Payments

Facilitate pay-by-bank, pay-by-link and smart payments, also known as variable recurring payments (VRPs), for higher conversion rates at lower costs.

High daily volume

Moneyhub supports daily payment volumes easily through scalable infrastructure and transactions per second rates in line with Tier 1 banking Requirements.

Faster Payments

Using Faster Payment Scheme payment rails as the underlying payment mechanism captures the majority of personal and business banking users.

High-value transactions

Single payments up to £250,000 per payment are supported.

Pay-by-link

Merchants, organisations and individuals can generate a unique payment link or QR code, shared with payers. Enable remote, or in-person payment requests without requiring the payer to enter destination account details manually, greatly reducing errors.

Pay-by-bank

Send or receive single immediate payments for fast and direct settlement. Authenticated payments improve collection rates while reducing the risk of fraud or misdirected payments.

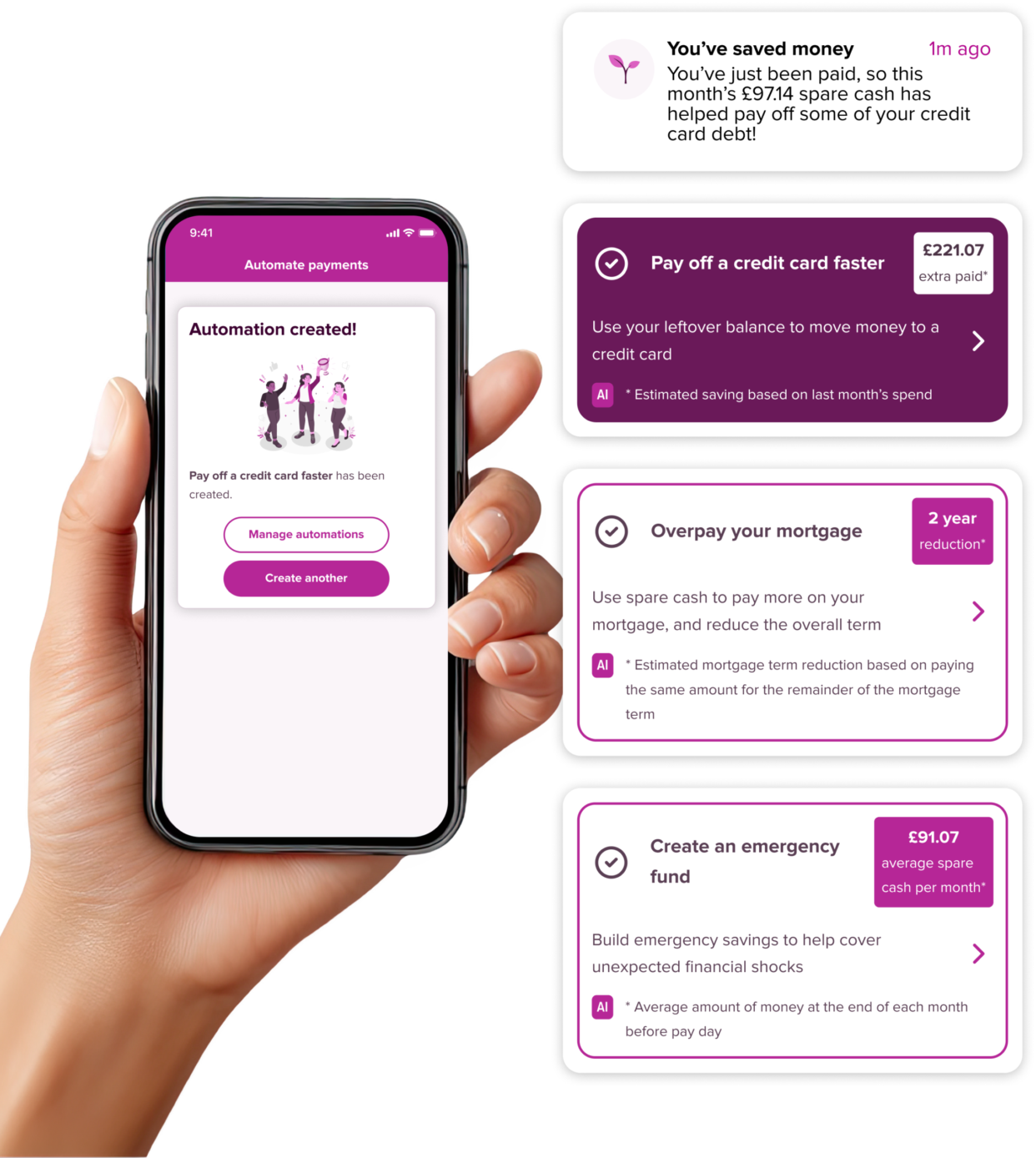

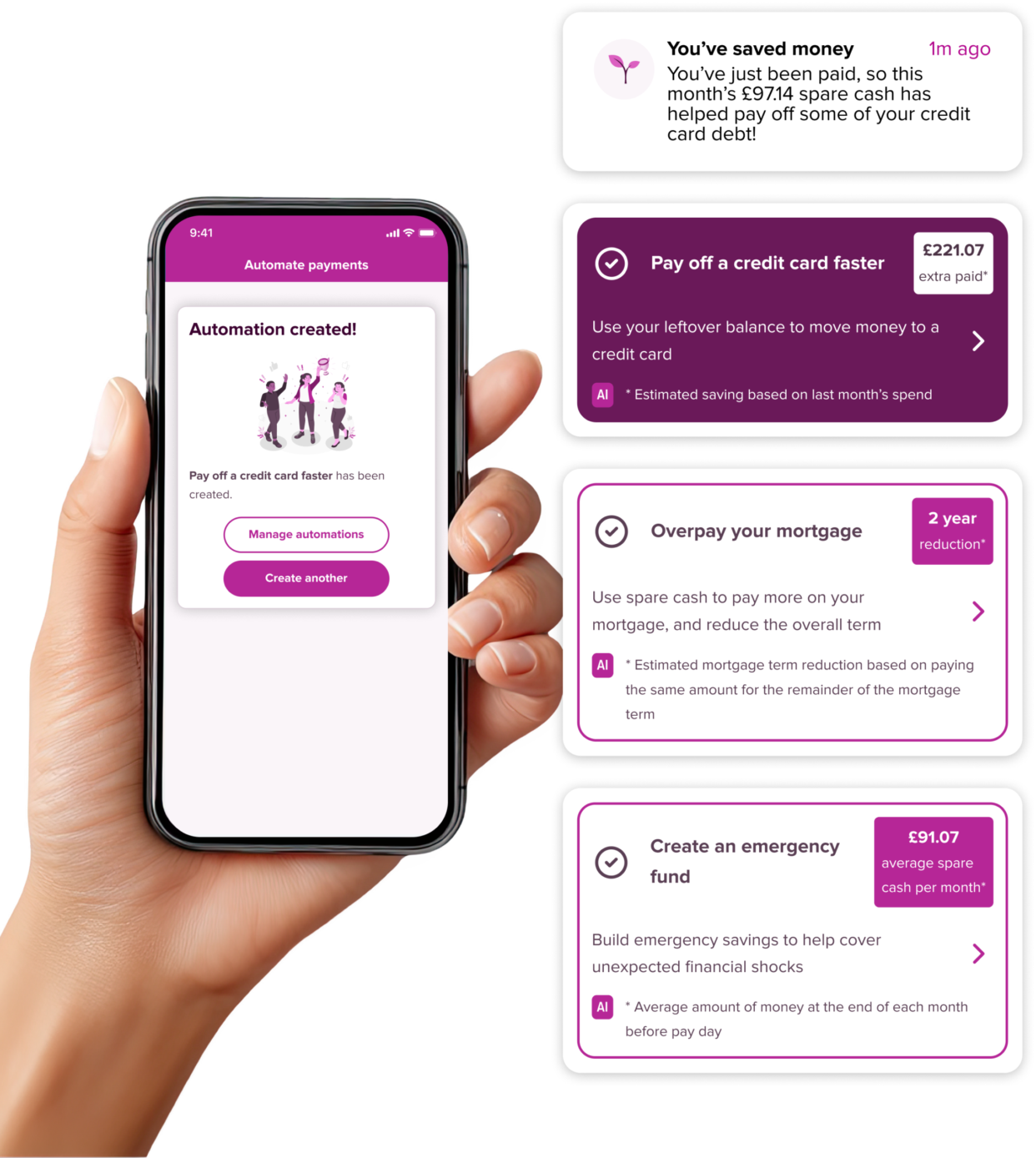

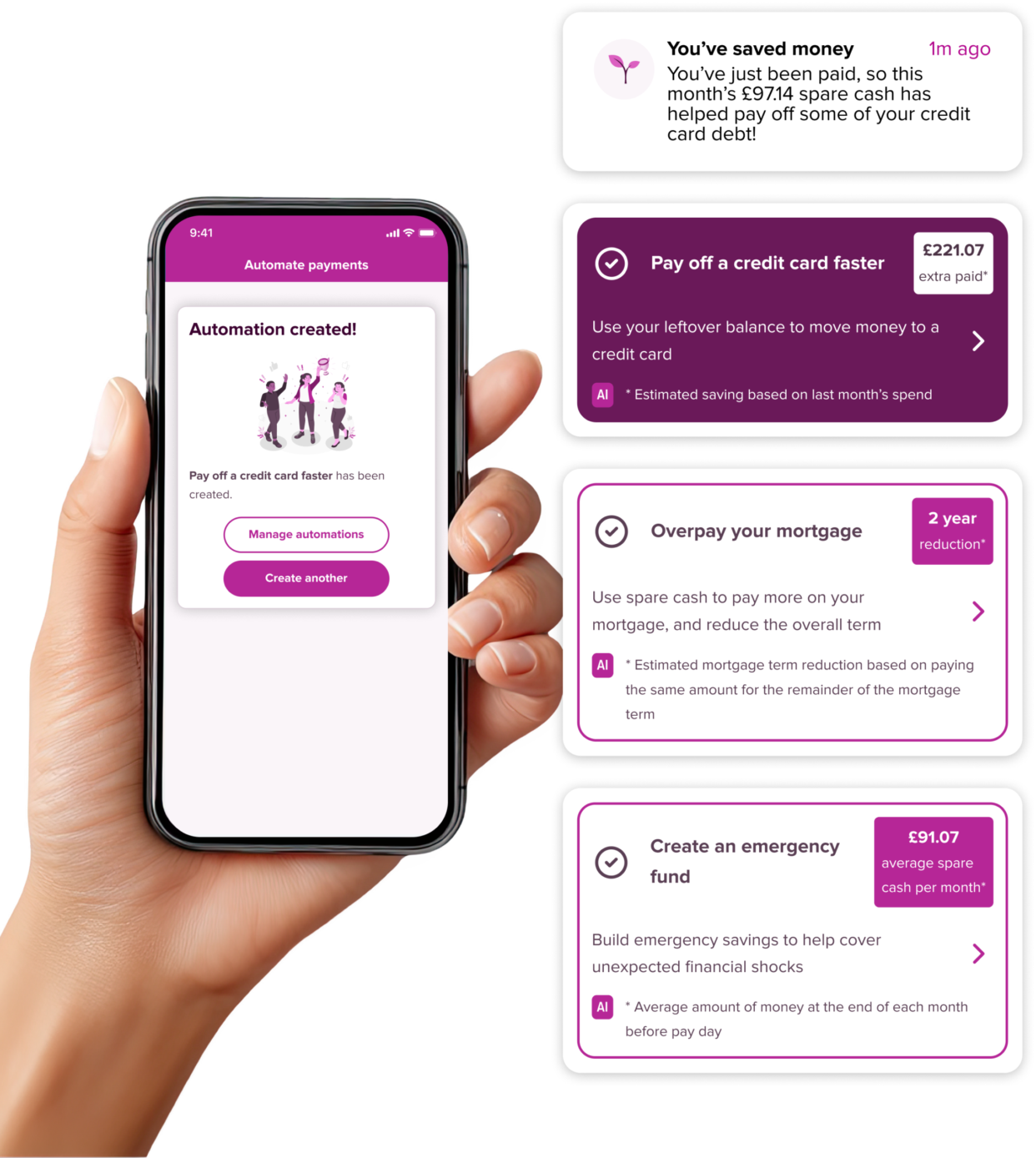

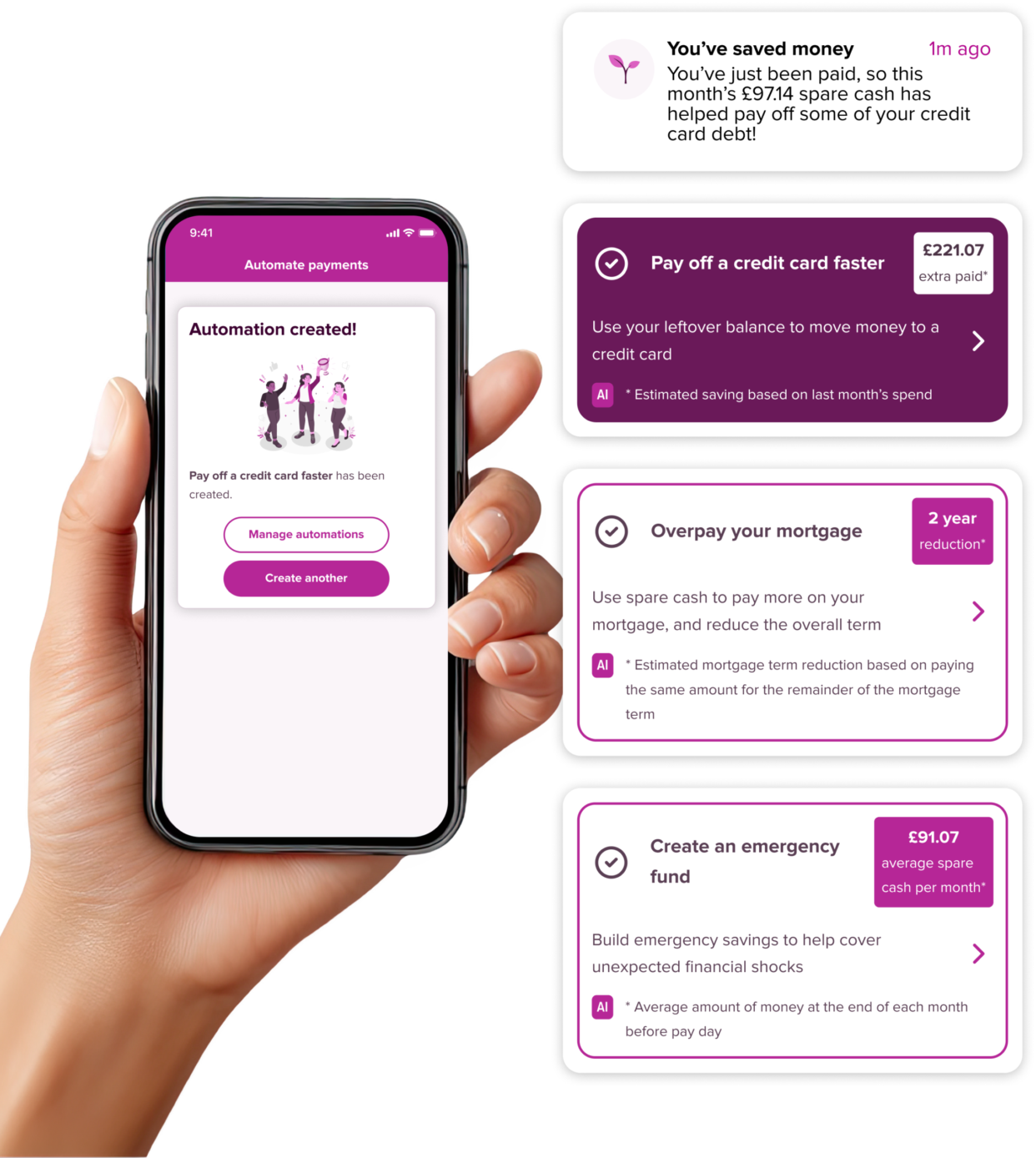

Smart Payments

Enable automated, unattended payments with varying amounts and frequency, pre-defined within consent parameters. Agree terms in advance with the end customer, creating higher first-time payment success rates compared to Direct Debits.

How it works: Pay By Bank – Variable Recurring Payments

The Variable Recurring Payment setup journey is designed to be a straightforward process for both the customer and the provider.

Your application presents payment options, including frequency and maximum payment amounts, which are confirmed with the user.

The user is directed to a bank chooser screen to select their bank. They are then shown a consent screen that summarises the agreed-upon VRP values.

The user is redirected to their banking application to log in, select the account, and confirm the VRP values.

Once confirmed, the user is redirected back to your application, and the VRP consent is active.

Use Cases

Sweeping savings

Automate the movement of funds between an individual’s accounts, based on account and event-based triggers that the customer and merchant jointly agree.

Instant

normally settled within seconds.

Direct

funds reach the destination account as soon as it leaves the payers.

Core

Automated Payments

With an active VRP consent, a merchant can initiate an unattended payment event without further user involvement, so long as it is within the scope of the consent.

Core

Flexible Consent

Consent includes key parameters such as payment frequency, a maximum total payment amount, and an optional single payment amount limit.

Optional

Attended Payments

Attended payments that require user interaction to initiate are also supported. Payers are not redirected to their banking app for each payment, making attended Smart Payments fast and streamlined.

Optional

Custom consent screens

Clients can choose to implement their own custom consent screens as part of the journey. This allows organisations the ability to add their corporate branding, copy and tone of voice into the payments journey, making for a more seamless integration.

Optional

Webhooks

Moneyhub supports a number of payment specific webhook events, enabling clients to perform account listening and react accordingly. For example, Payment Completion allows the host app to listen discretely for real-time payment activity, segment the customer and generate hyper-personalised messaging.

“This partnership has been transformational for our digital strategy. We’re not just digitising existing processes – we’re completely reimagining how customers interact with their finances.”

Guy Simmonds Head of Digital Proposition at Paragon Bank

- 65% of deposits by volume and 60% by value are made through Moneyhub (single immediate payments and VRPs)

- daily open banking payments have doubled month-on-month

- deposit times are 3x faster compared to traditional methods

- 99% customer satisfaction rating, with a customer effort score of 94%

- 4.9 Trustpilot score – customers are praising the ease of depositing through Spring

FEATURE SPOTLIGHT

Remote or in-person

Pay-by-link enables remote or in-person payment requests without requiring the payer to enter destination account details manually.

FEATURE SPOTLIGHT

Regular payment scheduling

Provide certainty over what amount will be taken and when, with an exceptional level of flexibility. Grow revenue sustainably and compliantly with regular payment schedules wrapped in agreed consent.