Intelligent growth and retention. Build for real life.

In an environment demanding proactive engagement and regulatory leadership, reliance on fragmented data is costing you assets and trust. Moneyhub is the intelligent decisioning platform that transforms member data into verifiable, automated actions. We empower you to win the race for primacy, mitigate the “asset leak” during decumulation, and secure long-term assets under management (AUM).

62%

increase in app engagement

60%

rise in pension visibility

91%

advice gap opportunity

Build and Retain

Grow engagement, grow deposits

Turn your platform into a daily destination for financial well-being, ensuring engagement and increasing deposits during the accumulation phase:

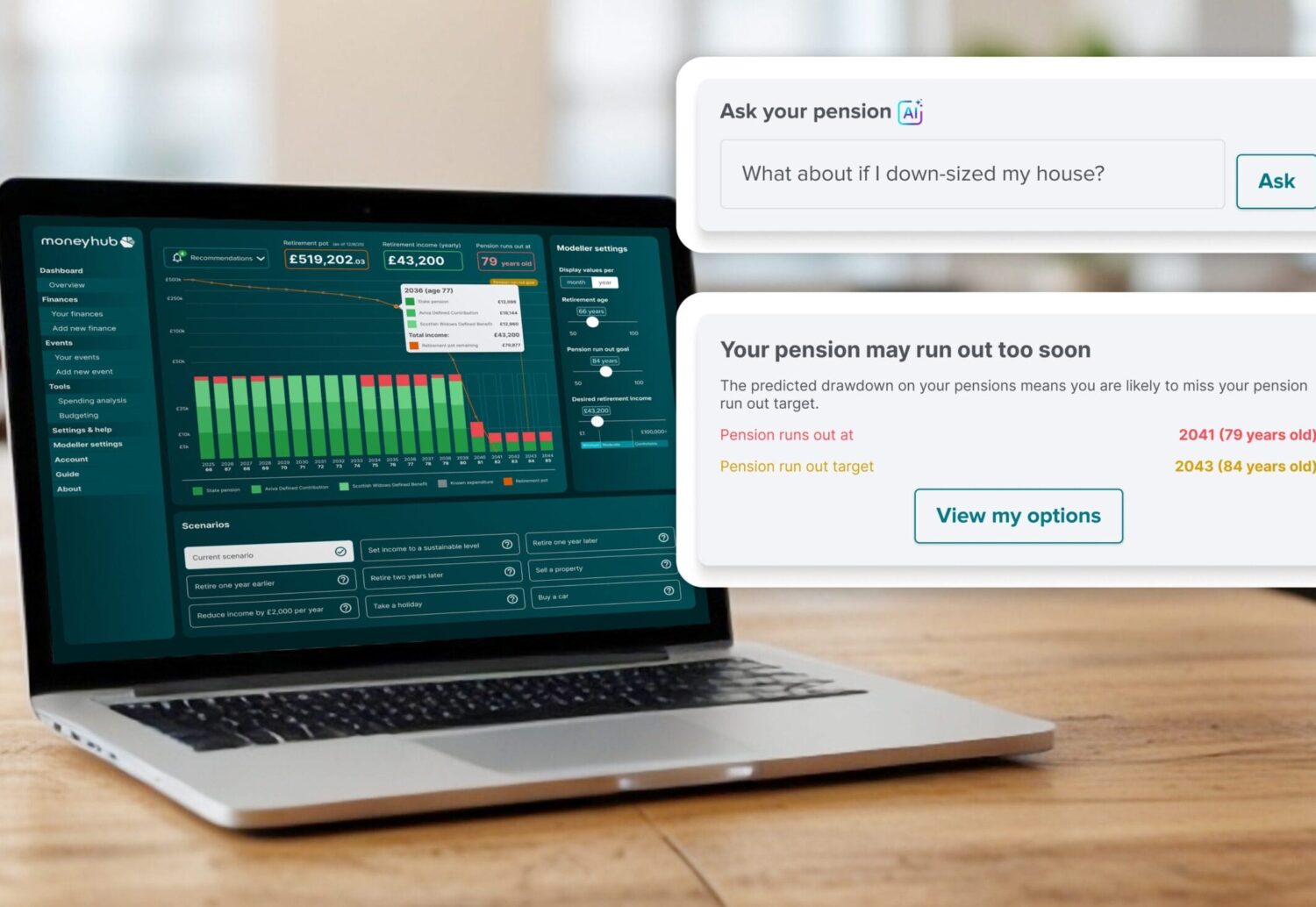

- Proactive insights: deliver personalised, real-time insights and automated nudges that help members increase deposits, manage early drawdown, and view their pensions as a valuable, tax-efficient asset

- Increase deposits: keep members actively engaged and grow assets by giving them a powerful, goal-aligned reason to log in and commit to increasing contributions

In Retirement

Plug the asset leak

Decumulation is the critical moment where assets often leak to competitors. Transform this risk into a retention opportunity:

- Mitigate outgoing funds: integrate modelling, sweeping, and drawdown tools directly into your platform, nudging users to make better financial decisions and preventing private wealth poaching

- Become the lifetime partner: provide continuous, meaningful value across the customer lifecycle, ensuring that when customers are ready to make a significant financial decision (like drawdown or consolidation), you understand all their options

Pension Dashboards

Win the race for primacy

The first Pension Dashboard your member uses is the one they are most likely to stick with. Use this regulatory moment to secure your future AUM:

- Secure consolidation: turn fragmented pension pots into a single, unified view and encourage high-value consolidation onto your platform.

- Retain assets: Provide customers with the tools to make better-informed decisions on their investments within your ecosystem, helping you retain assets for the long term.

- Regulatory advantage: Partner with the only provider to create a successful, end-to-end connection in beta-testing. Win the race for primacy by delivering a proven, reliable journey first.

“As we continue our journey to equip Mercer Master Trust members to achieve the best possible pension savings outcomes, Moneyhub’s commitment and cutting-edge solutions remain integral to our success”

Tim Adams Head of Digital, Mercer

Smart Fact Find

Streamline due diligence

Fact-finding is the necessary friction point that hinders scaling advice and increases the cost of compliance. Our Smart Fact Find solution eliminates that manual burden by leveraging Open Finance data access.

- Accelerate due diligence: replace arduous 45-minute phone calls and paper-based processes with a simple, secure 2-minute digital form-fill

- Access the full picture: instantly gain a verifiable library of real-time wealth, assets, liabilities, income, and spending data from the source, reducing data input errors and ensuring compliance

- Scale your advice: transform the operational cost of initial due diligence, freeing up your advisors to focus on high-value client relationships instead of data chasing

Simply send a link to your clients for single-step consent, and gain the data access needed for efficient, scalable advice.

Targeted Support

Overcome thin data files to provide better support

Move beyond generic communication and costly manual processes to serve more of the 91% of the market not yet receiving advice.

Confidently tread the line between 1-on-1 advice and generalised guidance with granular customer segmentation, driven by connections to all of a customers financial and non-financial data. Provide Targeted Support in an auditable and consistent way at the level of granularity required and replace time-consuming paperwork with efficient and scalable due diligence.

Win Schemes

Differentiate your firm

Achieve a 97.5% data-sharing consent rate to create personalised member experiences, differentiating your firm to win employer mandates. Replace thin slices of data with gamified in-app features and precise financial modelling tools, creating a meaningful value exchange for your customers. Use your skyrocketing engagement to differentiate during the RFP process and win wholesale schemes.

Moneyhub helps pension providers become the first choice

Data Aggregation

Connect to all of a customer’s accounts, both financial and non-financial. Standardise foundational and advanced data for seamless analysis. Our Data Aggregation solution provides market-leading connection, resilience and coverage, ensuring a reliable data foundation for your intelligent banking, pension and investment products.

Data Insights and Recommendations

Deliver the proactive future of finance today. Our Data Insights and Recommendations platform uses proprietary AI to instantly generate personalised, automated journeys, guiding users with the exact ‘next-best-action’ needed to optimise their money and secure lifelong financial well-being.

Embedded Solutions and Portals

Launch superior customer experiences instantly. Our Embedded Solutions and Portals provide trusted, pre-tested journeys—from secure consent to next best action modellers—ensuring a seamless user experience and out-of-the-box compliance with complex Open Finance standards.

FAQs

We support full branded, embeddable, journeys to secure your customers explicit consent for data sharing and to capture their information. We use our Brand Mirror capabilities which allow a true reflection of your brand through configuration rather than expensive custom builds. These flows have been optimised with hundreds of hours of testing. We can also offer these services via secure API if you would prefer to build your own flow.

This can take as little as a few weeks or up to two months for more complex changes. We generally work as fast as needed to meet clients’ aspirational deadlines.

Our uptime has been 100% across 2025 and we target 99.99%. We rarely need to completely take the platform down to perform scheduled maintenance, but when we do this, it is carefully managed to happen during off-peak hours.

We provide dedicated, specialist product support backed up by the technical expertise of our engineering, connections and data science teams. Moneyhub can provide 1st line support for white label platforms or second line support to back up a client’s support team. Service Levels are agreed in our contract and we report continually against those.

In line with industry best practices, we encrypt all data for both transport and storage, and transactional data is held separately from other PII. Access to the data, for both customers and staff, is controlled by a holistic Identity and Access Management (IAM) solution that provides Authentication, Authorisation and Accounting (AAA) for our financial-grade interfaces.

We keep individuals’ PII only as long as we need to be compliant with contractual and legal obligations. Our systems are used and audited by some of the largest banks and financial services firms in the world. We are ISO27001 certified and audited by the BSI.

“This initiative is not just about technology. It’s about empowering individuals to make better-informed decisions that guide them towards a more secure financial future.”

Graeme Bold Director of Workplace Pensions, Scottish Widows