

“Partnering with Level to offer our Data and Intelligence API to help build their app for Capita employees has been a brilliant opportunity to further this mission and collaborate with like-minded individuals to genuinely improve financial wellbeing for Capita staff. We look forward to how this offering will develop in the future.”

Notes to editors

For further information, please contact:

David Sells/Eleanor Ross at Teamspirit for Moneyhub moneyhub@teamspirit.uk.com / 07393 758446

Lucia Cappiello at Element Communications for Level

luciac@elementcommunications.co.uk / 0779 409 8735

About Moneyhub

Moneyhub is the leading Open Banking and Open Finance platform that uses the power of data, intelligence and payments to enhance the lifetime financial wellness of people, their communities and their businesses. Moneyhub’s APIs and white label solutions help businesses - both within and outside of financial services - drive customer engagement through hyper-personalised experiences.

The company takes consumer data security seriously and has been instrumental in the roll-out of Open Banking from its beginning. Leading the way in Open Finance since 2014, Moneyhub is authorised as AISP and PISP by the FCA, ISO-27001 certified, co-founder of FDTA and works on the Pension Dashboard and TISA Open Savings, Investment and Pension steering committees to put the power of data into the hands of those who own it: the consumer.

For more details, please visit https://www.moneyhubenterprise.com

About Level Financial Technology

Level is a financial health platform that helps employees take control of their finances and establish a savings culture. It achieves this by offering ‘salary linked’ financial products alongside a range of educational tools and resources. These empower users and generate positive behaviour change.

Website: www.getlevel.co.uk

LinkedIn: /levelfinancialwellness

Twitter: @GetLevel_