Smart Lending: lend more, collect faster, reduce risk

Our platform connects to verified, real-time spending data, enabling you to:

- Increase qualified loan approvals by 18%

- Reduce collections calls by an average of 45%

- Cut underwriting decision time in half

Free up your underwriters to focus on complex, high-risk cases while advanced machine learning automates the obvious “yeses” and “nos” based on your own internal rules and policies. Moneyhub delivers the confidence to expand your portfolio while automatically mitigating risk.

Make more lending decisions per day

We turn Open Finance data into instant, auditable decisions, helping our clients to win the decisioning race and accelerate portfolio growth:

- Win the decisioning race: filter applications instantly, using automation to immediately classify 22% of applications into ‘just say yes’ or ‘rapid decline.’ Customers get their answer when it matters most, reducing application drop-off.

- Safe portfolio expansion: our machine learning and direct-from-source data spots good customers that traditional models miss. Confidently expand lending into valuable yet complex segments, such as the self-employed.

- Operational efficiency: replace slow, legacy processes like manual statement uploads with a quicker, more secure digital alternative. Support your underwriters to work smarter, not harder.

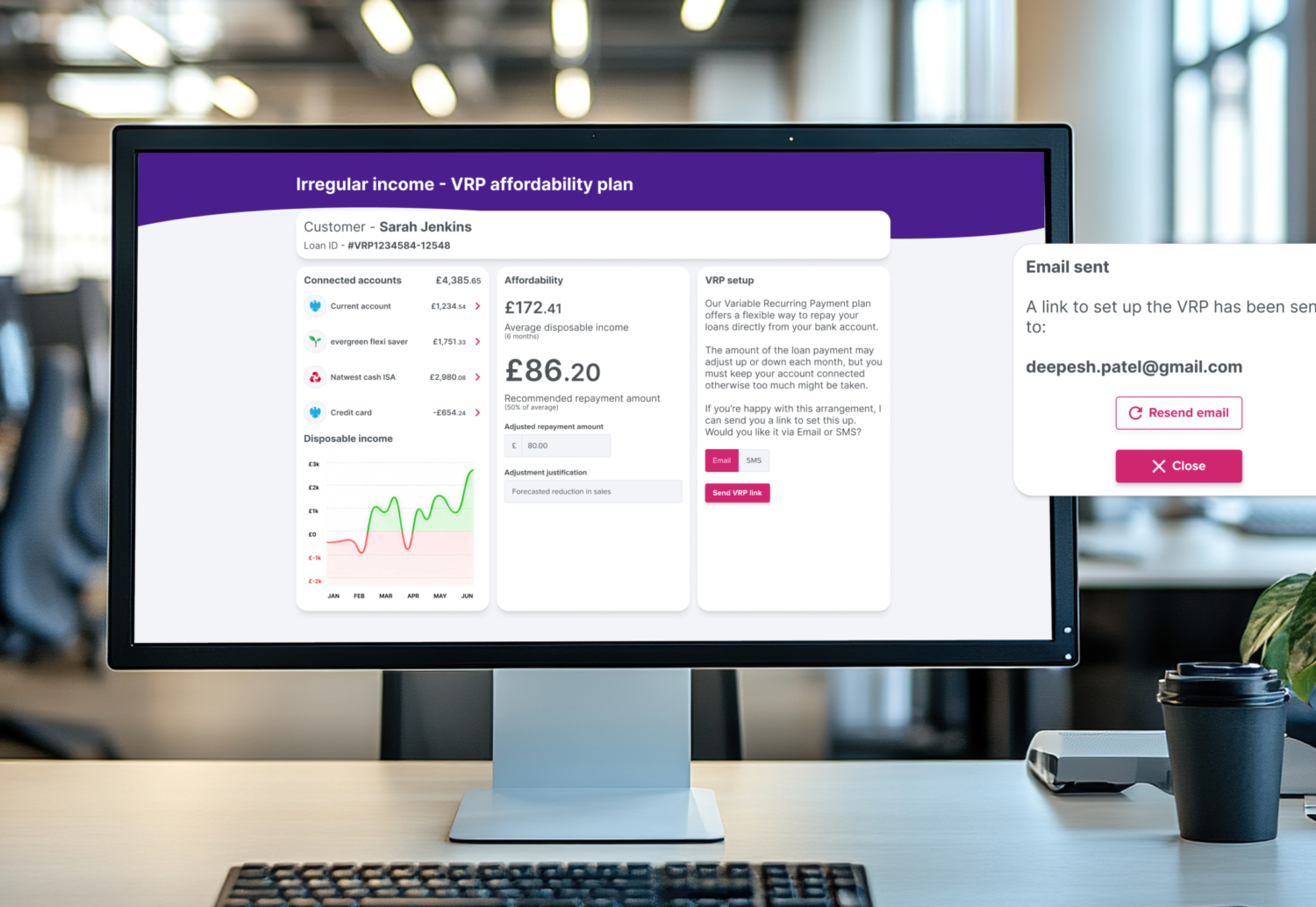

Increase repayment rates without increasing risk

As the only provider to combine Smart Payments (VRPs) with captured affordability data, we enable lenders to create flexible, sustainable repayment flows. Reduce defaults and secure revenue by empowering customers to safely overpay when they can afford it, or adjust payments based on their financial life.

The lending cycle is only successful if repayment is sustainable and compliant. Moneyhub’s unique integration of data and payments secures your revenue and meets regulatory demands for fair treatment. Safeguard against vulnerability by using verified customer data to ensure repayment terms are always compliant with Consumer Duty requirements, mitigating risk and avoiding penalties associated with unfair collections practices.

Shorten collections calls

Eliminate stressful callbacks, voicemails and 45-minute phone calls. We pre-populate real income and spending data to automatically generate repayment affordability assessments, making filling out Standard Financial Statements a 1 minute 42-second digital breeze.

Raise the data-sharing consent rate to 97.5%

Provide white-labelled consent screens that leave the branding in your hands. Create trusted, integrated and controlled data-sharing solutions to raise your consent rate to 97.5%. Reduce friction, generate a seamless customer experience, and boost conversion rates to get the data you need to build a complete financial picture.

“We’ve used Moneyhub to expand into new segments of customers, such as self-employed, giving us more data and confidence when looking at lending in new areas”.

Tim Parry Personal Loans Director, Admiral

Feature spotlight:

Income Verification

Use only the data you need. Our Open Finance platform provides mini affordability reports to cut decision-making time in half without increasing lending risk. You retain the ability to flag discrepancies for deeper review, ensuring complete audit and control over the final lending decision.

Feature Spotlight:

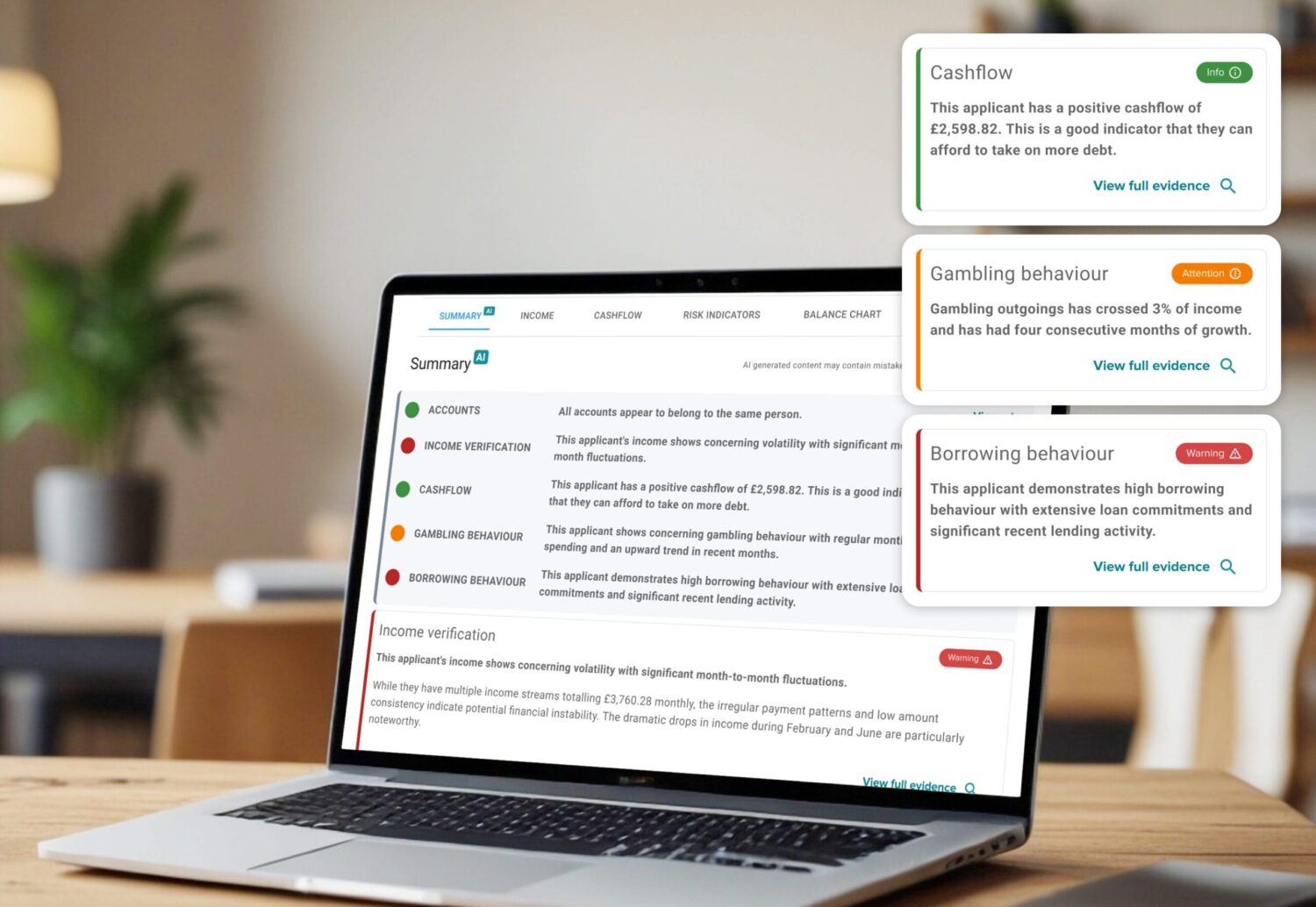

AI-powered Applicant Summaries

The applicant summary section of our reports brings your attention to specific insights within the five categories of affordability data. Powered by generative AI, it gives underwriters the ability to zoom into the details without having to scour through the report line-by-line.

Applicant summaries prioritises alerts from red warnings to orange ‘attention required’ and green information when it meets your criteria. It guides an underwriter through the affordability report, while helping the reviewer to retain full control.

Need to see more evidence? Each section is underpinned by the data, which is readily available as the insights are flagged.

Get visibility across an applicant’s entire affordability assessment while retaining full control.