Categorisation and Enrichment Engine

Turn raw, ambiguous banking data into clear, actionable insights.

98%

accuracy in categorisation

Trained on a broad range of client data collected over 15 years, consistently maintained and retuned to ensure continued accuracy.

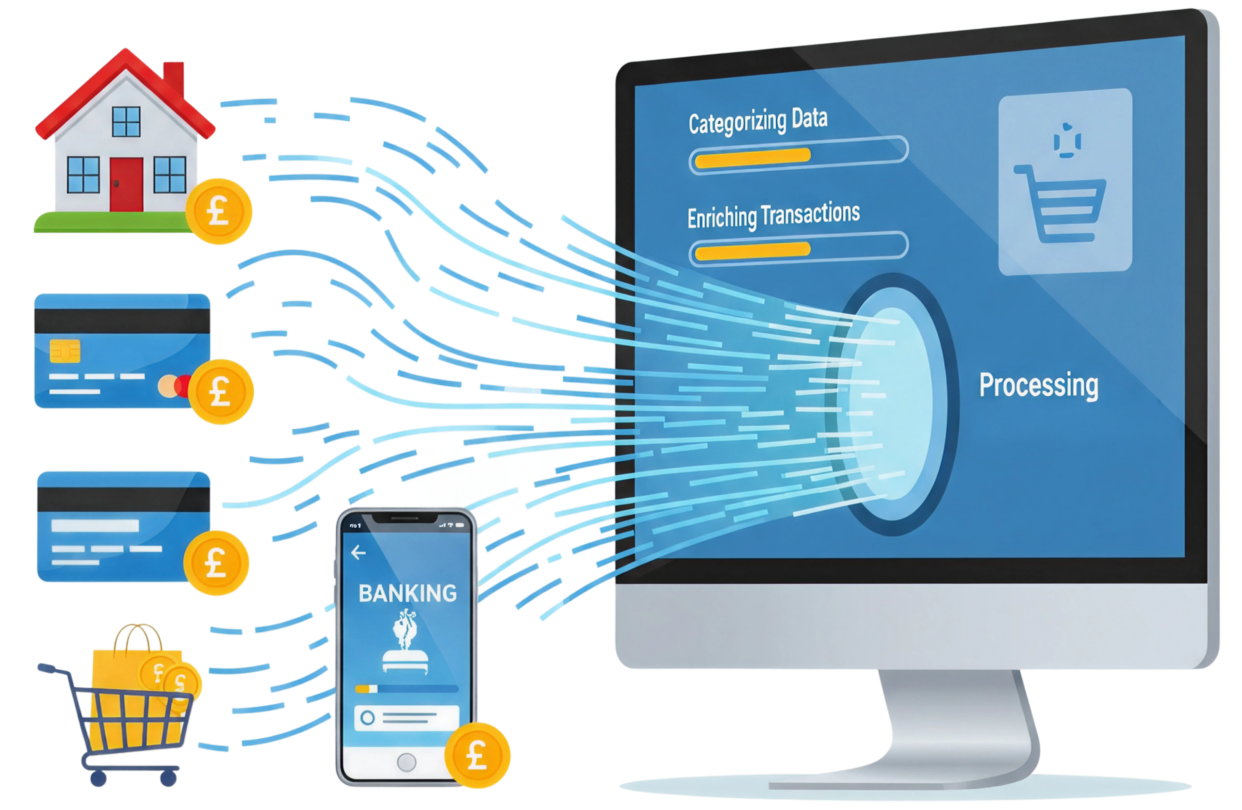

4

levels of granularity

Multi-level taxonomy provides up to three levels of detail for all transactions, with a fourth level specifically for categorising loan types.

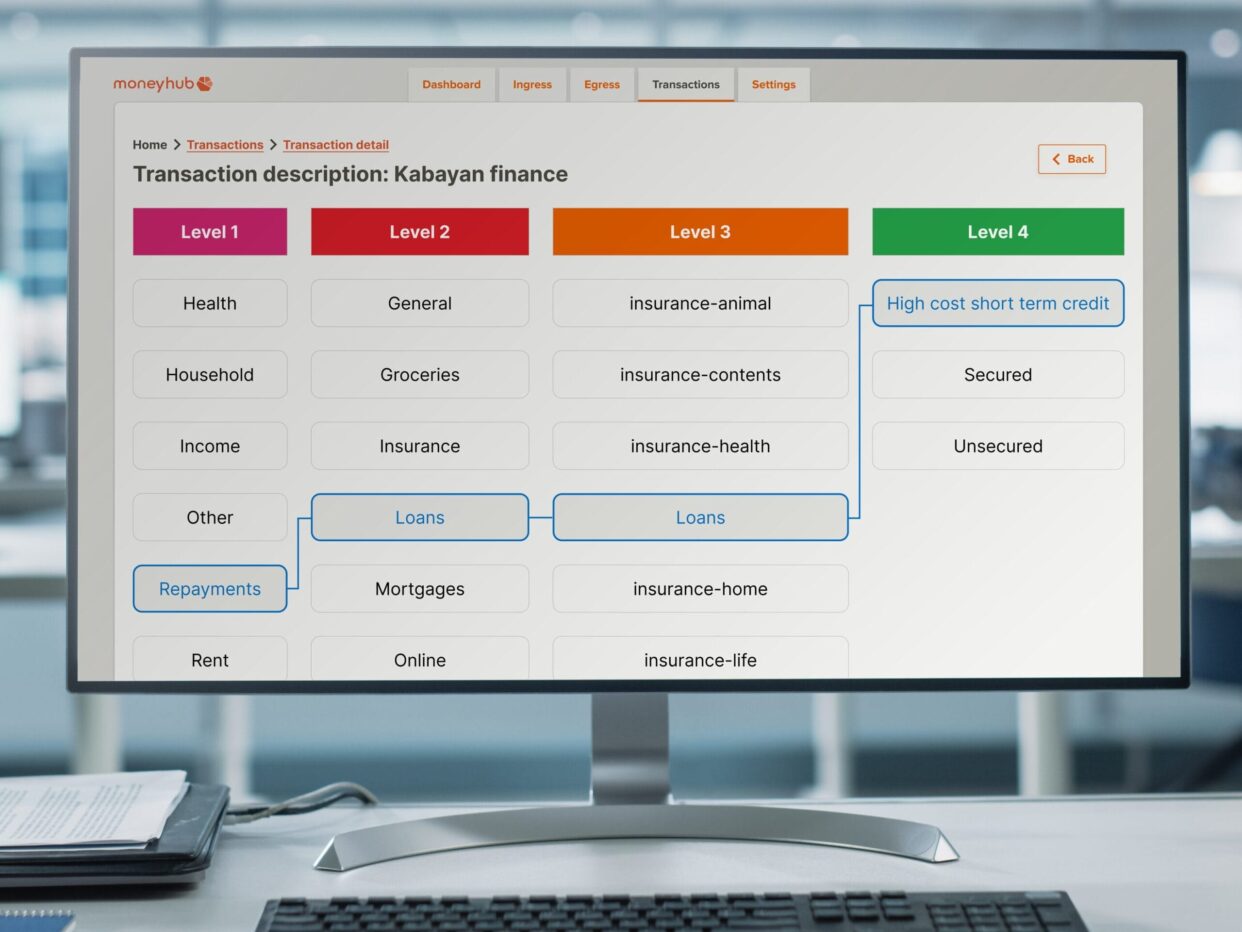

99%

accuracy in merchant ID

Identify when new merchants enter the market, ensuring accuracy for both major household names and small, independent merchants.

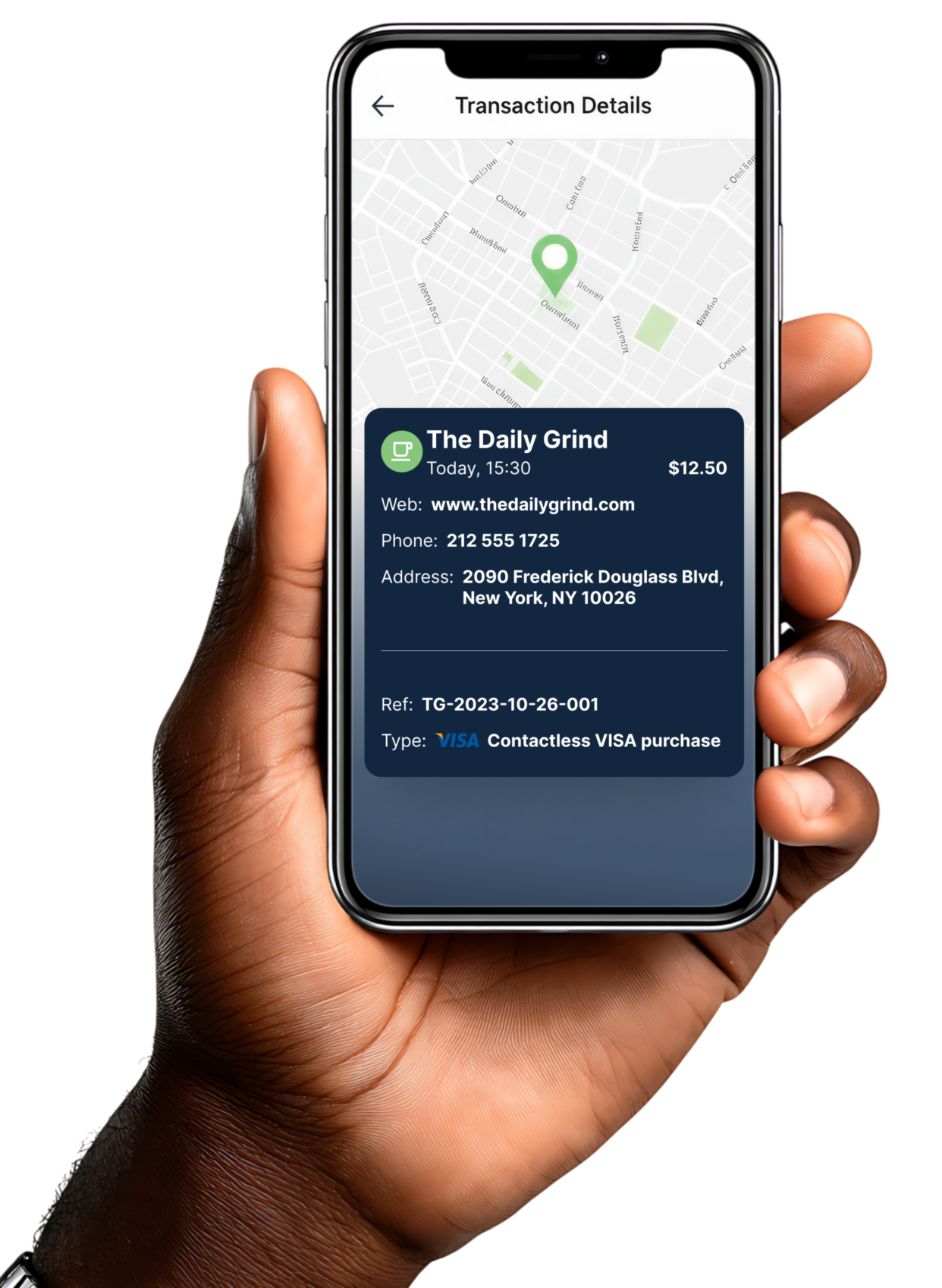

extra

layers of enrichment

Transactions are enriched with merchant data like logos, geolocation and telephone numbers, alongside industry standards: amount, category, date and name.

Use Cases

Help customers recognise their spending

Improve product marketing targeting

Identify fraudulent transactions in real-time

Increase deposits with savings goals

Improve cross-sell and upsell rates

“Moneyhub’s AI-driven tech will help enrich the data we’re giving back to our customers and set us up for success with even more personalised products and services in the future.”

Sri Kanisapakkam Chief Data and Analytics Officer at Nationwide Building Society

How it works: Categorisation and Enrichment Engine

The engine receives raw banking transaction data in real-time, either via an API or a direct link to your Kafka broker. It can accept data from Moneyhub’s Open Banking connectivity or from a client’s own proprietary data.

The engine uses proprietary AI to balance and process four key sources of data: Moneyhub’s exclusive labelled dataset, your data, Open Banking data, and open data. Model weights are assigned to each data type, ensuring that input values are accurately mapped to the correct output classes.

The engine detects spending analysis, regular transactions, and merchant names from the data. This information is then fed into a machine learning model that categorises transactions into a four-level taxonomy, from a broad category group (Level 1) down to a specific loan type (Level 4).

Once categorised, the engine enriches transactions with contextual data. This includes merchant metadata like logos, websites, and telephone numbers. Optional geolocation data can also be added for card-present transactions.

The final output is clean, enriched data that generates customer and financial insights. This empowers you to build a fuller financial picture, create nudges, and develop targeted cross-selling offers.

Secure

cloud infrastructure

multiple availability zones with automated failover capabilities.

1 billion

transactions per day

at an average of 12,000 transactions per second (TPS).

48,000

transactions per second

scalability, beyond Amazon’s average of 29,000 product searches per second.

GDPR

compliant

all data is encrypted in-transit and at rest for security and regulation.

Core

Multi-level customer centric taxonomy

12 x Level 1 Category Groups and 65 x Level 2 Categories, providing granular categorisation.

Core

Merchant detection

Thousands of merchants and associated metadata, such as logos, telephone numbers and websites.

Optional

Geolocation

Provides highly accurate location data for where the transaction took place such as latitude, longitude and postcode.

Optional

Retrieving static map

Integration of dynamic map displays. This service connects seamlessly to retrieve map images, offering users a visually engaging way to view transaction locations.

Optional

Enhanced transaction information

Integration of enhanced merchant data to retrieve their information, including; phone number, website, and opening hours.

Optional

Regular transaction detection

Identifies a regular series of transactions from all transaction types (both income and expenditure), beyond simply Direct Debit.

“Partnering with Moneyhub will allow us to rapidly deliver far richer and more valuable insights for our customers.”

Ranil Boteju Group Chief Data and Analytics Officer at Lloyds Banking Group