Smart Money Actions: journeys for growth

Smart Money Actions are embeddable journeys, developed to make the most of your fine grain data to dramatically reduce customer friction and increase your conversion rates.

Journeys are pre-designed to eliminate decision fatigue and manual effort. Use verified financial data to instantly populate application and assessment forms, increasing completion rates. With rapid deployment, accelerate time-to-market by integrating our low code and no code embeddable journeys directly into your existing apps and portals.

Achieve higher conversion rates and reduced cost-to-serve with automated precision.

Increase engagement with more time-on-app

Give customers a reason to return.

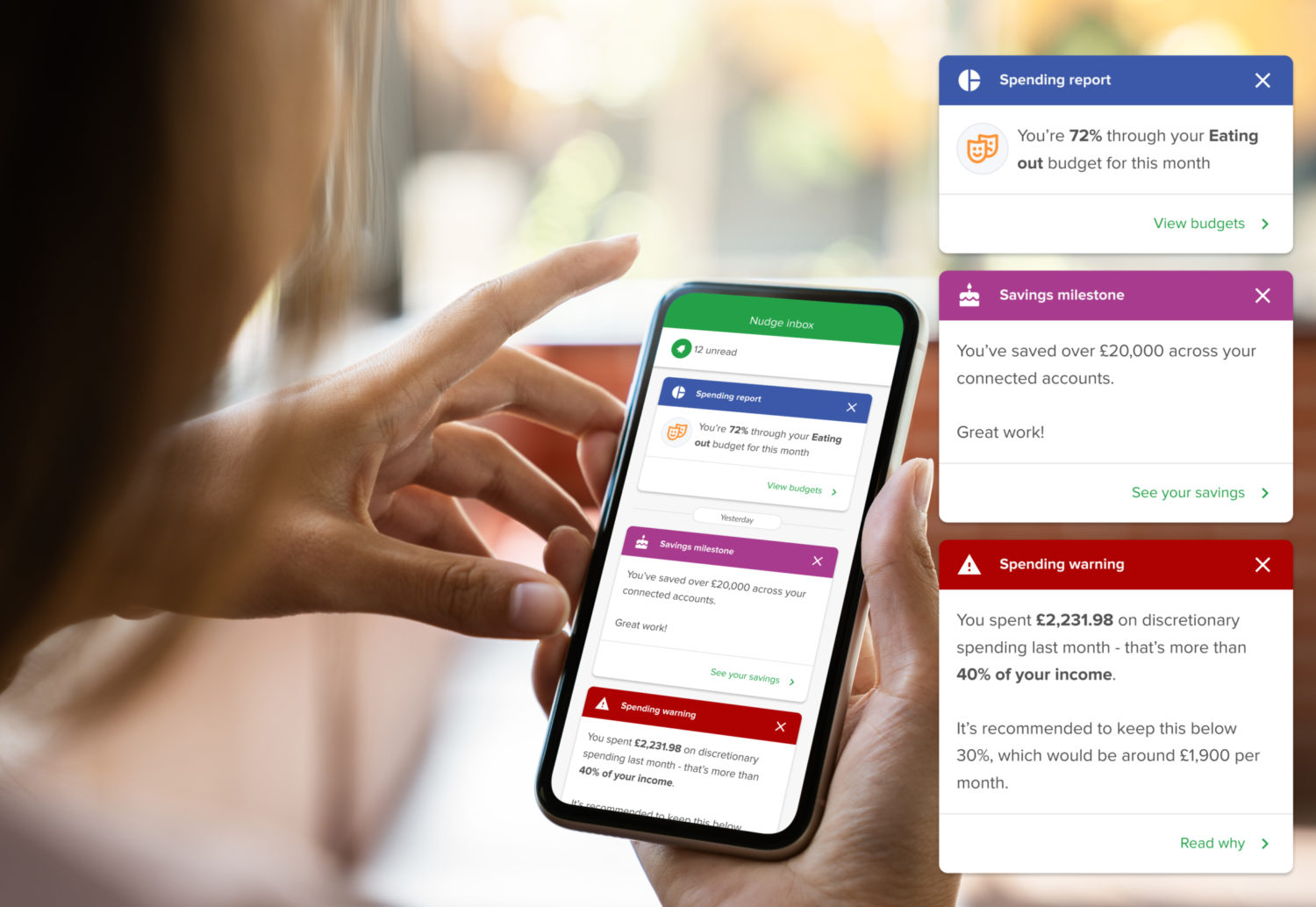

Use personal data to accurately assess each customer’s financial position and automatically decide which next-step nudge is best. With 20+ different journeys available to combine and customise you can build a deeply personalised customer experience.

Help users make faster progress towards reaching their financial goals, even in absence of a plan, removing decision fatigue for consumers. As users become more intrigued with seeing their finances flourish, you benefit from more frequent log-ins and more time-on-app, driving brand loyalty for future product purchases.

Turn loyalty into conversion

Use actual lifestyle and spending habits data to increase the precision and accuracy of your cross-sell targeting. Leverage the trust you’ve already gained to achieve higher conversion rates.

Embedded journeys encourage optimal behaviour. Double down on next best steps with targeted product offers and pre-anticipated suitability. Integrate with Smart Product Match to make targeted offers automatically.

No more hard sells, connect Smart Money Actions with Smart Product Match and watch as conversion rates soar.

Meet Consumer Duty demands and grow your NPS

Turnaround poor Net Promoter Scores by levelling up ‘good outcomes’ for typical and vulnerable groups, with data. Feed your decisioning engine with the widest array of verified data, increasing customer satisfaction levels when you return decisions with speed.

Tune up your customisation, validating compliance with Consumer Duty and stamping out inequalities driven by the financial education lottery.

Double down on the trust that you’ve already worked so hard to build.

“As we continue our journey to equip Mercer Master Trust members to achieve the best possible pension savings outcomes, Moneyhub’s commitment and cutting-edge solutions remain integral to our success”

Tim Adams Head of Digital, Mercer