Employees are a business’ most crucial asset. The relationship between employee well-being and financial health is well-established, as is its wider impact on productivity, satisfaction and retention.

Money is the biggest source of stress in the UK: one in eight employees are in working poverty [source]

Financially stressed employees are twice as likely to leave. [source]

Employees who are financially stressed are twice as likely to report poor health overall and take twice as many sick days, thereby impacting their productivity and overall team performance. [source]

Employees struggling with their finances are nine times more likely to have troubled relationships with co-workers, and are twice as likely to be searching for a new job, leading to increased HR and training burdens for employers. [source]

In light of all this, and the cost of living crisis, financial wellness is being pushed up the business agenda, but is still the least common area covered in HR strategies.

Almost 80% of employees are not satisfied with the efforts of their employer when it comes to managing their finances [source]

Why should you incorporate financial wellness into your employer strategy?

There are huge business benefits to delivering financial wellness to your employees:

83% of employers noticed an improvement in worker performance when financial wellness programs were implemented, and 81% noted increased employee satisfaction. [source]

Employees who are financially secure are engaged, healthier, and more productive. A decrease in financial stress leads to lower turnover rates, with 60% of employees more likely to stick with an employer that offers a financial wellness programme. [source]

76% of employees state they would be attracted to another company that they perceive cares more about their financial wellbeing [source]

How should you incorporate financial wellness into your employer strategy?

We’ve developed the Moneyhub Multibuy Plan to make it easy for you to offer your employees a practical tool aimed at supporting their financial wellness.

What is the Moneyhub MultiBuy Plan?

Employers can now bulk purchase licences to our award-winning financial wellness consumer app.

Your employees will sign up via a dedicated sign-up page that is in line with your branding. They’ll then be directed to simply download the app from the Apple Store or Google Play after registering.

The Moneyhub app’s entire user-interface (UI), logos, colours and typography will automatically update to your branding, to ensure you retain ownership of the relationship and consistency of experience.

We can roll out the access in as little as one week, making it fast and easy to incorporate financial wellness into your HR strategy so you can start reaping the rewards of a happier, more productive workforce, increased retention and attracting more top talent.

About the app

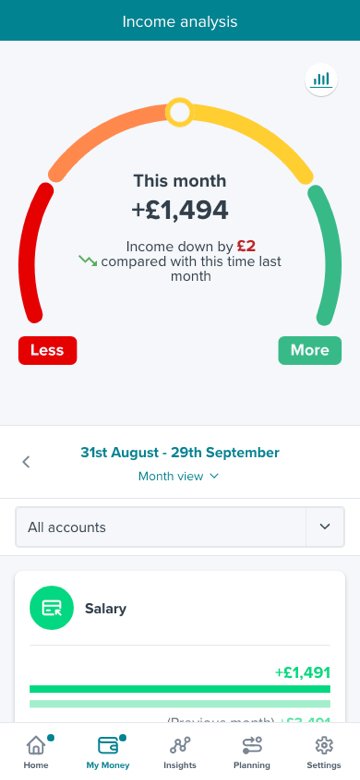

The Moneyhub app gives people unrivalled clarity over their financial world by offering them a clear 360° view of their finances.

Employees can connect bank accounts, credit cards, savings, pensions, investments, mortgages, assets and more. It provides personalised savings suggestions, offers and relevant services linked to the individual’s life stage and circumstances.

84% of Moneyhub users told us that after 3 months of using our app, they felt they had better control of their finances

Apps like Moneyhub offer employers a straightforward, intuitive way to help their employees understand, manage and improve their financial health.

They provide more continuation than money management workshops (although both work fantastically in conjunction with each other), and are available whenever, and wherever your employees wish to use them.

If you’re interesting in finding out more about how we can help you support your employees’ financial wellness, learn more about our Multibuy Plan here, or book a demo using the form below