Smart Segmentation: the call to action

Move beyond broad targeting and transform customer data into meaningful insights with Smart Segmentation.

Replace vague assumptions with precise, data-driven targeting to achieve better user engagement and product uptake. Apply the data to generate financial guidance at scale – a feat that’s simply impossible to perform manually. And help your customers to reach their goals quicker.

Sell more of your products at an improved rate of suitability, increasing your assets under management at a lower cost to you. Smart Segmentation can also reduce the cost of handling compliance with built-in alignment to regulations like Consumer Duty and Targeted Support.

Market-leading 98% accuracy

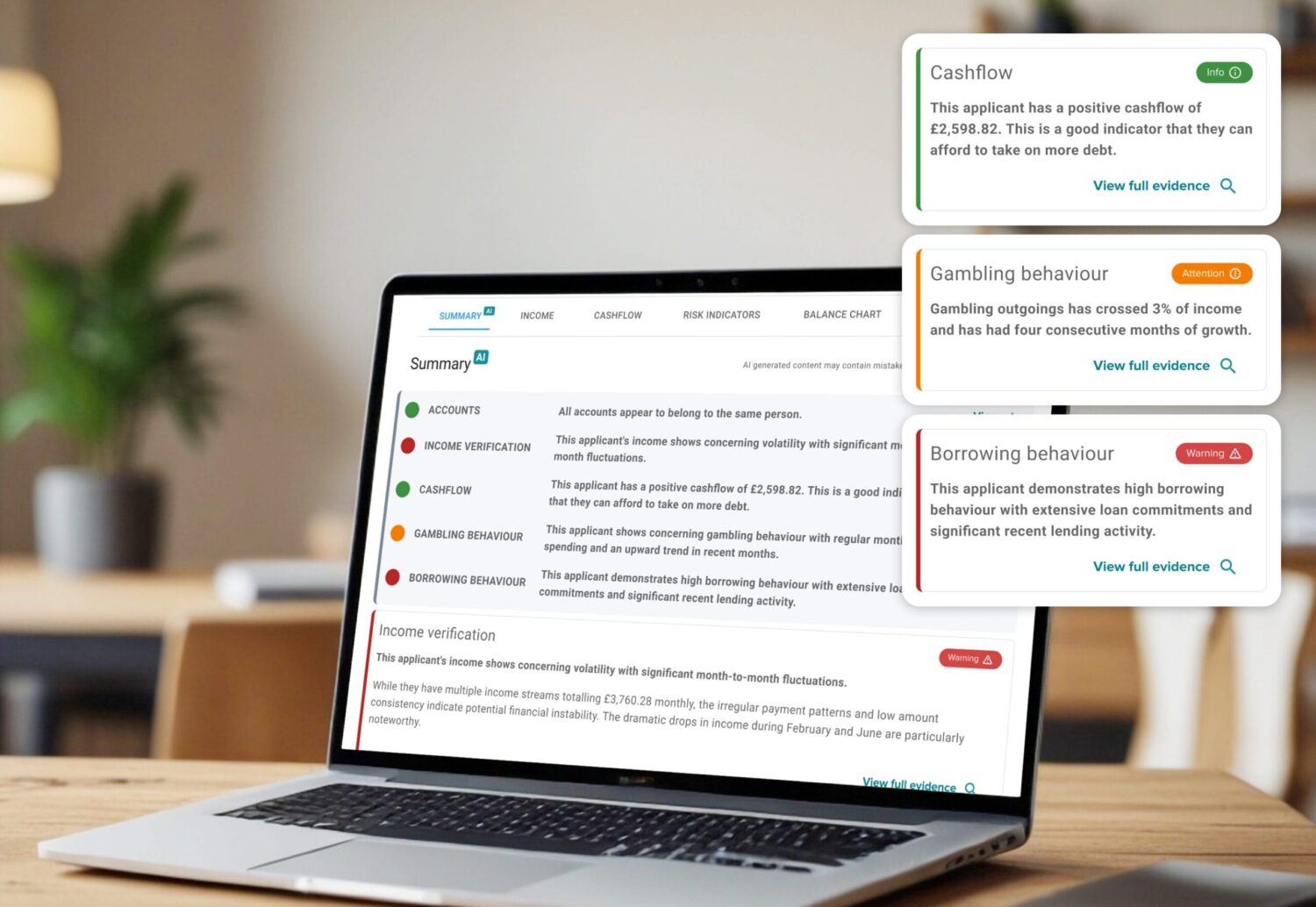

Underpinned by our proprietary transaction categorisation engine with 98% categorisation accuracy. Eliminate the risk of decisions based on inaccurate data with market-leading transaction categorisation and enrichment at the core of all affordability and suitability products.

Unlock new revenue streams with deeper customer understanding

Move beyond basic demographics to segment your customers more precisely, adding nuance and purpose to the data. Access transparent analytics on Data Explorer and segment your data with the precision to create cohorts of any size or complexity.

Use Smart Segmentation to deeply understand your customers for pinpoint product targeting. Turn assumptions and theories into evidenced outcomes, and feed the data into your marketing campaigns to unlock higher rates of conversion.

Generate revenue from cohorts that were previously overlooked and undervalued, and prove a measurable return on your data initiatives.

Drive customer action

Identify and categorise cohorts based on product usage, financial behaviour and lifecycle, using this data to map out customer journeys. With granular data at your fingertips, determine the next best action with ease.

Use tried and tested nudges to help customers take those actions. Provide financial guidance at scale, helping customers to build better financial habits and reach their goals faster without the burden of a manual workload.

Create a direct path to cross-selling more products, and increase uptake with precision.

“We’ve used Moneyhub to expand into new segments of customers, such as self-employed, giving us more data and confidence when looking at lending in new areas”.

Tim Parry Personal Loans Director, Admiral