Data Aggregation

Connect to customer accounts (financial and non-financial) to access and standardise foundational and advanced data for seamless analysis.

Financial Services

get the data you need in the format you want

Innovators

access to consent driven data from the regulated experts

Use Cases

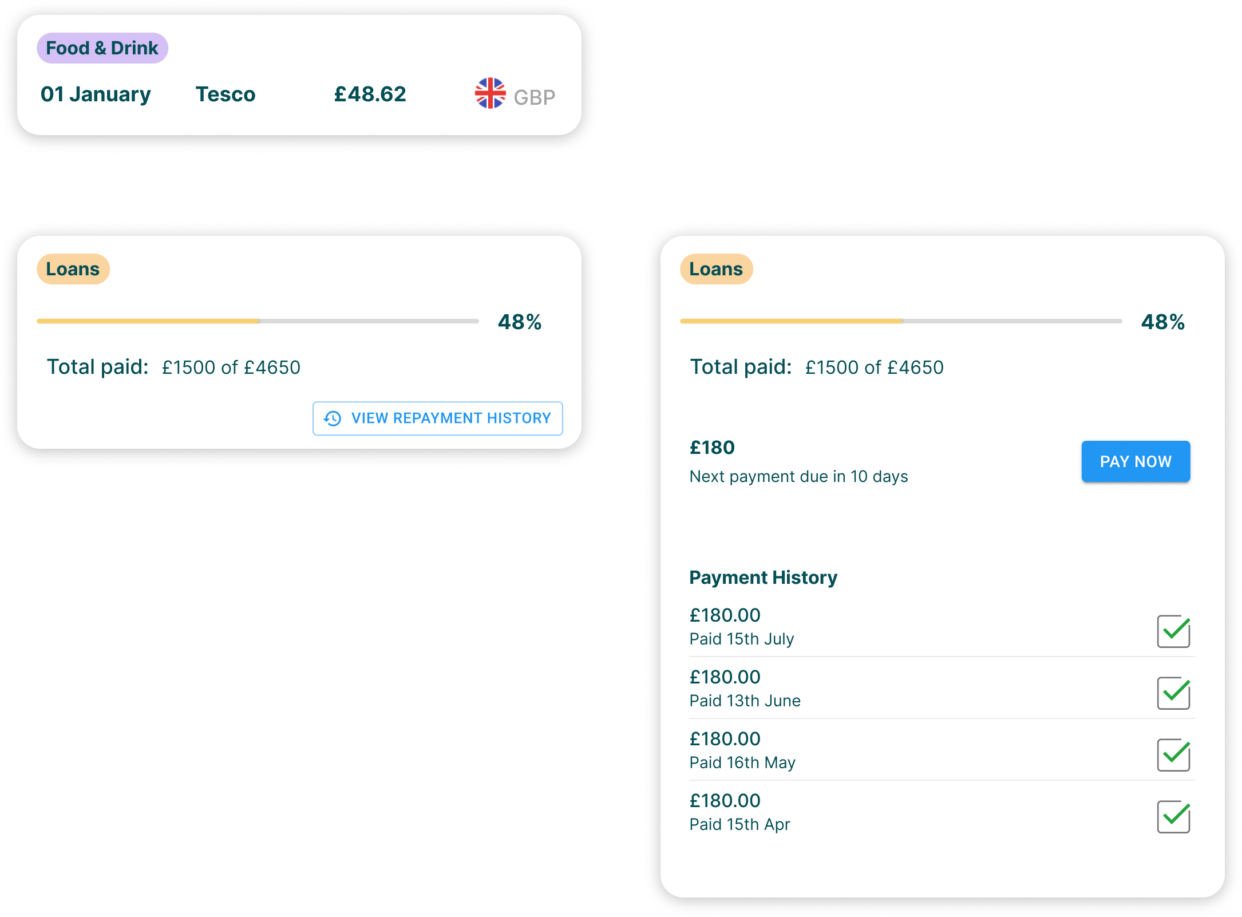

Daily spending balances, income and expenditure and cash savings

When you need to see current accounts and credit cards, this data is foundational to Smart Insights, Categorisation and Enrichment and other data services.

Moneyhub is regulated to provide easy and robust access, with data coverage that surpasses industry standards. The broadest coverage available delivered in the most effective way.

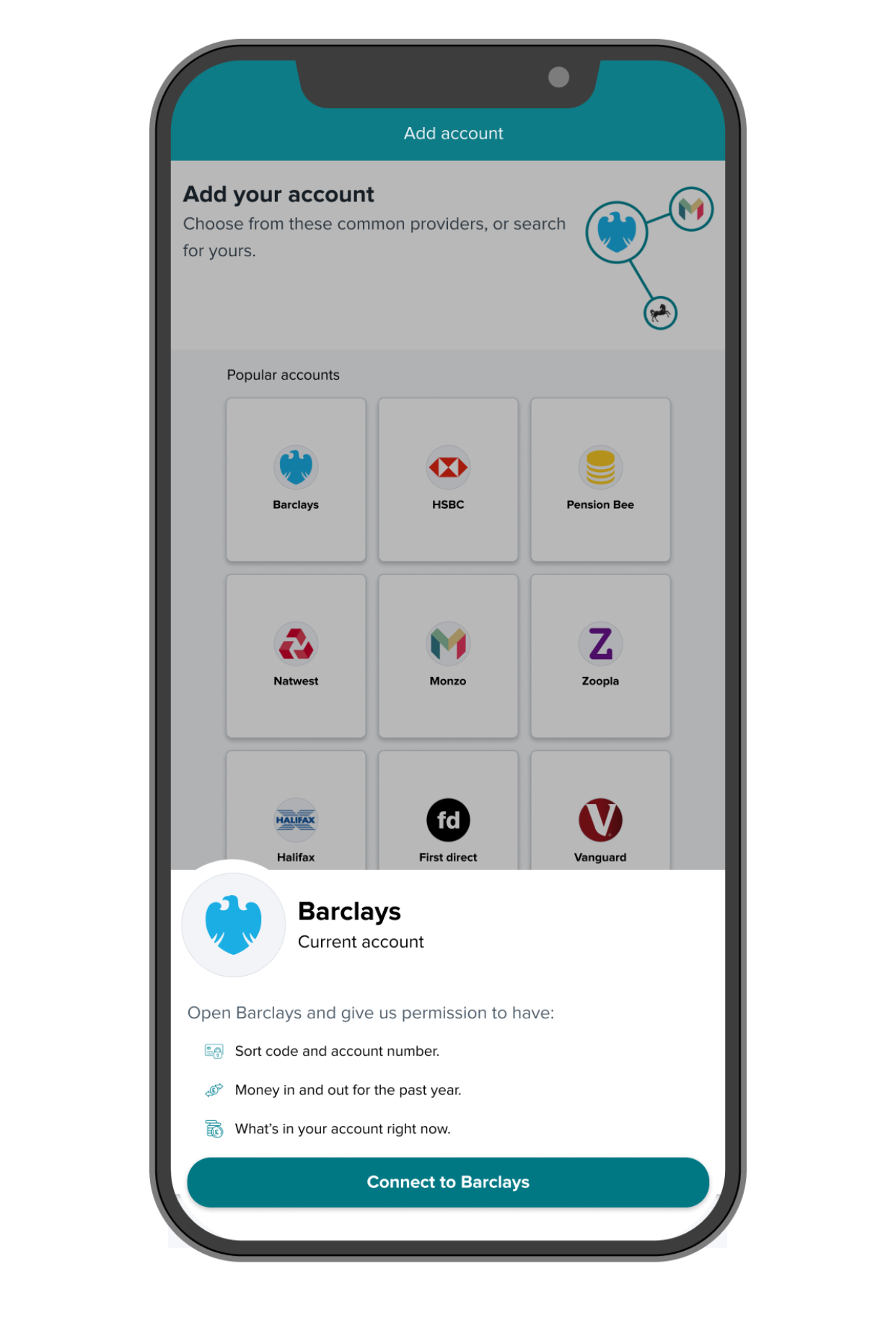

How it works: Data Aggregation

The core function of Data Aggregation is to securely connect to a wide range of financial institutions, retrieve data, and transform it into a single, consistent, and easy-to-use schema.

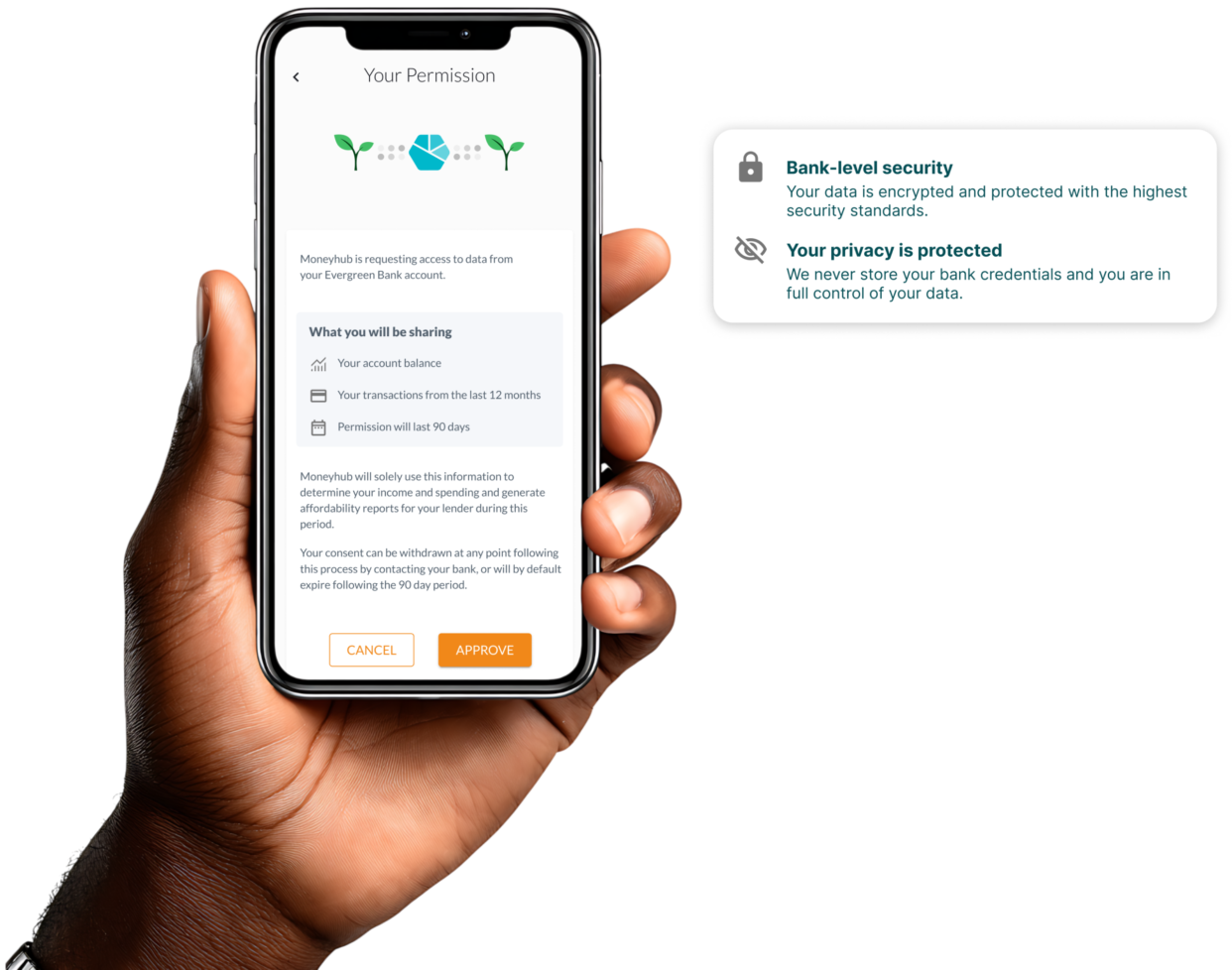

The customer grants one-time access or permission for multiple updates for up to 90-days to share their data.

Moneyhub carries out a secure and regulated data exchange with the account provider using Open Banking APIs, private APIs, or bespoke data feeds from partners.

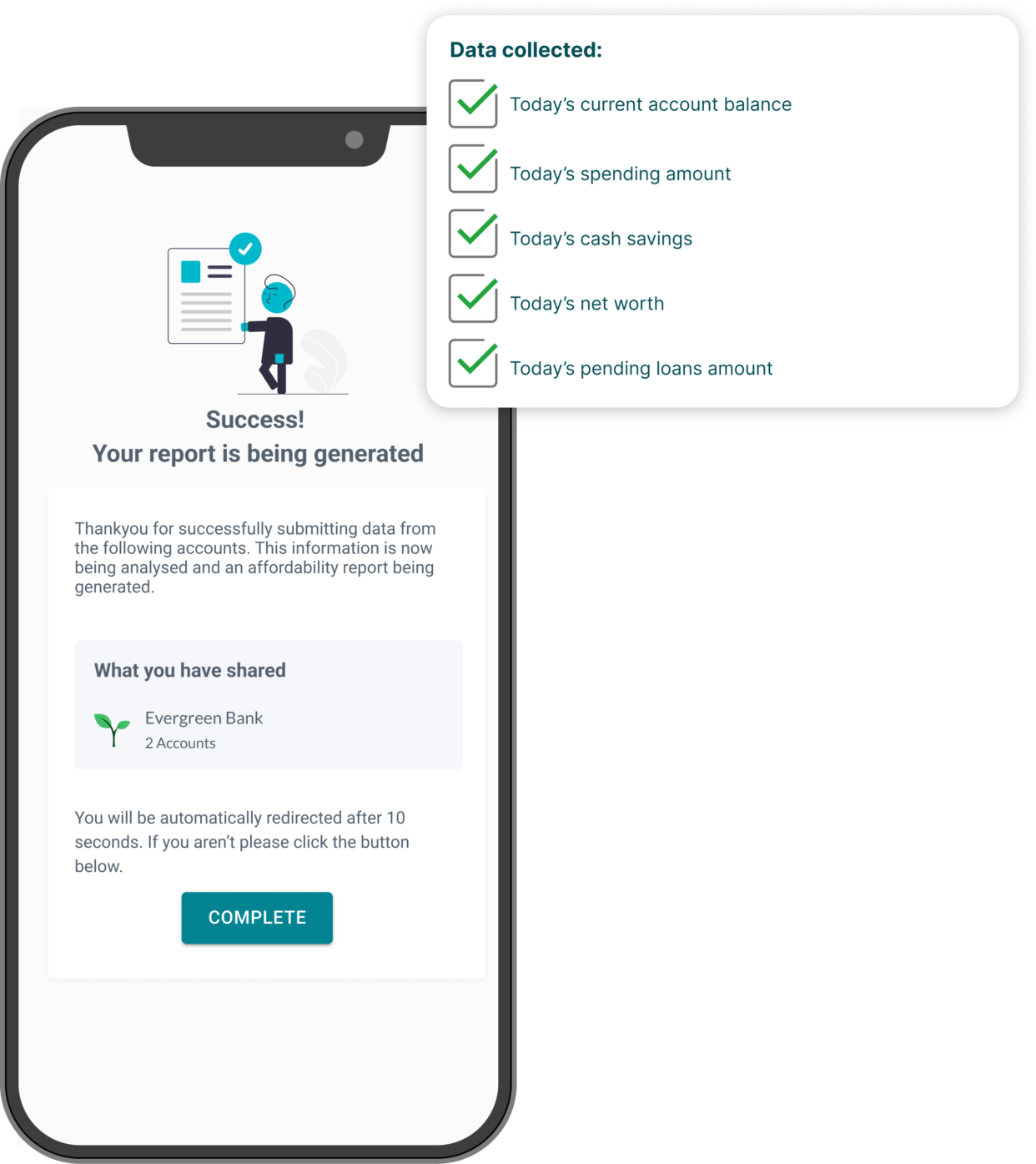

The engine retrieves a library of real-time wealth, assets, liabilities, income, and spending habit information. Data is polled multiple times a day for new transactions and updates pushed to your service.

Moneyhub formats and standardises the data into a consistent schema for smooth integration into your systems.

Better

data quality

Lower

lending risk

Precise

product targeting

Core

Data aggregation

Securely connect to UK current accounts, savings accounts, and credit cards via Open Banking APIs.

Core

Data normalisation

All retrieved transaction and account data is processed into a single, standardised JSON schema, regardless of the source institution. Key fields include standardised transaction descriptions, amounts, dates, and balances.

Core

Data polling

Automated, periodic polling for new transaction data once a connection is established multiple times a day with updates proactively pushed to your service.

Core

API data access

A comprehensive set of REST APIs for retrieving all aggregated data.

Optional

Open finance connectivity

Expansion of data aggregation to include pensions, investments and mortgages.

Optional

Open data connectivity

Expansion of data aggregation to include asset valuation, such as house and car valuation services.

“This initiative is not just about technology. It’s about empowering individuals to make better-informed decisions that guide them towards a more secure financial future.”

Graeme Bold Director of Workplace Pensions, Scottish Widows