We’re thrilled to have supported a recent research project into how the Building Society sector is evolving and what opportunities organisations - large or small - can embrace.

Revealingly, the report, which was released in partnership with the Building Societies Association (BSA) and Whitecap Consulting, found that over 55% of Building Societies now recognise the opportunity presented by Open Banking.

Of the 10% of respondents that viewed Open Banking as a threat, 100% perceived larger organisations to be better placed to reap the benefits of Open Banking, yet in our experience the reality is very different, with a number of smaller organisations (such as Newbury Building Society) already using Open Banking successfully to innovate.

“One of the significant barriers to uptake highlighted in the report was a lack of understanding, with 71% of those who perceived it as a threat, acknowledging that they were still unsure of the benefits possible. ”

However, without the large pockets of the major banks, Building Societies have not, on the whole, been in a position to keep up with the rate of digital transformation within the sector. The report confirmed this, identifying that 67% believe digital transformation to be the primary challenge for the sector over the next five years.

Open Banking has the potential to improve efficiencies across the board, from savings to mortgages, and help build strong relationships with customers, improving loyalty and retention rates. A common misconception is the time, effort and impact on the rest of the business to implement - this technology can be easily applied when working with a third-party provider (like Moneyhub), without the need to overhaul legacy systems.

One of the significant barriers to uptake highlighted in the report was a lack of understanding, with 71% of those who perceived it as a threat, acknowledging that they were still unsure of the benefits possible.

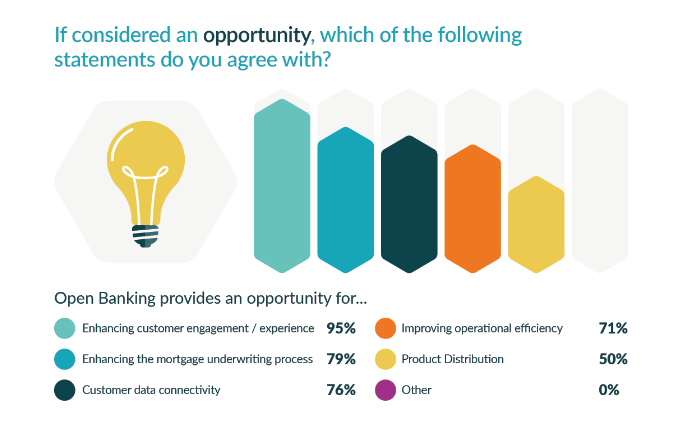

Of those that considered Open Banking to be an opportunity, there was a resounding recognition of the benefits, such as enhancements to customer engagement (95%), the mortgage underwriting process (79%), customer data connectivity (76%) and operational efficiency (71%).

This disparity will be improved through more open conversation and showcasing of tangible, live examples between the community. With the obvious benefits to the end customer, embracing Open Banking will help building societies to thrive in this new environment.