Intelligent banking. Build for real life.

In an era defined by strict regulation and competitive pressure, relying on fragmented data is a liability. Moneyhub delivers the platform that transforms raw customer data, from a broad range of sources, into verified, real-time insights. We empower banks and lenders to match people to products, automate risk assessment, accelerate compliant approvals, and safely increase customer lifetime value.

98%

transaction categorisation accuracy

99%

merchant accuracy

18%

increase in lending approvals

98%

reduction in payment costs

Transaction Categorisation and Enrichment

Leverage instantly recognisable spending into new revenue

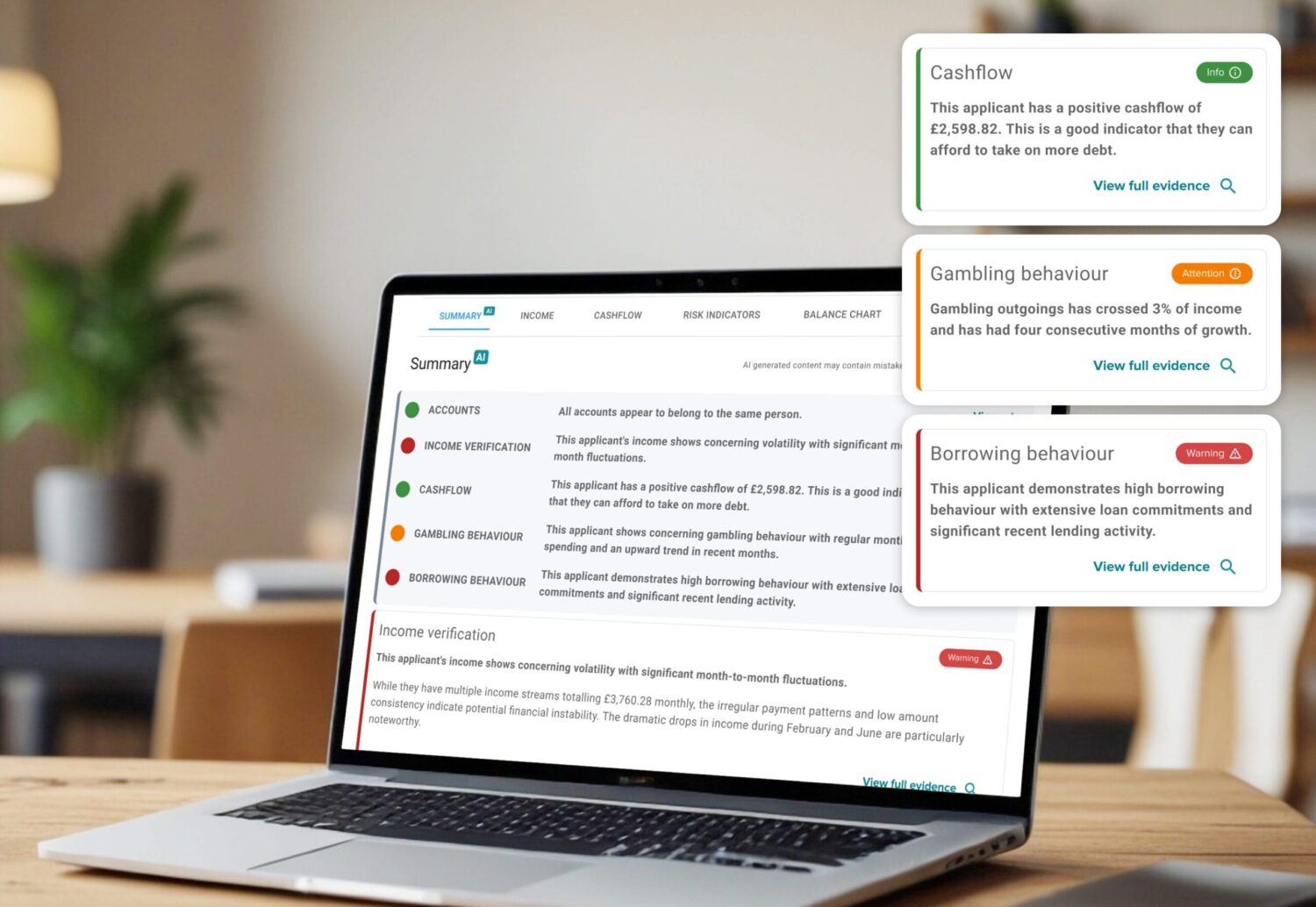

Smart Lending

Increase lending approvals and reduce risk

Increase lending approvals by 18% without increasing risk. Our solution replaces financial uncertainty with verified income and spending data, empowering your team to:

- Accelerate time-to-decision and boost applicant volume per hour through automated approvals and rejections

- Safely expand your portfolio by confidently assessing new, complex segments, such as the self-employed

- Free underwriters to focus their expertise on complex edge cases, automating the manual, time-consuming steps

Smart Segmentation

Gain a deeper customer understanding

Replace vague assumptions with precise, data-driven targeting to achieve better user engagement and product uptake. Apply the data to generate financial guidance at scale – a feat that’s simply impossible to perform manually. And help your customers to reach their goals quicker.

Sell more of your products at an improved rate of suitability, increasing your assets under management at a lower cost to you.

“We’ve used Moneyhub to expand into new segments of customers, such as self-employed, giving us more data and confidence when looking at lending in new areas”.

Tim Parry Personal Loans Director, Admiral

Smart Money Actions

Optimise user behaviour and meet compliance objectives

Move beyond static product offers to delivering automated, contextually relevant advice and offers. This increases engagement, product uptake, and lifetime value by:

- Connecting data dots with behavioural analytics to serve the exact ‘next best action’ at the optimal time

- Ensuring product suitability and meeting compliance objectives before an offer is ever made, mitigating mis-selling risk

- Turning forgotten accounts into high-value daily app logins and engaged customers

Smart Payments

Improve first-time payment success rates and help customers feel in control over their outgoings

Complete the loop from insight to action with intelligent, low-cost payments that improve cash flow and customer trust:

- Reduce costs: Achieve a 98% reduction in single payment costs by replacing traditional failures with integrated, flexible Smart Payments

- Increase Success Rates: Replace broken Promises-to-Pay with Variable Recurring Payments (VRPs) to improve first-time payment success rates to 70%

- Empower Customers to set automated rules for loan repayments, improving financial control and compliance

Smart Product Match

Driving Engagement

Move beyond generic nudges. Our platform connects customer data dots with fine-grained behavioural analytics to identify the precise next best action for every user.

Mitigate risk and meet Consumer Duty requirements while growing average lifetime value of each customer. Proactively identify and flag signs of financial vulnerability through behavioural triggers, offering timely and compliant support. Fuel targeted cross-sell with optimised messaging for highly-segmented cohorts, ensuring product offers are relevant, timely, and significantly increasing conversion rates.

Moneyhub supports banks and lenders to optimise customer value through better use of data

Categorisation and Enrichment Engine

Transform messy financial data into clear, actionable intelligence. Our best-in-class Categorisation and Enrichment engine delivers superior accuracy and coverage, powering your applications for better affordability, vulnerability, and hyper-personalised customer outcomes.

Embedded Solutions and Portals

Launch superior customer experiences instantly. Our Embedded Solutions and Portals provide trusted, pre-tested journeys—from secure consent to next best action modellers—ensuring a seamless user experience and out-of-the-box compliance with complex Open Finance standards.

Payments

As a regulated AIS and PIS provider we streamline account-to-account payments. Embedding our API-first services in our clients user journeys we move money faster, giving a better client experience using bank-level authentication. With Smart or Variable Recurring Payments allow frictionless journeys with automatic triggering so customers can move money where it’s needed.

FAQ’s

We support full branded, embeddable, journeys to secure your customers explicit consent for data sharing and to capture their information. We use our Brand Mirror capabilities which allow a true reflection of your brand through configuration rather than expensive custom builds. These flows have been optimised with hundreds of hours of testing. We can also offer these services via secure API if you would prefer to build your own flow.

In line with industry best practices, we encrypt all data for both transport and storage, and transactional data is held separately from other PII. Access to the data, for both customers and staff, is controlled by a holistic Identity and Access Management (IAM) solution that provides Authentication, Authorisation and Accounting (AAA) for our financial-grade interfaces.

We keep individuals’ PII only as long as we need to be compliant with contractual and legal obligations. Our systems are used and audited by some of the largest banks and financial services firms in the world. We are ISO27001 certified and audited by the BSI.

We offer standalone solutions that require no technical resource, as well as no-code and low-code integrations if you would prefer an embedded solution. For any clients with more technical resources or a desire to maintain autonomy over the solution, we offer a suite of APIs giving you full control over any aspect of the product. Your team may want to optimise the models before go live or wait for the initial results and optimise from there. Whatever the approach, we will work with you to ensure a successful project.

Our uptime has been 100% across 2025 and we target 99.99%. We rarely need to completely take the platform down to perform scheduled maintenance, but when we do this, it is carefully managed to happen during off-peak hours.

We provide dedicated, specialist product support backed up by the technical expertise of our engineering, connections and data science teams. Moneyhub can provide 1st line support for white label platforms or second line support to back up a client’s support team. Service Levels are agreed in our contract and we report continually against those.

“By partnering with Moneyhub and using Open Banking technology we are able to streamline the process and in doing so allow our members to start earning a higher rate of interest on their money right from day one.”

Daniel King Chief Digital Product Owner, Nationwide