Pensions Dashboards

Our end-to-end packages support you in the scoping, regulatory permissions, build and launch of a Pension Dashboard Service.

Founding Member

Alpha Partner

Our end-to-end packages support you in the scoping, regulatory permissions, build and launch of a Pension Dashboard Service.

Founding Member

Alpha Partner

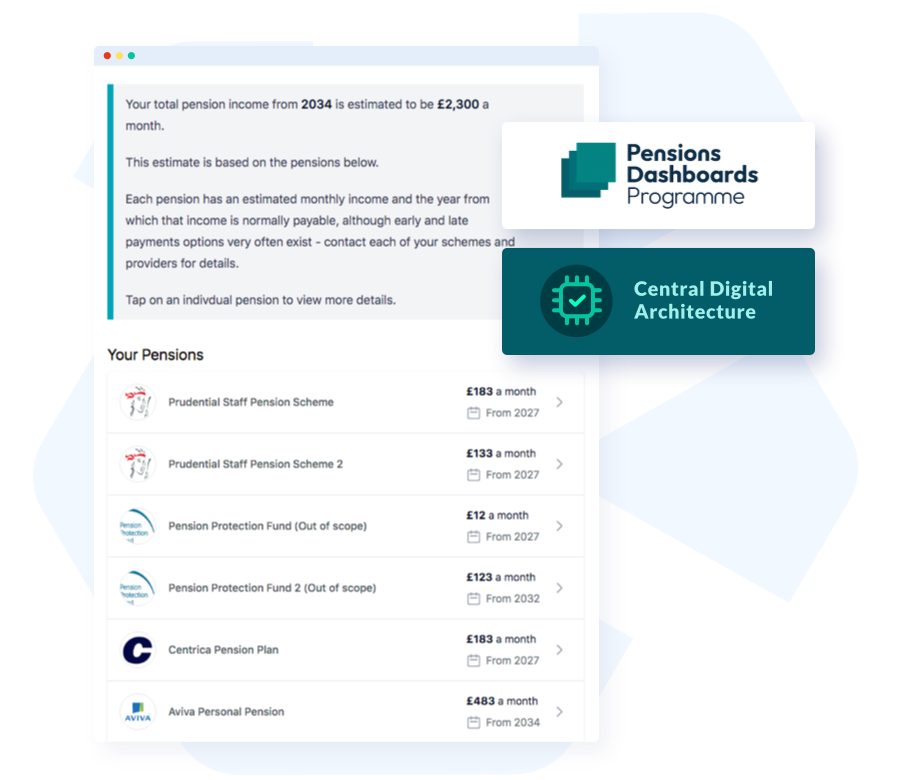

Commercial Pensions Dashboards enable your customers to:

Find all of their pensions, including State pension, via the Central Digital Architecture

View a summary of each of their pensions and access pensions detail

Make choices and next steps with their pension information, including using tools and services to help better understand their retirement options, finding a regulated financial adviser and accessing support and guidance

Some of the UK’s largest pension providers, like Standard Life, Aviva, Legal & General and Scottish Widows have already committed to offering their own pensions dashboards.

Your customers might have pensions with providers set to be first movers, and will be invited to use their dashboards.

Uptake of different dashboard providers is driven by exposure and convenience. The first dashboard consumers use is the one they are most likely to stick with.

Managing Director of Workplace

CEO of Retail

Our end-to-end package supports youin the scoping, regulatory permissions, build and launch of a Pension Dashboard Service (PDS).

Preparing for QPDS

We will help you:

Prepare to submit your FCA Variation of Permissions to become a QPDS

Select configure and test any initial Post View Services

Help you assess technical readiness and understand the size scale and nature if changes required for your business to launch a dashboard

Deploy, configure, connect and test

We will help you:

Connect to the Central Digital Architecture (DAC)

Undertake end-to-end consumer testing,

Begin technical deployment and required integrations

Launch and iteration, ongoing testing and journey development

We will help you:

Execute your QPDS take-to-market plan

Begin your live reporting to the PDP

Monitor live usage of your QPDS

Continually iterate in line with usage and changing standard, build and test further Post View Services

Launching early, learning from live usage, and iterating, are key to meeting different users’ needs