Moneyhub, the award winning top 100 global fintech, has been granted permission to provide Credit Information Services by the Financial Conduct Authority (FCA).

Scottish Widows partners with Moneyhub to help customers see all their finances in one place

Moneyhub appoints Nick Middleton as Strategic Account Director for Partnerships

To consolidate or not to consolidate: One in ten pension savers don’t think it’s worth the effort to combine pensions

Moneyhub top 100 ‘most promising’ fintech startups in the world for 2023

One in five now make payments using Open Banking

Auto-enrolment - savers with workplace pensions are more than twice as likely to be disengaged

Savers with workplace pension schemes are significantly less likely to understand or engage with their pensions compared to their counterparts with personal pensions, according to new research from Moneyhub, the award-winning data and payments platform built on Open Banking and Open Finance principles.

Heads in the sand: Quarter of pension savers never check their pension

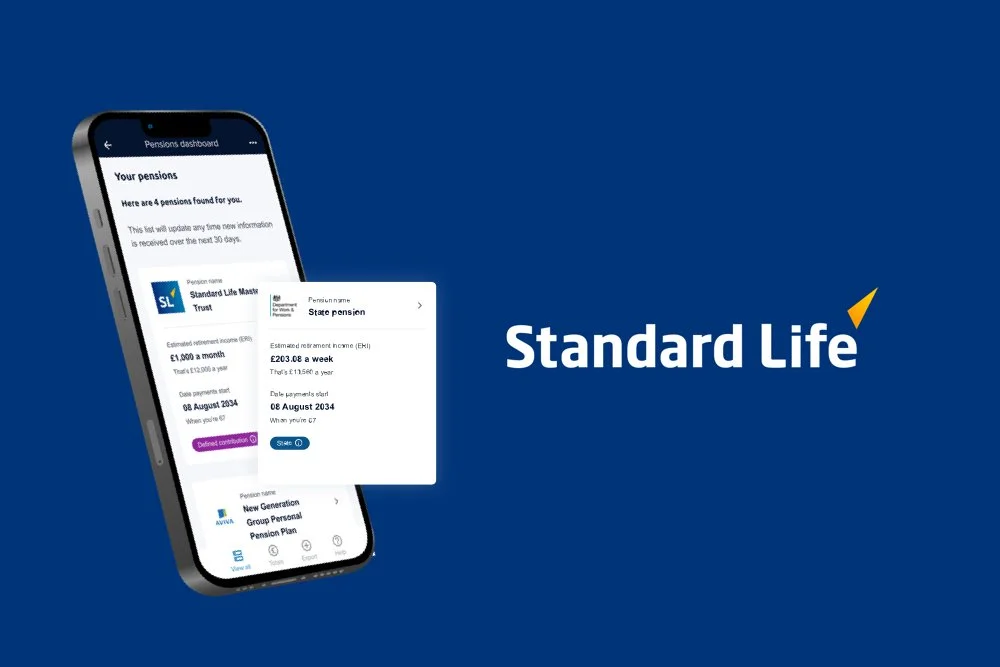

Standard Life strengthens partnership with Moneyhub and announces plans to deliver commercial pensions dashboard

Standard Life, part of Phoenix Group, the UK’s largest long-term savings and retirement business, has partnered with Moneyhub, the market-leading Open Banking and Open Finance platform, to deliver its pensions dashboard. This marks the first UK provider to commit to offering a commercial pensions dashboard.

Lenders can help Brits improve financial resilience with data amidst cost of living crisis

Young people becoming increasingly reliant on credit as cost-of-living crisis continues

The cost of living crisis is causing more young people to become dependent on the use of credit to manage their finances. In the last six months, 24% of under 35s have applied for an overdraft and 19% have applied for a payday loan, with 22% and 29% of those with personal loans and payday loans using these products to manage everyday expenses. With Consumer Duty looming, banks and other lenders will need to ensure customers are on the most suitable products for their circumstances.

Moneyhub partners with wealth planning solutions provider Voyant

Moneyhub and MX Partner to Drive Global Adoption of Open Finance

Moneyhub, the award-winning data and payments platform built on the principles of Open Banking and Open Finance, has today announced a strategic partnership with MX Technologies, Inc., a leader in Open Finance in North America. This partnership enables Moneyhub and MX to leverage each company’s capabilities and networks to help drive positive outcomes for organisations and consumers in both Europe and North America.

Open Banking powered fundraising for Leukaemia Care’s Unicornfest kicks off in Bristol

Data and Payments platform Moneyhub expands with senior hires

Rising rates could push more into the red: A quarter of homeowners won’t be able to afford their mortgage if rates rise again

Millions of homeowners could be at risk of defaulting on their mortgage if interest rates move upwards again according to new research from Moneyhub Decisioning, the data platform built on the principles of Open Finance to drive better affordability, eligibility, suitability and vulnerability checks.

Moneyhub responds to Ministerial update statement on Pensions Dashboards

Moneyhub, the award-winning Open Data platform and alpha partner to the Pensions Dashboards Programme (PDP), responds to today’s Government announcement. It has announced that statutory connection staging dates will be replaced with guidance to facilitate flexible roll out as organisations are ready and able to do so.

Standard Life partners with Moneyhub to integrate open finance functionality across its app and dashboard

Moneyhub first to add Chase Bank Open Banking connection

New research to shine light on the real day-to-day experience of financial uncertainty among UK households

Today, Nest Insight, the Centre for Personal Financial Wellbeing at Aston University, and the Yunus Centre for Social Business and Health at Glasgow Caledonian University have announced the launch of a new research programme that will build an in-depth understanding of the lived experience of financial uncertainty among low to moderate income households across the country.