Embedded Solutions and Portals

Embed customised solutions into your app for better use of data and analytics without consuming all your developer budget.

Deliver

valuable user journeys

Access

financial and non-financial customer data

Engage

users with proven, extensively tested journeys

Use Cases

Drive deposits

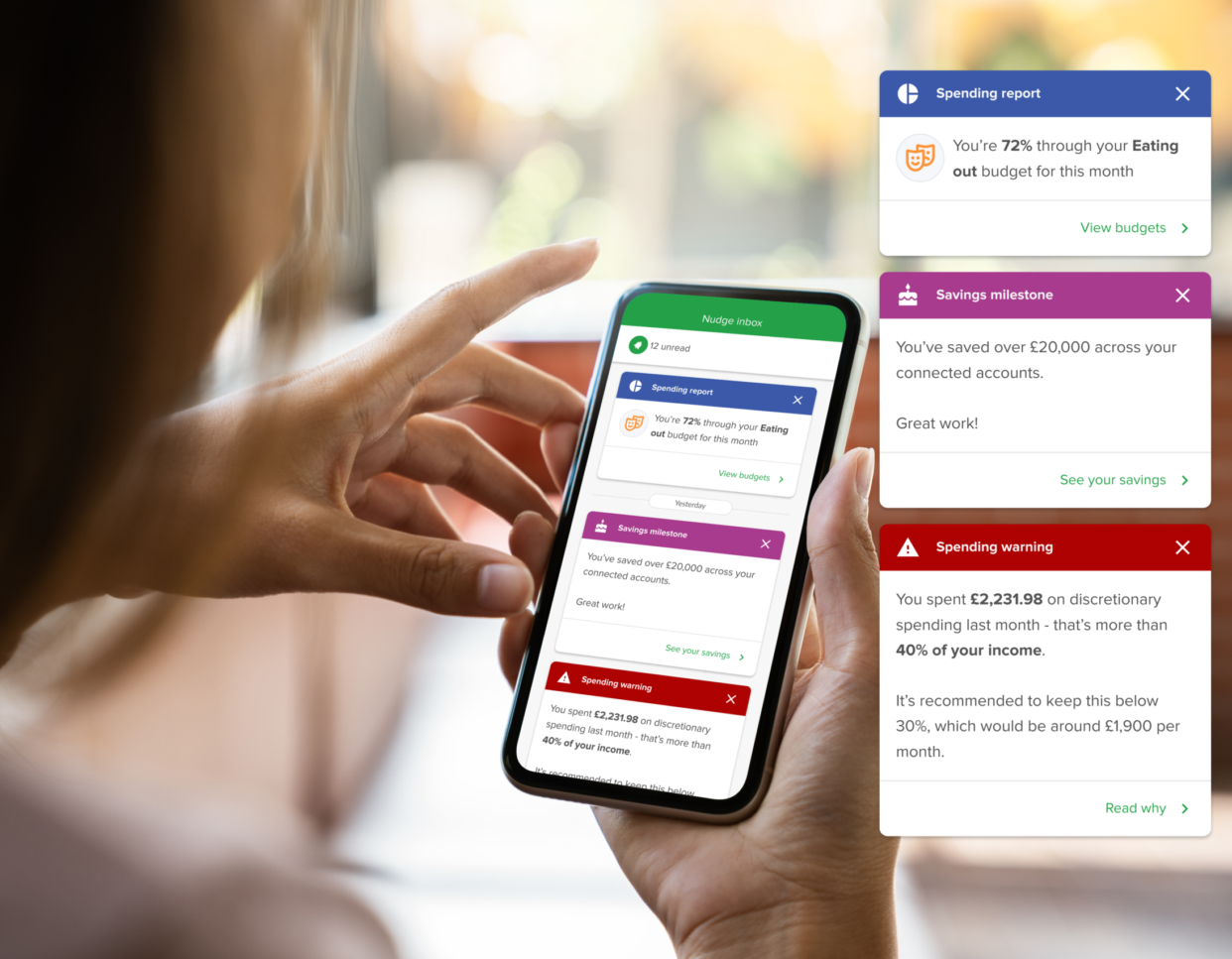

Help users increase deposits and reach their savings goals through next-step nudges.

How it works: Embedded Solutions and Portals

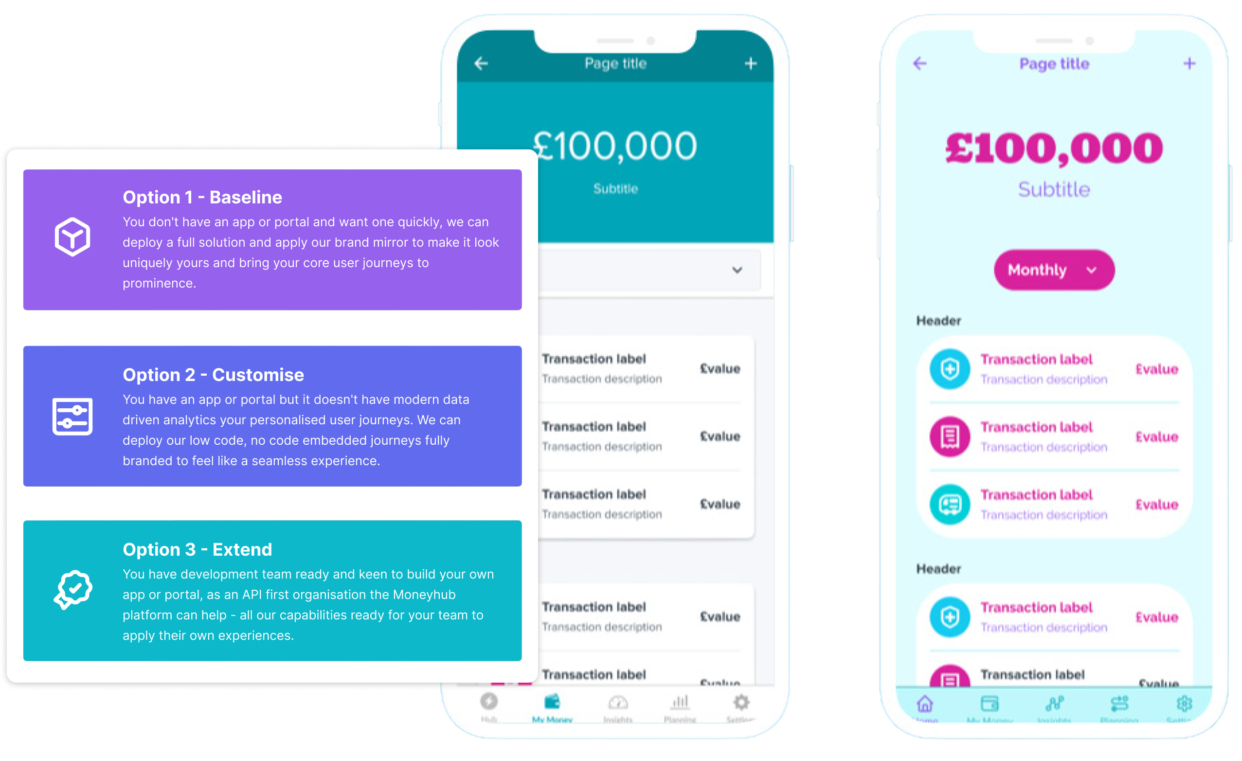

Embedded Solutions and Portals integrates with your pre-existing customer app. Whether it’s built on react native, flutter, or an alternative, our functionality leads to easy integration.

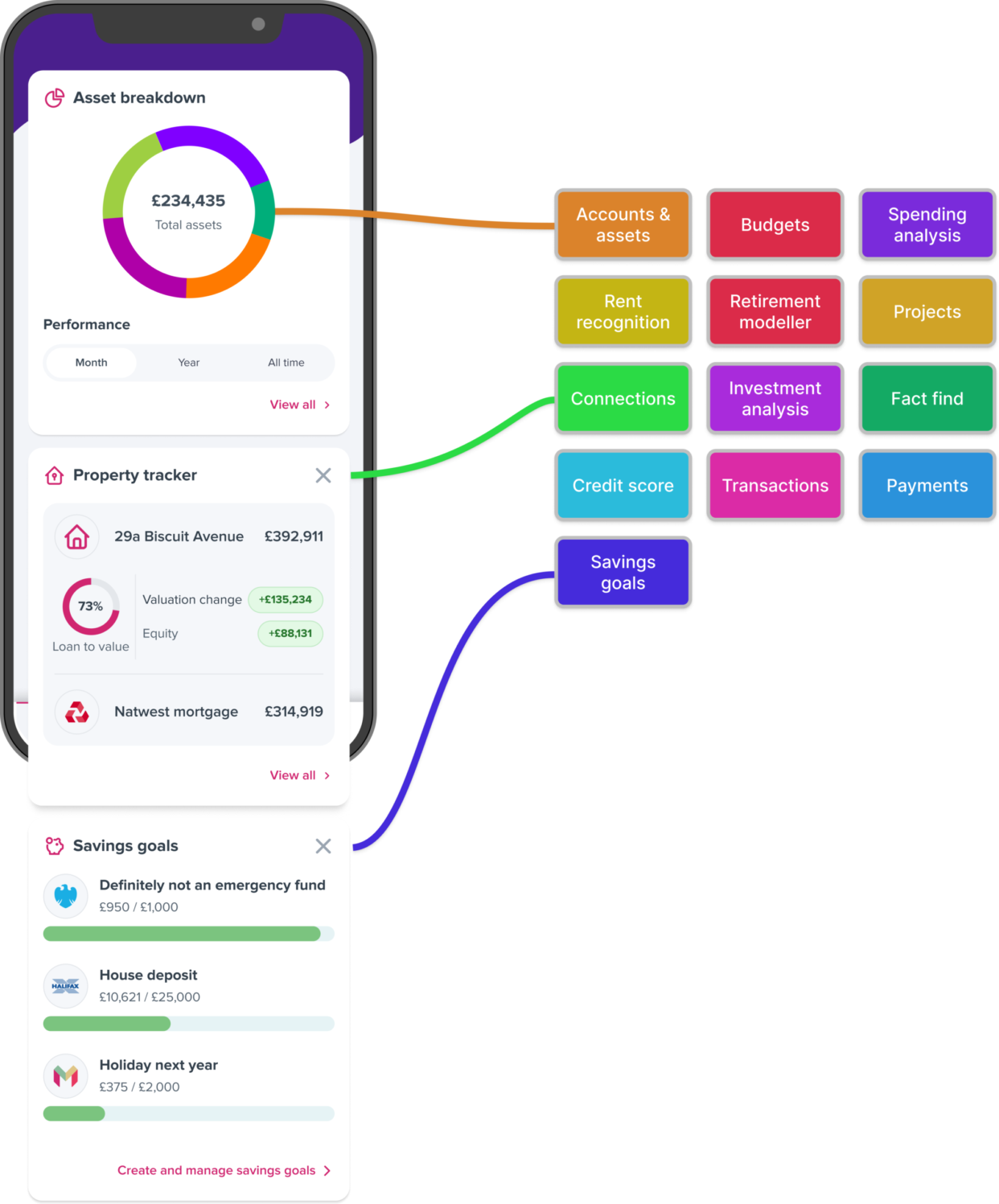

Decide on which customer journeys you’d like to deploy from 20+ customisable options

Deploy Moneyhub’s embedded portal as a webview inside your app

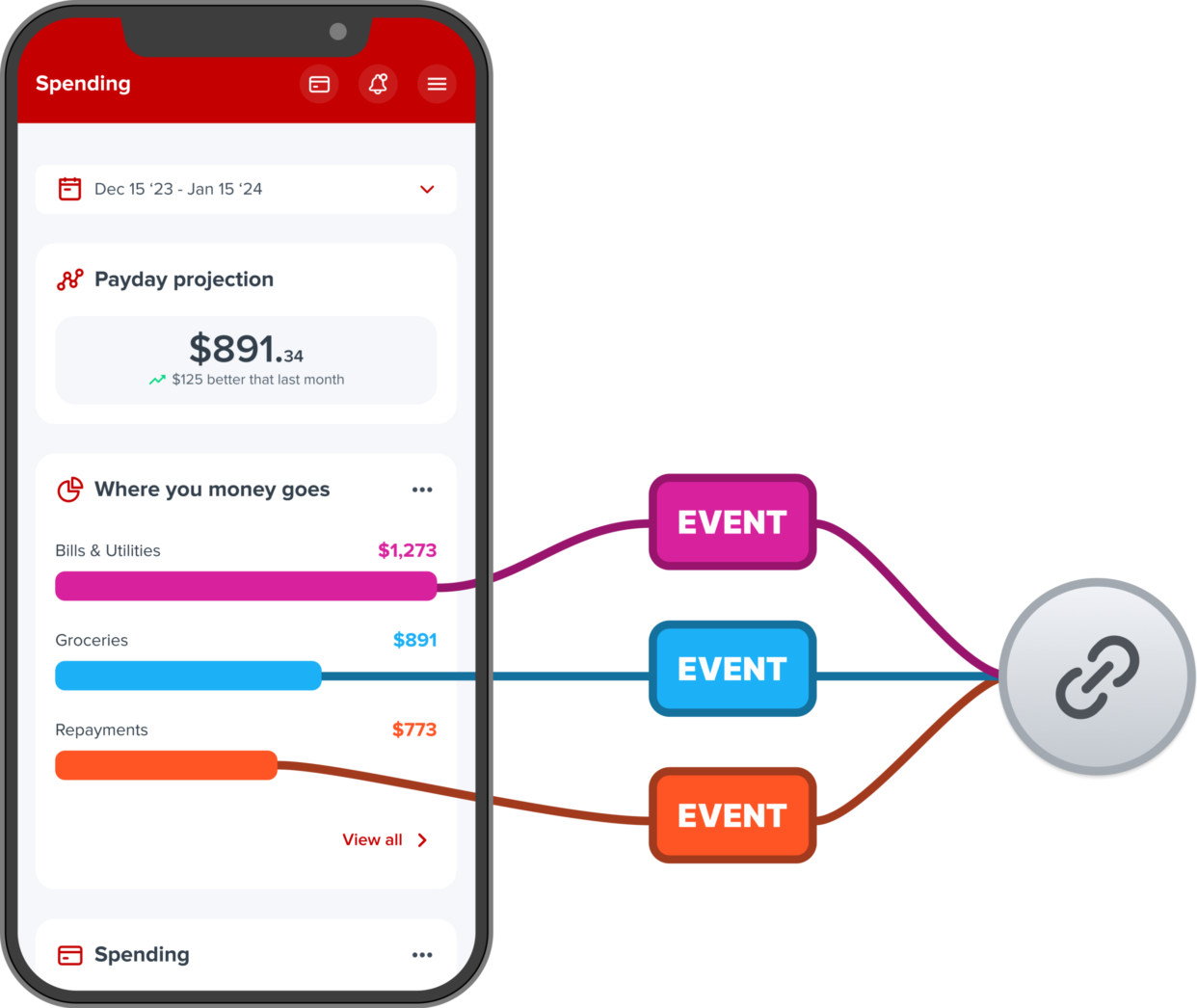

Configure webhooks to communicate between our tech and your app

Trigger personalised notifications with next-step nudges as users log in

Move customers through their financial journeys based on granular segmentation

Faster time-to-market

Real-time operational efficiency

Increased customer loyalty

Core

Assets and Liabilities

Aggregate, categorise and enrich the broadest possible range of assets and liabilities data for every customer.

Core

Net worth

Get real-time net worth calculations and instant updates upon new loans, income levels and financial changes.

Core

Spending analysis

Get a complete spending analysis, including categorised reporting across real-time and historical data. Find trends and patterns to learn more about the customer’s needs, lifestyle and full picture.

Core

Regular payments

Allows users to set up regular payments, based on traditional consent structures or new rules-based models (known as VRPs) to manage the entire customer lifecycle in-app. Provide convenience and stretch lifetime value.