VRPs allow customers to connect authorised Payment Initiation Service Providers (PISPs) such as Moneyhub to their bank account to automatically transfer, or ‘sweep,’ money between a customer’s own accounts within agreed parameters. It sounds simple enough, but the impact on financial health could be immense.

Variable Recurring Payment (VRP) enabled ‘sweeping’ will be mandatory within 6 months in major step forward for financial wellness

Open Banking – the opportunity for building societies

Whitecap Consulting, in partnership with the Building Societies Association (BSA), recently published a report analysing the competitive landscape for the building society sector. The Whitecap team is summarising the key findings in a series of blogs.

In this article, Julian Wells, Director at Whitecap Consulting, reflects on the findings of the research in relation to one of the hottest topics in FinTech – Open Banking.

In the online survey conducted during the research, we asked respondents about Open Banking, finding it to be perceived as an opportunity for building societies by 65% of survey respondents. We also found the largest opportunity from Open Banking is considered to lie with enhancing customer experience/ engagement (60%) and data connectivity (51%).

There is no doubt that building societies are acutely aware of the development of the increasingly prominent role APIs are playing in modernising the financial sector, fuelled by the continued and growing success of FinTech and Open Banking. At the same time, we found that while Open Banking is an area of strong interest for societies, it does not currently feature in their immediate priorities, with most CEOs adopting a ‘watch and see’ approach.

This may be a reflection of the fact that only 10% of building society survey respondents consider Open Banking to be a threat for the sector. We also found building society respondents were twice as likely to suggest that they had not fully assessed Open Banking’s potential (35%) over non-building society respondents (14%).

“There is no doubt that building societies are acutely aware of the development of the increasingly prominent role APIs are playing in modernising the financial sector, fuelled by the continued and growing success of FinTech and Open Banking.”

The potential of Open Banking and Open Finance

Moneyhub, a FinTech that provides secure, Open Banking (bank account and credit cards) and Open Finance (pensions, loans, mortgages, investments, property values) integrations and applications to businesses and individuals, has found wide ranging use cases for Building Societies, including:

Digital wallet solutions (for example the Moneyhub platform) can provide a society with a payments facility without the need for the significant costs associated with setting up and running a current account

Open Finance presents the full picture of an individual’s financial situation, it allows building societies to provide content, tips and tools to help customers with day-to-day finances

This holistic view allows building societies to identify those who may begin to struggle with mortgage payments before it actually occurs. Through a defined set of algorithms, risk factors can be flagged and help and advice offered proactively

Using a customer’s current and historical Open Banking data for credit checking, affordability and income verification allows fast, efficient and cost-effective underwriting

Open Finance allows customers to share their data - other savings accounts and mortgages for example - to receive personalised offers and switch accounts

FinTech firms interviewed during the research consider the use of Open Banking by building societies to be at a very basic level, citing opportunities for societies to adopt it to help streamline key processes such as ID and verification, dynamic data capture, and the evaluation of mortgage eligibility and automated regulatory reporting.

We reported on a number of current examples of the use of Open Banking within the building society sector, many of which are listed below. This year we can expect to see an ever increasing number of deployments of Open Banking within the building society sector as it gains further traction and as the financial services sector continues to move towards an Open Finance model.

Perhaps the greatest prize will be found in improved engagement - by being useful, relevant and personalised. Building societies appear to have a unique opportunity to use Open Finance as 21st Century financial wellbeing providers.

Examples of Open Banking deployments in the building society sector mentioned in the report include:

Newbury Building Society has developed ‘NBS Money’ in partnership with Moneyhub. NBS Money is an app that accesses Newbury products alongside a ‘virtual’ current account banking feature using account aggregation services

Newcastle Building Society has partnered with Paylink Solutions to assist customers in financial difficulty by launching a digital debt help service, with integrated Open Banking technology.

Phoebus, a core banking platform provider, has developed a self service customer portal which can be deployed as a standalone component to plug into any core banking platform to access mortgage data for balances, statements, and emails, as well as Open Banking functionality.

Sandstone has developed API gateways and Open Banking onboarding as part of its digital and mobile banking proposition across current account, savings and mortgages.

Mambu’s partnership with Tandem provides an example of a financial institution updating their technology to keep up with consumer demand. Tandem wanted to quickly introduce new financial services by building a new innovative product within their existing product and embracing open banking.

In 2018, Skipton was one of the first societies to trial the use of Open Banking, offering its direct mortgage customers the choice to use it in the mortgage affordability process rather than manually providing bank statements. It is possible that competition could be the key driver in taking API adoption to the next level. This is particularly pertinent at the front-end of the mortgage process, where it has been found that 83% of brokers surveyed primarily sought to understand eligibility when assessing the market for options for their clients.

Building Society Sector Analysis 2021

A review of the strategic landscape for building societies

The research underpinning this report was conducted by Whitecap Consulting in partnership with the BSA and involved a quantitative data analysis of all 43 building societies, interviews with 33 of the building society CEOs, and an online survey which received a total of 134 respondents.

This analysis and report have been funded through sponsorship from a number of industry stakeholders including: Credera, DPR, Equiniti, Mambu, Mutual Vision, Moneyhub, Nivo, Phoebus Software, Sandstone Technology, Shoosmiths and Sopra Banking Software.

The eight blogs in this series focus on key topics addressed in the research: FinTech, Strategy, Mutuality, Regionality, Technology, Open Banking, Mortgages, and Savings.

This article was originally published by The BSA. you can find it here.

Author

Julian Wells

Julian Wells is a director at Whitecap Consulting, a strategy consultancy based in Leeds, Manchester, Milton Keynes, Bristol, Newcastle and Birmingham, where he leads the FS & FinTech Practice Area. Whitecap is particularly active in the digital, technology and FinTech sectors. Financial services clients have included banks, building societies, technology providers, outsourced service providers, FinTechs, retailers, universities, and various firms in the intermediary financial services market.

Insights from this year’s Open Banking World Congress event

It was brilliant to be part of the insightful discussion at Open Banking World Congress - with speakers presenting from all over the globe and thousands of live viewers tuning in to hear from them - plus many more to follow as the on demand viewing figures rise.

This was an event we were fortunate to participate in ourselves, with a keynote presentation from Moneyhub CTO Dave Tonge on whether API security is up for the Open Finance challenge, which is available to view now:

CEO Sam Seaton took part in three comprehensive panel discussions which are now available to view too:

How Open Finance can boost financial wellness

Consumer money management - Open Banking style

Tech & Data Driven Innovation in Open Banking

So what were some of our main outtakes from this year’s event?

When it comes to API Security, there’s no need to reinvent the wheel – there are really good security standards already in place. And with FAPI 2.0 on the way, we’ve ironed out any areas of confusion and put in place stronger industry standards.

The new currency that everyone will need to survive and thrive is trust. That’s the way that we will make it as businesses in the future. Open Finance and Open Data are the keys to unlock trust.

20 million say their financial situation is worse since the Covid-19 pandemic, and the impact will drive behavioural changes that are here to stay. Open Finance can help these people in ways that any business can leverage, through:

Connectivity that gives greater clarity and control to consumers over their finances

Technology that delivers real-time, data-led personalised understanding and does the heavy lifting for you

Better engagement via unique insights and tailored smart-nudges that help any company to build trust with their customers

Bringing convenience to the forefront with account-to-account payments

Simple propositions make Open Finance accessible and appealing to everyday consumers. Just putting long-term savings and pensions alongside day-to-day money drives a huge shift in consumer engagement with their long-term finances.

And finally, whilst we miss travelling, getting to meet new people and hear from other speakers in person, there are some real advantages to the impact the pandemic has had in driving events online. From an attendee point of view, you can join any talk you like at the click of a button, whether that’s live, or later on at your own convenience, giving us far greater opportunity to truly engage in and absorb the discussions that matter to us - on our own terms.

If you have any questions or feedback for us following Open Banking World Congress, or if we can help you with you Open Banking or Open Finance journey, please feel free to drop us a line, we’d love to hear from you.

The Future Payments Landscape - Variable Recurring Payments

The UK’s roughly 90 trillion-pound payments industry is on the cusp of a dramatic makeover: The pandemic has accelerated a broad digitisation that had been gathering pace since the creation of the iPhone, while three years after the launch of Open Banking, a range of new possibilities have been unleashed, including Variable Recurring Payments.

We asked two industry experts to help guide us through the evolving payments landscape: Mike Chambers, Chairman of AnswerPay, who served for over a decade as Chief Executive Officer of the UK’s biggest retail payment system, and Dan Scholey, our very own Chief Operating Officer at Moneyhub, who facilitated the first ever Open Banking payment by a member of the public.

What follows is a synthesis of their thoughts on the future of payments:

Where are we today?

Even with the vast technological advances of the past decade, we still rely on too many legacy cumbersome payments systems that are increasingly not fit for purpose and make it very difficult to move our money in a way that suits our modern lifestyles.

Payments between individuals can be time-consuming and laborious, while, for businesses, receiving payments can be expensive and inefficient.

“The development of Variable Recurring Payments, which are enabled by Open Banking, is a big step forward for the industry. VRPs are an emerging and novel way of making payments where customers set up mandates via regulated third parties known as Payment Initiation Service Providers, such as Moneyhub, to execute payments automatically based on set and personalised rules.”

Open Banking can help remedy a lot of these pain points, but for most of the three years since its 2018 introduction, much of the industry’s focus has been on access to and aggregation of data.

Away from the public eye, organisations including Moneyhub have been collaborating to commercialise the Open Banking payments infrastructure. And today we are at an inflection point where a slew of large enterprises, as well as government agencies, are starting to take advantage of the massive payments opportunities afforded by Open Banking.

Where will we be tomorrow?

The development of Variable Recurring Payments, which are enabled by Open Banking, is a big step forward for the industry. VRPs are an emerging and novel way of making payments where customers set up mandates via regulated third parties known as Payment Initiation Service Providers, such as Moneyhub, to execute payments automatically based on set and personalised rules.

VRPs can strip out layers of complexity and cost, while also providing greater flexibility and control for customers and facilitating the creation of new types of financial services.

Sweeping, automated payments where funds are moved between two accounts in the same name allowing, for example, customers to avoid unnecessary fees by moving money between accounts so as not to go overdrawn, are enabled by VRPs.

“Existing electronic payments methods, such as Direct Debits, are not going anywhere just yet, and new services will develop gradually. And challenges of identification, fraud and financial inclusion when using digital services could serve to slow the move to a world of ubiquitous Open Banking payments.”

How will we get there?

Taken together, VRPs and sweeping allow individuals to act like corporate treasurers: managing their cash flow and seeing their financial position in real time.

“We will have a bank in our phone and we will be our own bank,’’ says Scholey. “So we will be in control of our money: we will be choosing who we pay, how we pay and when we want to pay them.’’

Even with all this innovation and the rapid Covid-inspired digital transformation the long-standing rule of the payments industry, that evolution takes time, still holds true. To take just one historic example: it took over 15 years from the first use case for contactless payments to widespread adoption.

Existing electronic payments methods, such as Direct Debits, are not going anywhere just yet, and new services will develop gradually. And challenges of identification, fraud and financial inclusion when using digital services could serve to slow the move to a world of ubiquitous Open Banking payments.

Still, fortune favours the brave and early-adopters will be best placed to benefit in the long term.

“Some of the established payments providers stand to lose out here and they won't go down without a fight,’’ says Scholey. “Even so, I think as an industry we need to take each of the objections raised and really think about how we tackle them. The end result being better for consumers and merchants."

To read the full article, please click here.

Find out more about VRPs or get in touch to find out how we can help your business innovate.

Over half of Building Societies now recognise the opportunities available through Open Banking - but misconceptions are slowing progress

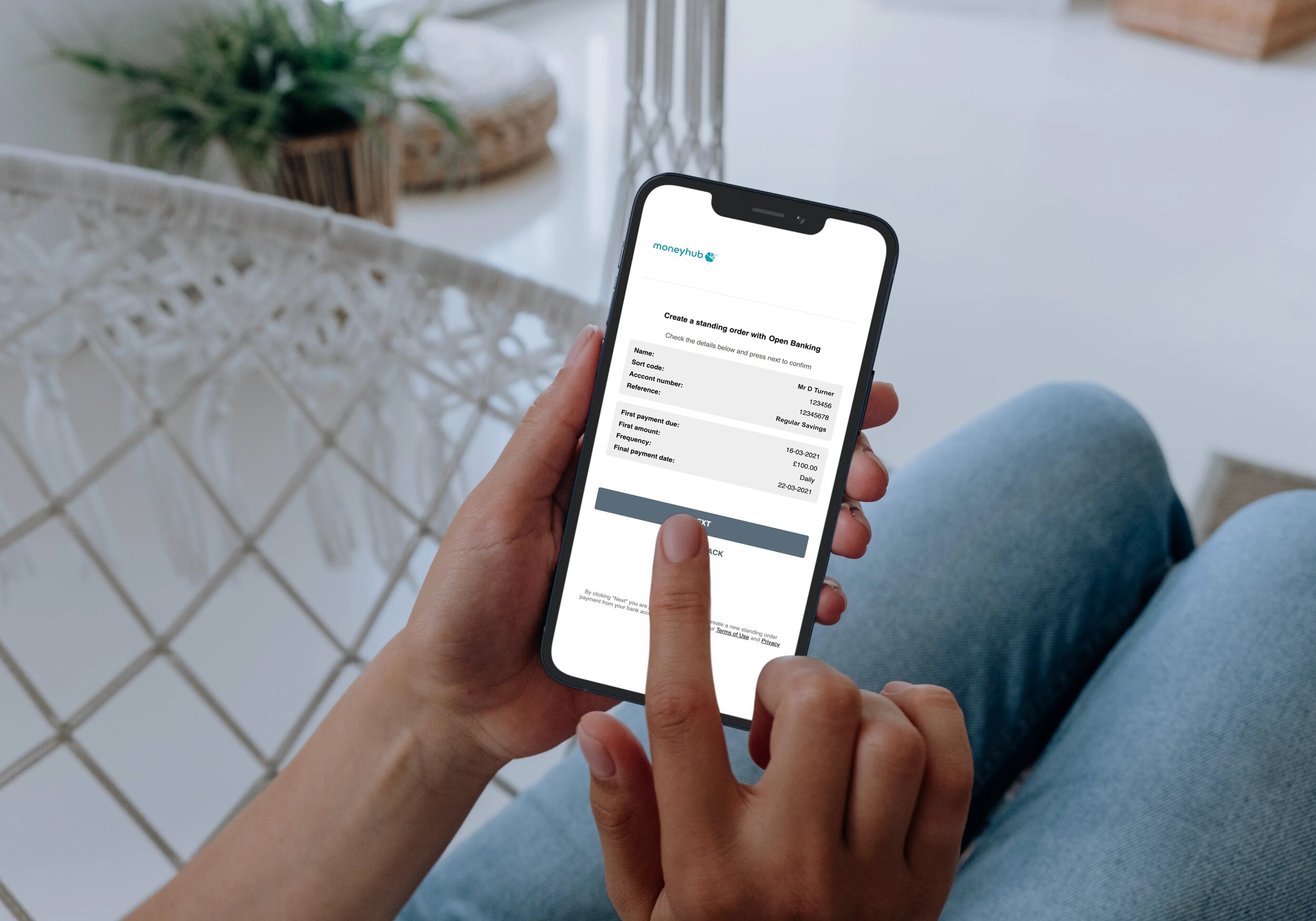

Standing Orders - one of the many API features available with Moneyhub

Standing orders have many use cases for your customers. They are the cheaper, faster and more secure way to make a Fixed Recurring Payment - and are just one of many features available through our Payment API.

What is a Standing Order?

Standing Orders are recurring scheduled payments for the same amount, with a frequency you choose, which are often used to pay for things such as rent, mortgage or any other fixed regular payment into savings, pensions or investment accounts. They can be executed to make automated payments either daily, weekly, monthly, or on another fixed schedule of your choice.

“Standing Orders are set up and controlled by the end user, giving consumers more visibility, and more control over making changes. ”

Using Open Banking payments, which allow a customer to transfer money from one bank account to another, Standing Orders are usually processed and received on the same day they are sent. As they are based on the same Faster Payments infrastructure used in current bank transfers, most Standing Order payments should be made almost immediately, if both accounts are part of the Faster Payments Scheme.

Benefits to customers

Standing Orders are set up and controlled by the end user, giving consumers more visibility, and more control over making changes.

Standing Orders are also a cheaper, faster and more secure way to make a Fixed Recurring Payment. There is no mandate to sign, no complicated guarantee to understand, and no card number to give away and be stored. Due to this, Standing Orders make a great alternative to ‘card on file’ or paying via Direct Debit. Direct Debits are set up by the end merchant, whereas Customers are also able to set a unique reference for each Standing Order to make it easy to reconcile the incoming payment when viewing their transactions.

“Standing orders can be set up to donate regularly to your chosen charity and these can be amended over time to change the amount of the donation and frequency at no cost to you or the charity. ”

Some Standing Order use cases

Topping up savings and investments

A Standing Order is ideal for recurring account top-ups. The customer can ensure they are regularly added to a savings, investment or pension account that aligns to when they receive their salary each week or month. If a customer’s circumstances change - such as changing jobs or receiving a pay rise/cut - they can change the standing order instantly, without the fear of incurring any fees for cancelling or amending.

Paying personal bills of a fixed amount

Standing Orders can be used to pay recurring household bills that are unlikely to change in cost each month - such as water, phone and broadband, or even rent or mortgage. For tenants living in a shared house, if one person pays a bill directly, Standing Orders from all tenants into the payer’s account for their portion of the payment can be a helpful way for customers to keep on top of who owes what.

Business expenses, overheads and customer payments

The cost of setting up and using Standing Orders for regular payments is low, meaning a business can efficiently stay on top of their costs. Some small businesses also collect regular payments from customers by Standing Order knowing that payments will be collected automatically and on time.

Paying for subscriptions

Many people have subscriptions for magazines, food boxes, software or streaming services like Netflix or Amazon Prime, which charge a fixed fee on a monthly basis. A Standing Order can be the perfect option to pay these, as the Standing Order can be cancelled or modified by the user, rather than having to contact their bank to cancel a Direct Debit, for example.

Charitable organisations

Standing orders can be set up to donate regularly to a chosen charity and these can be amended over time to change the amount of the donation and frequency at no cost to the customer, or the charity. This is especially important in the post-Covid world, where 53% of charities reported a drop in donations since the start of the crisis (source: CAF UK Giving Three Month Coronavirus briefing).

How can I get started with Standing Orders using Moneyhub’s Payment API?

Standing Orders are just one of many features you’ll receive as standard with our Payment API. Visit our Standing Order documentation to start building, or get in touch to find out more.

Author

David Turner

David is Moneyhub’s API, Payments and Connections Product Manager and is responsible for delivering new features for our API platform to enable fintechs and larger firms to build amazing customer experiences. He works with our existing clients to understand their needs so they can deliver more for their clients, and aims to continually improve our market fit to grow our customer base. David has over 10 years’ experience in Financial Services in project delivery, IT Operations and product ownership roles.In all his roles, David’s key focus has always been ensuring the technology solutions deliver fantastic and resilient outcomes.

International Women’s Day 2021 - Women in leadership: Achieving an equal future in a COVID-19 world

To celebrate International Women's Day 2021, we got an incredible group of women together for a candid and open chat (with chocolate and fizz!) centred around a subject that’s very close to our hearts all year round: the UN’s theme, ‘Women in leadership: Achieving an equal future in a COVID-19 world’.

Why now is the time to innovate with Open Finance

The ‘Amazonification’ of financial services is truly a game changer for businesses and individuals alike. With Open Finance, businesses (in any industry) now have the opportunity to develop innovative propositions that use that sector’s resources, without the capital and regulatory burden of becoming a direct participant in the regulated financial services markets - just as Amazon Web Services has enabled the explosion of SaaS businesses over the last decade.

Previously siloed aspects of financial services data, such as mortgages, consumer credit, bank accounts, investments, loans, savings, pensions and more can now be seamlessly connected thanks to the power of Open Finance and innovative TPPs (third party providers) such as Moneyhub.

As Angela Strange, general partner at Andreessen Horowitz, predicts: “nearly every company will derive a significant portion of its revenue from financial services” - and in the not-too-distant future too.

What do we mean by ‘The Amazonification of businesses?’

Before we had Amazon Web services, if you had a brilliant idea you had to go out and buy equipment, find a building and spend ages wiring things together. All of this had to be done before building the first line of code. AWS flipped this on its head and now anyone with an idea can quickly and easily start a tech business. The same is now happening with financial services.

What is Open Finance and what benefit does it have?

When it comes to finances, there are three questions people tend to have:

What have I got?

What do I need?

And how do I get what I need?

Open Finance is a consumer content-driven approach to answering these questions by bringing your financial world into one place, and providing unique and relevant data, tools and insight.

In practice how can it be used?

Open Finance helps people solve real world problems. such as applying for a mortgage, saving, getting rid of debt, enabling payments, tax returns, and planning for career breaks, as well as even more technical challenges.

What is Open Banking?

Open Banking is built on top of the Payment Service Directive Two (PSD2). Open Banking has finally unlocked bank data and put it in the hands of its true owner - the business or consumer who owns the account. This has been a great first step for organisations towards true open data (and Open Finance) - something Moneyhub has always been working for.

Using Open Finance to help engage people with their pensions for Mercer Money

Mercer is the world’s largest outsourced asset management firm. They approached us with one core problem: “pensions modelling tools are typically over-complicated, arduous and stressful to use, and provide no incentive for people to come back and manage their finances.” We set out to tackle this problem using our technology to build the Mercer Money platform - offering Mercer customers a complete financial wellness tool.

Using Open Finance to support ethical investing with The Big Exchange

The Big Exchange (co-founded by The Big Issue) are building a community focussed on making a positive impact through an inclusive financial system that is available to anyone. We used Moneyhub technology to power their digital wallet and their marketplace - offering a win-win scenario where The Big Exchange can increase assets under management, the consumer is happy with returns, and the world benefits as a result of these investments doing good.

How technology can totally overhaul Mortgage affordability checking - making it simpler, fairer and faster

A building Society came to us with a vision: “there must be a fairer, quicker and more cost effective way to run affordability checks on customers”. Open Finance makes it possible to truly understand all aspects of a customer's financial world - well beyond what is visible from traditional credit reports. The result is mortgage affordability checking that is faster and simpler than traditional approaches and can say ‘yes’ to more people, offering a fairer outcome for applicants.

Get in touch

To find out how we can help your business innovate with Open Finance.

Variable Recurring Payments and Sweeping: What are they, and why do you need to know about them?

Variable Recurring Payments (or VRPs for short), are a hot topic in Financial Services right now, as the Open Banking Implementation Entity (OBIE) launches its consultation into their effectiveness, alongside Sweeping. If you work outside of the sector, chances are you haven’t heard of them, however, with the obvious benefit to consumers and businesses alike, it’s worth familiarising yourself now.

What is a Variable Recurring Payment (VRP)?

In a nutshell, Variable Recurring Payments allow customers to safely connect authorised payments providers (PISPs) to their bank account so they can make payments on the customer’s behalf, offering more control and transparency than existing alternatives such as direct debits and card payments.

What is Sweeping?

Sweeping (which is enabled by VRPs), is the automated movement of funds for a customer between two accounts in their name. There are many examples of where this could be used, such as Sweeping funds from a current account to a savings account, or a current account to a loan account - the possibilities are endless, and more examples are covered below.

“VRPs and Sweeping form an exciting relationship to make personal finances run more effectively, encourage easier saving and ultimately make money work harder for the individual.”

What are the benefits of VRPs and Sweeping?

This is where it gets genuinely exciting: VRPs not only provide a more secure and cost effective replacement for Direct Debits and card payments, but they are also faster and less prone to error. Gone will be the days of mistakes due to manual form entry, delays with BACS payments (which take up to 3 days) and worry about data breaches (as cardholder data will not be collected or stored).

Minimise error

Mistakes made due to manual form entry can and unfortunately do happen, with cards often used as a back-up. But even then, credit cards can increase customer churn when they expire, are lost or stolen.

Increased security

With VRP, no credit or debit cards are required to make a payment, nor is there a need for businesses to collect or store confidential cardholder data on file. This makes VRP more secure for the customer, as no data can be intercepted by fraudsters. Also, it’s very easy to cancel mandates from either the bank or the PISP, meaning the consumer doesn't have to worry about leaving a credit card on file and forget about it. Businesses in turn don’t have to worry about data breaches, high card related fees, and the associated burden of Payment Card Industry Data Security Standard (PCI DSS) compliance. Instead, customers’ are securely connected to their bank’s website or app to pay by bank transfer.

EXAMPLE: Instead of a card on file, with VRP, a customer can connect their bank account to their Amazon account, only with rules to limit their spending based on their own preferences. The customer will be more secure and have a better experience, and businesses can receive funds faster and without concerns around cardholder data - win win.

With VRP, no credit or debit cards are required to make a payment, nor is there a need for businesses to collect or store confidential cardholder data on file.

Speed

Outdated systems such as the BACS system used for Direct Debits could really impact the potential of Sweeping. Often operating on a three working day cycle, a payment request is made on day one, with the funds debited and credited on day three. This means that any Sweeping instruction would have to be made three days in advance of when the funds are transferred (and even longer if the working days straddle a weekend or a Bank Holiday). We believe that this delay significantly undermines the ability to create valuable Sweeping propositions for the end customer.

Repayments

When it comes to repayments, there are some staggering benefits to using VRPs. At the moment, repayment plans rely on expensive Direct Debit payments. Direct Debits were never designed to allow money to move between people’s bank accounts - they were meant as a way for a merchant to take money from people with no restrictions. For Direct Debits to work for Sweeping, an Intermediary Account would be needed, which carries prohibitive costs - which are often passed onto the debtor as an additional charge. It’s made worse, because if the debtor has insufficient funds for the payment rather than being notified, the bank charges another fee. VRP stops this because the balance can be checked before the payment is triggered.

EXAMPLE: A repayment is due at the end of the month, but the customer is paid a day late, meaning there are insufficient funds and they will therefore incur a charge or go overdrawn. With Open Banking, there can be a balance check first to ensure funds are available. Moreover, the missing income can be flagged and everyone involved alerted (with consent from the consumer) to wait an additional day and try again.

When combined with Account Information Services, we see even more innovation, as repayments can dynamically increase when spare cash is available and the consumer has consented to pay off their debts as quickly as possible, even building up credit should they need to take a payment holiday.

EXAMPLE: Any unused money at the end of the month, can be spotted automatically and the customer offered the option to automatically sweep the extra money to pay off any outstanding debt. Most lenders are comfortable with overpayment, and some even allow a payment holiday based on any previous overpayment made. Sweeping left over money can help repay debts quicker or build a safety net for months with unexpected bills or outgoings.

Savings

Sweeping has the potential to revolutionise the savings world. Through VRPs, you can sweep spare cash into savings, pensions or investments, and interest rates on savings can be maximised to reach saving goals sooner. Loans can also be repaid quicker, reducing the cost of debt, while funds can be swept into different pots to enable consumers to budget more effectively. The individual can set up rules with interventions, for example, when a pending recurring payment is due that might mean Sweeping is not the right thing to do. In the future, we believe it should be possible for money to be swept to a charity, house mate or family member - something that banks should already be championing, but aren't.

EXAMPLE: A customer who lives in shared accommodation is asked by their flatmate for their share towards the payment of a gas bill. With VRP, it is easy to trigger a payment that automatically sweeps the money from all involved parties, into the account of the person who paid - all on the same day the money came out. This means that nobody is out of pocket, and the house remains harmonious.

“It’s important to understand that it’s all about the rules which can be wrapped around VRP that trigger the innovation. To date, consumers rely on banks to do what is right. In the future, automated money management will be determined by the consumer or business who the money belongs to.”

VRPs and Sweeping form an exciting relationship to make personal finances run more effectively, encourage easier saving and ultimately make money work harder for the individual.

What’s next?

The team at Moneyhub passionately believe in innovating for the benefit of the end customer, and helped develop the Open Banking Standards we use today. But we don’t want to stop there. VRP paves the way for the development of payment innovation and the creation of new financial services propositions that truly put customers first - we will be championing their use, and encourage you to do the same and join the consultation process.

We’ve made our response public in advance of the deadline to encourage the wider community to utilise the response and add their own voice to the consultation. All consultation responses are due by 12pm GMT on 4th December and must be submitted by the online Consultation Survey only.

To find out more about how we can help your business innovate with VRPs, please get in touch.

Open Finance drives greater transparency of pensions and investments impact

The issues of pension engagement and the impact of investment are coming to a head with campaigns like MakeMyMoneyMatter, the need to build back better after Covid-19 and regulatory change. It is no coincidence.

More than 10 million people are contributing to workplace pensions following auto-enrolment, but engagement and contribution levels remain low. Traditional ways to engage people in later-life planning have not worked. And this matters, as the vast majority of people are at risk of lower living standards in retirement.

Bridging the engagement gap

One way to bridge the engagement gap is to talk about the things people say they care about. A range of studies, including the FCA, show people - especially younger people - are more likely to engage, save more and take some investment risk when their pensions are responsibly invested.

Percentage of members willing to engage, contribute or take more risk if pension savings are responsibly invested - Data source: FCA

All investment has impact, and regulators, scheme managers, providers and members are increasingly incorporating environmental, social and governance factors as part of prudent risk management. Now, schemes’ statement of investment principles have to state how they account for financially material considerations, including Environmental, Social and Governance (ESG) considerations like climate change.

The overwhelming majority - more than 90% of master trust pension scheme members - are invested in their providers’ default fund. Default funds provide many important protections for pension members. So why not tell scheme members about the real world impact their pension contributions are having while invested for their future within the default fund? This Quietroom video shares pension savers’ positive reaction to seeing their pension is invested in housing, hospitals and renewable energy - and horror at the thought it could be funding tobacco or coal.

A recent DCIF report showed 80% of DC savers want their pension investments to do some good as well as provide them with a financial return. Younger cohorts and women are particularly interested in the impact of their money and ESG issues (Ref. 1) so there is an opportunity to have an outsized effect engaging with these groups that have often been underrepresented and underserved.

“A recent DCIF report showed 80% of DC savers want their pension investments to do some good as well as provide them with a financial return.”

Using technology to make it personal

Open Banking and Open Finance are secure data-sharing frameworks that enable data from utilities companies, ESG ratings and investment fund holdings to be combined with financial data sets to support a range of propositions to resonate with people.

While millions of people are in the same default fund, a provider could share personalised communications based around members' preferences. For example, two members invested in the same default fund could receive different digital annual statements: highlighting the amount of renewable energy generated, or tonnes of waste diverted from landfill for a member with environmental concerns, while another member in the same default hears about improvements in diverse board representation or gender pay gaps. Across millions of members, or retail investors, those same preferences could inform future proposition development around thematic default funds or retail investment funds based around the UN Sustainable Development Goals. Examples are emerging through The Big Exchange (co-founded by The Big Issue) and tickr.

An aggregated view of someone’s personal finances is an essential part of sound financial planning. Including ESG ratings and fund holdings into this view helps informed decision-making and sound investment diversification. For example, a holistic view of pension, ISA and general investment accounts could reveal a concentration in particular sectors or firms. Sugi is the UK's first app to check the carbon impact of investments and compare investments across a range of funds and platforms to help consumers’ build a greener portfolio.

Read more about Sugi here

With the data capabilities in place, Open Finance enables firms to cost-effectively deliver a level of personalisation and insight to consumers previously the preserve of conversations between high-net worth individuals and their wealth managers.

Footprinting everyday spending

Companies such as Co-Go are already integrating carbon and transaction data to create a carbon footprint tracker for everyday spending. Elsewhere, integrating utilities bill data could show the real payback for a green retrofit of your home, for example.

Cost-effective technology brings transparency

For asset managers, these alternative data sets can not only inform future proposition development around thematic default funds or retail investment funds, they can also be used in equity and fixed income research. More than $30 trillion - which is more than a third of the world’s professionally-managed assets - are in ESG and impact investments. Yet, as noted in a recent Columbia Threadneedle report, ESG data has been hampered by a lack of verification as researchers have relied on voluntary disclosure in annual financial and CSR reporting. Open Banking and Open Finance could provide “alternative datasets” to help “minimise reliance on voluntary disclosure”.

Open Finance provides transparency for customers — be they individuals or companies — and employees to align their purchasing, saving and investment choices with their values. Technology, member appetite and regulatory support together mean best in class providers are tantalisingly close to bridging the pensions engagement gap.

Author

Hannah Gilbert

Hannah is a Client Director with senior industry experience in financial services, telecoms, public and not-for-profit organisations. Hannah has co-authored policy papers including “Pensions for the Next Generation: Communicating What Matters” and has consultancy experience in sustainability, responsible investment and social enterprise. With two Masters (Economics and Sustainable Tourism), Hannah is on the EMBA programme at Cass Business School and Women in FinTech Powerlist 2019.

Open Finance - The journey from insight to value

This article was originally published in The Paypers Open Banking report 2020. To read the full report, please download it from The Paypers website.

Moneyhub was born out of frustration. Frustration at not being able to see accounts in one place; repetitive data entry; obstacles to financial planning and, above all, financial institutions withholding data as if it was theirs and not the customer’s. This was in 2014 – before Open Banking, but in the thick of the hype around Big Data.

Data is the new oil

Data is called the fuel of the Fourth industrial Revolution. Like oil, data needs to be extracted and reservoirs tapped, but concerns have grown that this can be at the expense of consumer privacy. It was soon clear that the data also needed refining if insight was the goal, but the processing was still exploitative. In financial services, it seemed that the asymmetry of information between provider and consumer was ever-widening.

Key to your data processing strategy, and your customer experience design, is how you get to know the people you’re interacting with quickly, effectively, and in context. This isn’t about extracting data upfront, it’s about progressively sharing, reciprocating and proving your trustworthiness.

Trust: the sum of transparency and consistent value delivery¹

But the value was still elusive and Moneyhub could see why. The industry needed to focus on the value it creates, rather than the value it takes. By focusing on doing this consistently, people will trust you to deliver - and trust also compounds over time.²

“The industry needed to focus on the value it creates, rather than the value it takes. ”

It means focusing on the value, meaning, and engagement you create for the people you serve. When utilising people’s data to create value for them, it means making sure they understand how their data is being used to create that value - and that goes beyond consent-based data sharing.

The role of financial services in building trust

But an industry obsessed with pushing products still has lessons to learn when it comes to the difference between leveraging insight and selling it.

We need to accept that people should control who accesses their data and for what purpose. We need to think of organisations as data custodians or information fiduciaries. That means that providers need to be relevant and useful and Moneyhub provides that missing link.

It aggregates, organises, and enriches data and then monitors it on behalf of the customer. Then, with an understanding of the customer context, actionable insights (or ‘nudges’) can be introduced to coach the user towards better outcomes. This might be through prompts, alerts, or new options being surfaced - it’s about helping people and for what exchange of value.

Harnessing insights to enable Open Banking payments

Insight is not an end in itself and the consumer needs the means to put in action decisions, simply and cheaply. Moneyhub uses money to savings, investments, and pensions, or to pay bills and reduce debts.

By being a trusted partner of the customer, the insight from income and expenditure analysis combines with navigation towards improved financial wellbeing. Helping customers by being the everyday financial coach, means that wellbeing is not a goal but a by-product of improved customer outcomes. Here are some of our practical examples of that in practice:

Expenditure analysis shows that the customer is paying rent. There is no sign of contents insurance - so is there an awareness of the risk associated with that? Or could that rental payment history be used to support a mortgage application?

An employer provides a range of employee discounts from retailers – as one of our clients has shown, by personalising offers based on past expenditure, the average Moneyhub user can save over GBP 70 per month, with no change in spending habits.

Consumers are keen to invest ethically and sustainably but, in addition to aggregating and scoring their investment portfolio, expenditure analysis could be used to create nudges towards greener lifestyle options or a carbon footprint offset savings plan or donation.

Impulse spending can be converted to impulse saving with an unplanned treat being accompanied by a self-imposed rule to sweep the same amount into an ISA or a pension.

Variable recurring payments can be set up when goals are met or a budget is tracked.

By adding a house price feed combined with mortgage repayments, customers can be alerted to new financing deals becoming available as the loan-to-value ratio comes down.

With 80% of employees not sure if they are saving enough and the self-employed still outside of auto-enrolment, the adequacy of pension saving can be forecasted and nudges made to help towards a better outcome, referencing current expenditure and in-retirement lifestyle.

Despite companies often having substantial customer data available, they continue to require customers to go through time-consuming and inaccurate fact-finding processes. With consent, the consumer can share their data, containing verified assets, income, and expenditure information.

Consumers can self-police by using ‘appropriate friction’ such as alerts around budget overshoots or comparing the effect of saving an amount rather than spending it.

Privacy & personalisation: a mutually inclusive relationship

By never selling customer data or taking a third-party commission on product sales, Moneyhub and its enterprise clients have always respected customer interests and balanced privacy against personalisation. The value exchange is always fair and controlled by the consumer.

Open Banking is useful but ancillary to the benefits derived from holistic Open Finance.

Critically, value creation from insight is organic and relationship- based, a far cry from crass product pushing. If a product solution is involved, it is more likely to be bought than sold and more likely to be retained as it is suitable and affordable. From here, customer centricity becomes a reality rather than a slogan - and the path from insight to value is lit by Open Finance adoption.

References

1 and 2: Greater Than X's work on Data Trust: www.greaterthanexperience.design and video.

Author

Vaughan Jenkins

Vaughan is an experienced Sales Director with senior industry experience in financial services, especially the life and pensions, asset management and wealth sectors. He co-authored ‘The Insurtech Book’ and has worked as an associate and consultant to a number of businesses.

Eat Out To Help Out: Did It Work?

In August 2020, the Government’s “Eat Out to Help Out” scheme went live. The goal of the scheme was simple: to encourage consumers to begin spending again at restaurants that had been left empty during the height of the pandemic. We teamed up with Lumio to analyse and explore restaurant spending in August, to attempt to answer the question.

Another world first in payments - Moneyhub launches Open Banking powered QR code payments for charities with Gift Aid

Two years ago, something pretty special happened in the world of payments. At a conference, Moneyhub COO Dan Scholey facilitated the first ever PIS Open Banking payment by a member of the public, live. Fast forward two years (almost to the day) and we’re thrilled to launch another world first with our Open Banking powered QR code payments with Gift Aid.

Putting pensions within reach

Every penny counts: How Open Banking can transform the charity sector

Supporting small business: How Open Banking can improve cash flow in a time of need

Covid-19 and the Black Lives Matter movement prompts a rise in charitable giving

The unprecedented events of the last few months has prompted huge changes in how we spend both our time, and our money. New data from our Open Finance platform reveals significant increases in one particular area of spending - charitable donations.

Data from our Open Finance platform shows consumers are spending more time at home and less time and money on trips out, clothing and shoes. Spending on clothing and shoes in particular dropped significantly, by 22% in April, 41% in May and 23% in June, compared to the same months in 2019. As Barclaycard’s research shows, consumers have instead turned to spending their money on purchases like home entertainment, ‘insperiences’ (in-home experiences), and donating to charitable causes. Our user data confirmed this, showing that donations shot up in April - June 2020, compared to the same months in 2019, as the Covid-19 pandemic and causes like the Black Lives Matter movement prompted an outpouring of support.

The stats in a nutshell:

Spending peaked in April, with 88% more going to charitable causes than in April 2019. May 2020 was up by 74%.

Total spending on charitable giving in June 2020 was 25% more than in June 2019.

This compares to February 2020, pre-lockdown, when the average spend per donation was significantly lower, only 4% up from the previous year.

Samantha Seaton, CEO of Moneyhub commented: “The coronavirus pandemic has caused us all to consider our own fortunes and has prompted a surge in support for good causes. Whether it’s giving to the NHS or those on the frontline of the crisis, or more recently rallying behind the global Black Lives Matter movement, Britons have been more inclined to do their bit and donate their extra cash. Increased charitable donations are a good sign that consumers are saving more and spending less, and therefore have more disposable income to give away.

“While this is a positive trend, we may see these transactions begin to drop as life returns to normal and people are encouraged to spend on businesses that will get the economy moving again. It’s important that people find a balance in their spending and maintain positive saving habits as we move out of the lockdown and potentially into a recession. Money management platforms that are powered by Open Finance data and intelligence can give users insight of all their finances in one place. This can help them understand the state of their finances, make more informed decisions, and ultimately build up more savings. This can help give people more financial security and allow us to carry on spending on the things that are important to us.”