Moneyhub is in complete agreement with DWP and the FCA to maintain pace and momentum against the guided timeline for the provision of pensions data to meet millions of consumers’ demand

Consumer-focused Pensions Dashboard webinar on Wed 17 May to highlight consumer expectations

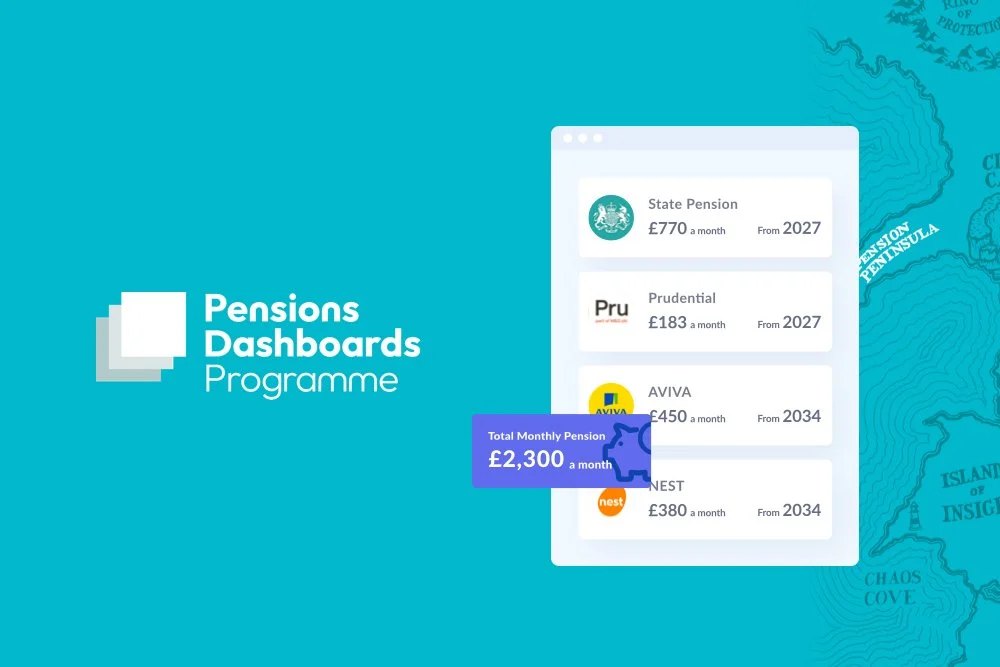

Moneyhub, the award-winning Open Data platform and alpha partner to the Pensions Dashboards Programme (PDP), has tested its beta Pensions Dashboard with consumers, to prove that it is easily understood - as per the Financial Conduct Authority (FCA) and PDP requirements for Pensions Dashboards providers. This testing demonstrates how much consumers value and need Pensions Dashboards with 100% of people questioned seeing a benefit.

One test participant, in her early 50s, said:

“I’d be really excited about a tool like this where you can see all your pensions together. It would make my life easier. I love the way it’s laid out, it’s very simple to use. So many people are just in denial about their pensions - they don’t even think about, let alone look at, their pensions. I think it’s brilliant!”

Moneyhub will highlight these and further findings at a consumer-focused Pensions Dashboards webinar, in conjunction with Which?, the consumer champion, and PDP, on Wednesday 17 May at 11:00-12:00. Register for the webinar here.

Moneyhub is in complete agreement with the DWP and the FCA to maintain pace and momentum against the guided timeline for the legislative provision of pensions data to meet millions of consumers’ strong demand and need.

On 2 March, a written Ministerial Statement to Parliament said that the PDP needed more time to deliver the Central Digital Architecture (CDA) which underpins dashboards, and standardises the way data is exposed to dashboards.

In the meantime, leading providers are already introducing their own innovative Pensions Dashboards solutions putting current money alongside future money and engaging people to take action when it matters.

Dave Tonge, Moneyhub Chief Technology Officer said: “The UK is the only multi dashboard provider in the world and it is vital that we use this advantage to drive good consumer outcomes.The largest master trusts and personal pension providers are ready to connect to the ecosystem and they want to get on and focus on the subsequent benefits. And at Moneyhub, we’re ready to be a Qualifying Pensions Dashboard Service (QPDS) with the FCA so we can support this essential end-to-end service now and when it becomes regulated.

“All of this will mean consumers will be able to use Pensions Dashboards sooner, which our latest testing with consumers reminds us they want and need. Working together as an industry we can bring these ground-breaking solutions to consumers that will truly benefit their financial futures.”

In the meantime, as Moneyhub published in March when the DWP reset was announced, firms wishing to offer their customers a dashboard should press ahead with:

preparation of their applications to the FCA to become authorised as a regulated QPDS

undertaking the detailed customer journey testing required to support the application

defining the data export and post-view service journeys

Firms who take these actions early will give their customers the best experiences when the mandated pensions data is available.

Firms can learn more about providing a dashboard at Moneyhub’s consumer-focused Pensions Dashboards Webinar with Which? and PDP this Wednesday, 17 May.

Find out more how Pensions Dashboards can help your business.

Moneyhub Contacts

Ingrid Anusic

Marketing Director, Moneyhub

ingrid.anusic@moneyhub.com

M: +44 783 722 6553

About Moneyhub

Moneyhub is a global ISO 27001 certified software developer of Open Banking, Open Finance, and Open Data applications. Its FCA-regulated Open Data platform enables companies to quickly and easily transform data into personalised digital experiences and initiate payments. Its APIs and fully customisable platform provide data aggregation, insights, notification nudges, and payment systems. As a result, clients have the consent-driven data and analytics they need to create super-personalised offers, products, and services. Hundreds of organisations, spanning finance to media and retail, rely on Moneyhub’s award-winning technology.

For more details, please visit www.moneyhub.com