You have just received your monthly salary and so the first thing you do is pay your bills, do your grocery shopping and also pay a huge chunk of your credit card debt.

Phew, now you can sit back and relax… that is until the car won’t start, the dog eats something it shouldn’t or you realise it’s your anniversary tomorrow and you forgot to buy your partner that perfect, sentimental but very expensive gift!

As humans, we naturally want to do things as quickly as possible. This is no surprise, the quicker we have reached the finish line, the better we will feel, right?

Not exactly!

Slow and steady wins the race 🐢

Paying yourself first is a way to prepare for any unplanned expenses that might pop up, whilst also contributing to any outstanding debts or payments that need to be paid.

How does it work? 🤔

Every month on payday you sweep a lump sum into a savings account and leave it there to build. This pot of money can then be used to chip away at any large expenses such as debt, but will also act as an emergency fund for any unplanned expenses.

How much should I put aside? 🤷

Everyone’s financial situation is different. You know your finances best and so this is entirely up to you.

The goal is to put enough to one side, that you still have enough left to cover your needs and not leave you feeling financially stretched.

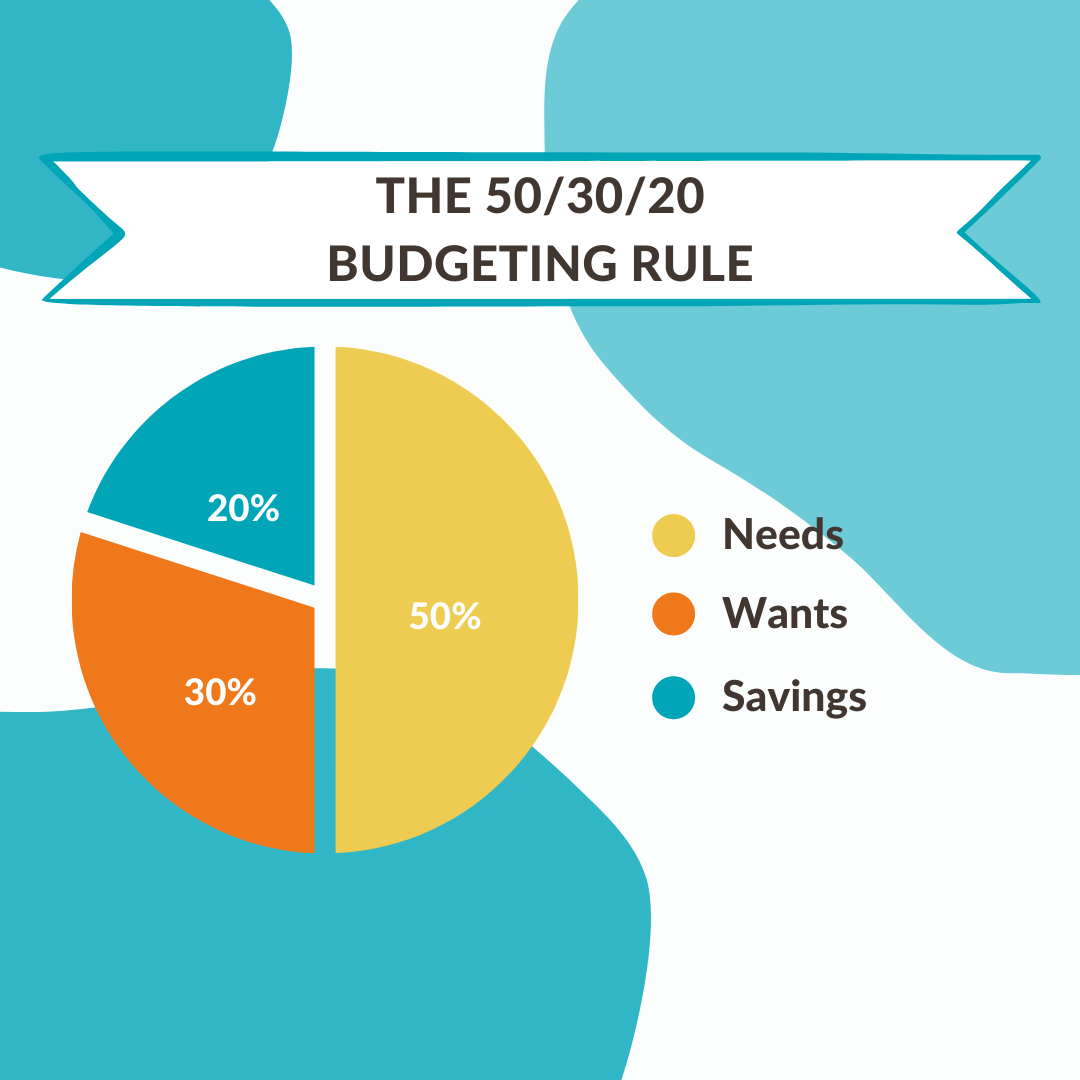

To help with this, some people put 10% aside of their monthly salary or you could try the 50/30/20 rule.

Remember, saving something is better than saving nothing. Don't feel guilty if you end up with less in your savings pot at the end of the month than you had at the start.

Automate your saving 🤖

Make it even easier by setting up a standing order to automatically sweep your money into your savings account on payday.

This way you can save without having to lift a finger, and removes the temptation to hold on to it or spend unnecessarily.

Keep on track 🚂

Track how much you are spending and on what with a money management app such as Moneyhub.

Our Spending Analysis will tell you exactly what you have spent and on what so you can set yourself personal spending goals with our Spending Budgets feature.

Download Moneyhub and get six months for free here.