Smart Product Match: right offer, right time

Use whole-view financial data to accurately anticipate product needs and use these opportunities to cross-sell, maximising customer lifetime value. Replace inefficient targeting, through broad demographics, with real-time insights, driven by transactional and deep user insights.

Confidently meet suitability requirements, even as life events change the products that become relevant, and increase conversion rates through deep personalisation.

Identify missing product opportunities

Find out when customers are missing the financial products that will support their lifestyle, neds and goals, and then match them with suitable offers.

Combine the power of our market-leading Transaction and Enrichment Engine with Data Explorer and Data Insights and Recommendations to unlock a deeper understanding of your customers. Use rich transaction data and account-based events to segment customers into specific cohorts, decoding the true story of their financial lives to assess their unique product needs.

Identify these gaps in uptake by comparing the products that a customer currently pays for with those they could benefit from.

Drive cross-selling and win market share

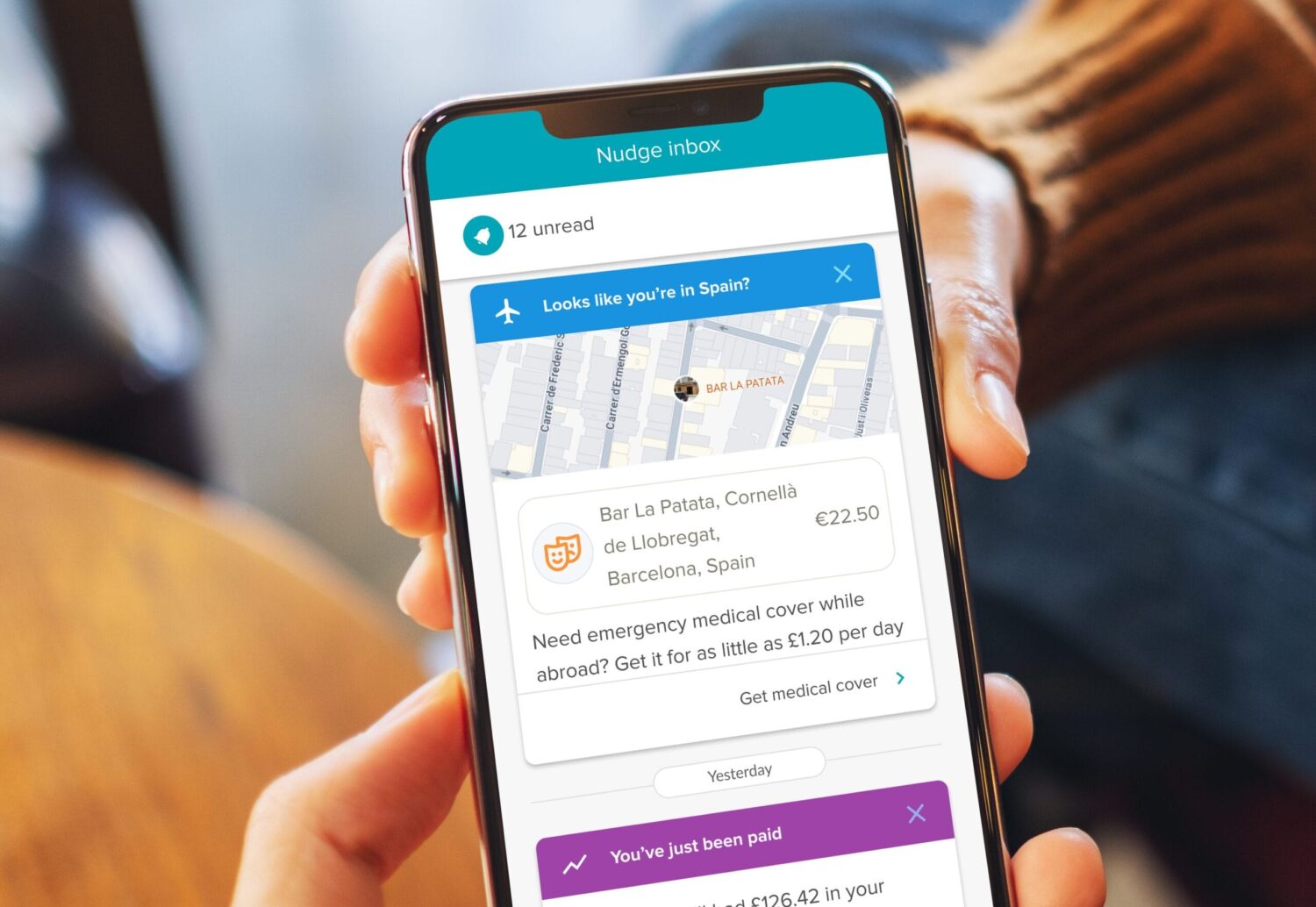

Once the product gaps are accurately detected, drive cross-selling by prompting customers with timely and relevant offers. Data Explorer provides granular details, including current fees and premiums that customers pay, product renewal dates, and payment history.

Combine this with Data Insights and Recommendations to target customers:

- as they approach renewal

- to compete on market pricing

- when new products become suitable due to lifestyle changes

Make product offers that competitors can’t, and increase the lifetime value of every customer.

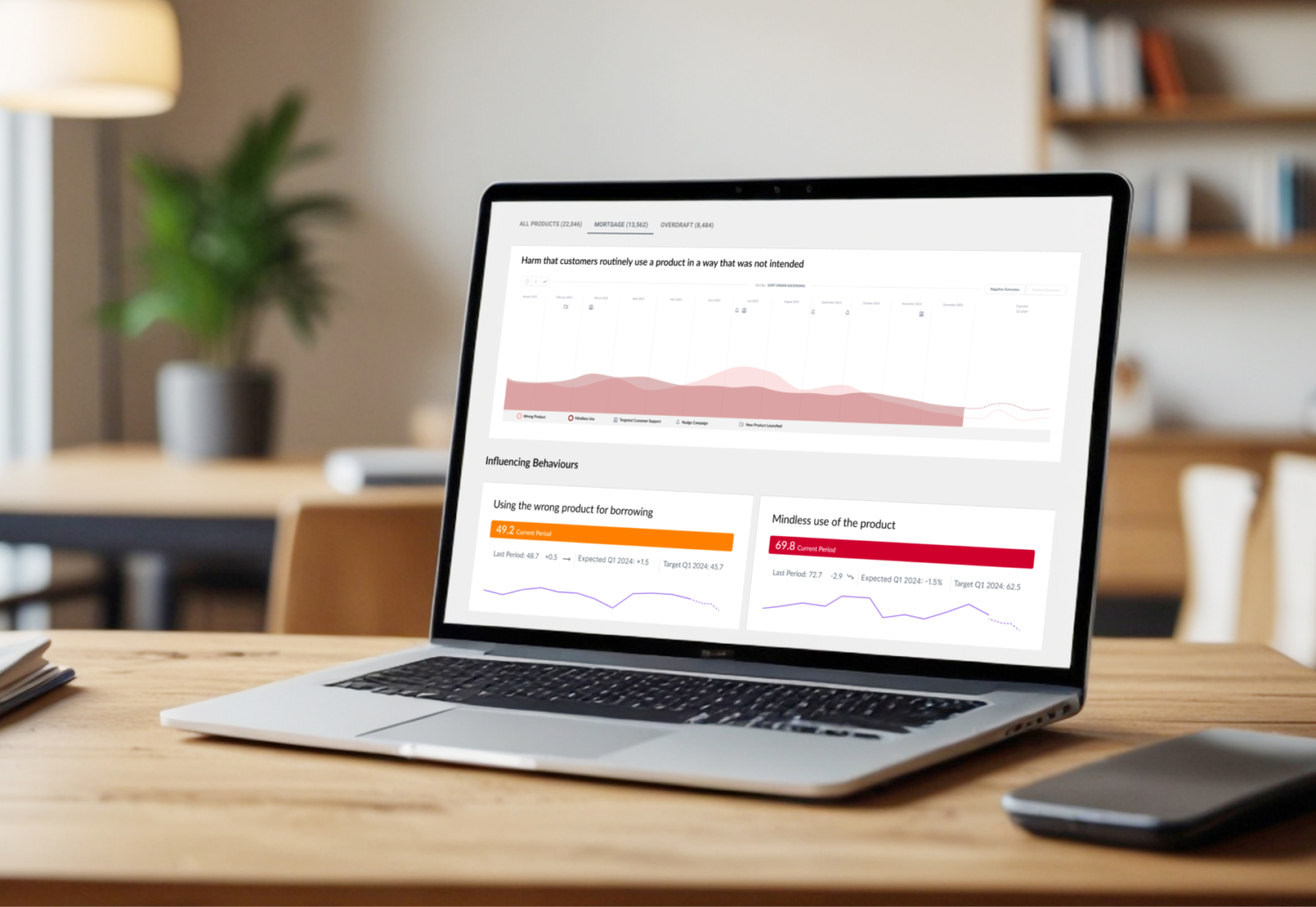

Meet suitability and compliance requirements

Pre-qualify users based on your own criteria to eliminate the risk of making inappropriate product offers. Report segmentation and user journeys into your feedback loop, meeting internal and external compliance requirements.

Remove the guesswork and stress from the process, ensuring that your offer is a good fit and that you have a verified data trail to demonstrate suitability to auditors.

Move beyond cross-sell: inform product design

Smart Product Match is more than just a sales tool; it’s a strategic platform that provides the data to inform your product design. Identify gaps in your product set and drive new product design with supporting data, ensuring your offerings are truly built for your customers’ lives.

For example, if a client’s product offers free travel insurance but real-time data shows a segment of customers that never travel abroad, the data can be used to identify that a different feature might be more valuable to them.

By using whole-view financial data to accurately assess a customer’s needs, you can move beyond a one-size-fits-all approach to product features.

“Utilising Moneyhub’s Open Finance technology, we have been able to streamline the process with automated eligibility checking … which means we can get people who are typically financially underserved connected to the services they need faster”

Scott Currie Head of VOXI at Vodafone