The state of savings in the UK

Many people struggle to save towards their goals, sometimes relying heavily on credit to make purchases which could lead them into debt. Research from the FCA found that, in the UK:

34% of adults had either no savings, or less than £1000, in a savings account

Another 18% have less than £5,000

One in four (12.9 million) UK adults have low financial resilience

50% of under 25s have no savings at all, as do 25% of over 65s

Capacity to save is impacted by factors like income, cost of living and even where you live (the East Midlands has the lowest average saving amount of £6,438.49 in the UK compared to London with the highest at £28,978.40.

Despite this, almost everyone will be trying to save towards some sort of goal; building an emergency fund for if the boiler breaks down, saving for a major life milestone like a wedding or a first house, a holiday or a new car.

How do Savings Goals in Moneyhub help?

We’re giving users the power at their fingertips to create, track, and boost multiple Savings Goals through our Open Finance platform. This further helps them take control of their finances, improve financial wellbeing and set them on their path to achieve their personal goals.

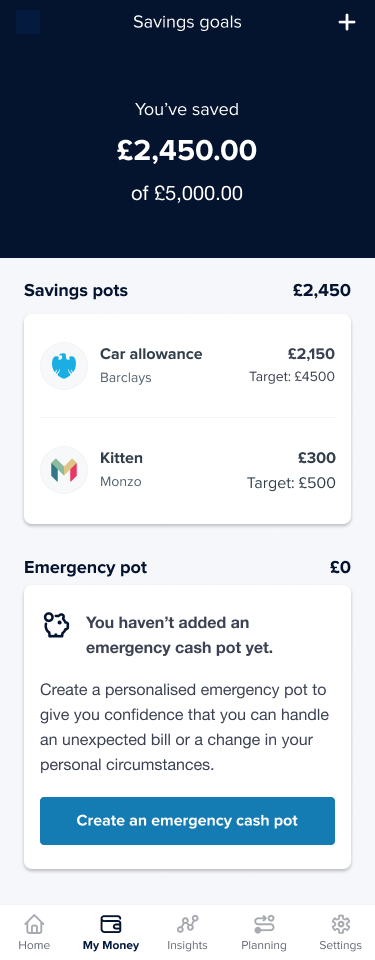

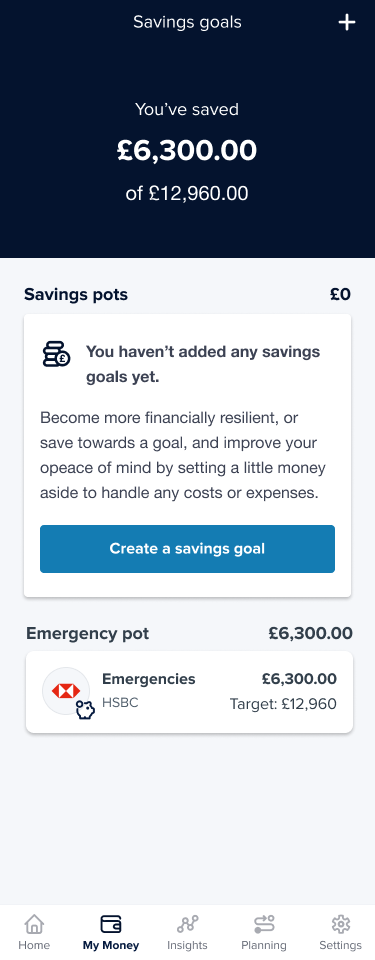

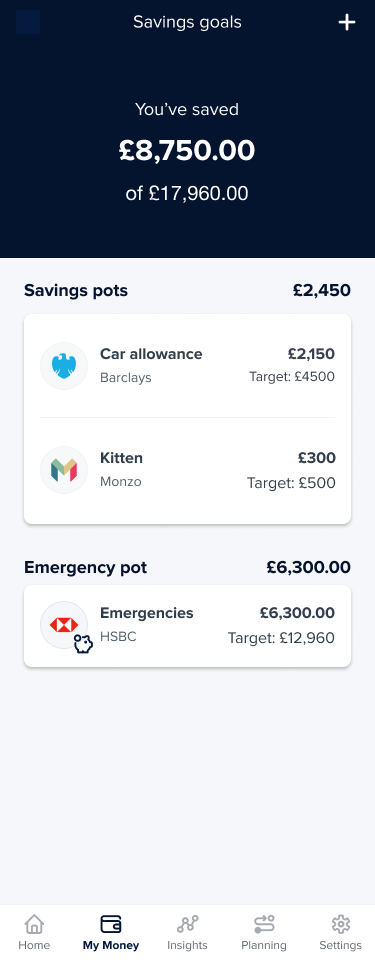

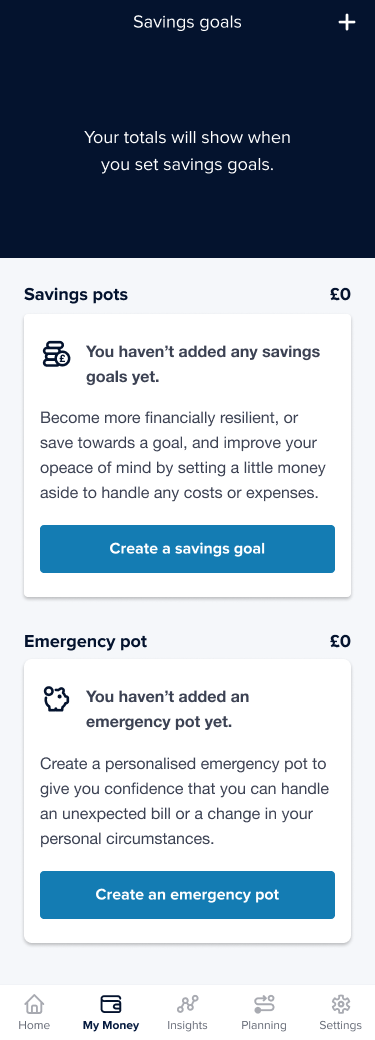

Within our platform, users can:

Understand the benefits and process of creating savings goals

Nominate an account to house their saving goal

Give their pot a name, a target and an optional date where by to achieve the target

Suggest a monthly saving amount to achieve goal

Monitor and quickly see their progress and status toward their goal

See recent activity

Top up or boost their saving pot quickly

Our white label partners who roll this out to their users can:

Promote this feature to their users

Track through our Admin Portal

Adoption (number of savings goals created)

Engagement (total amount saved)

Retention (number of achieved goals)

And utilise this data to gain a deeper understanding of their users, and demonstrate a commitment to their financial wellbeing.

The Savings Goals feature available as part of our full Personal Financial Management platform, or as a widget that you can incorporate into your own app. Just get in touch with us to find out more →