Payments: secure revenue, slash costs, and automate

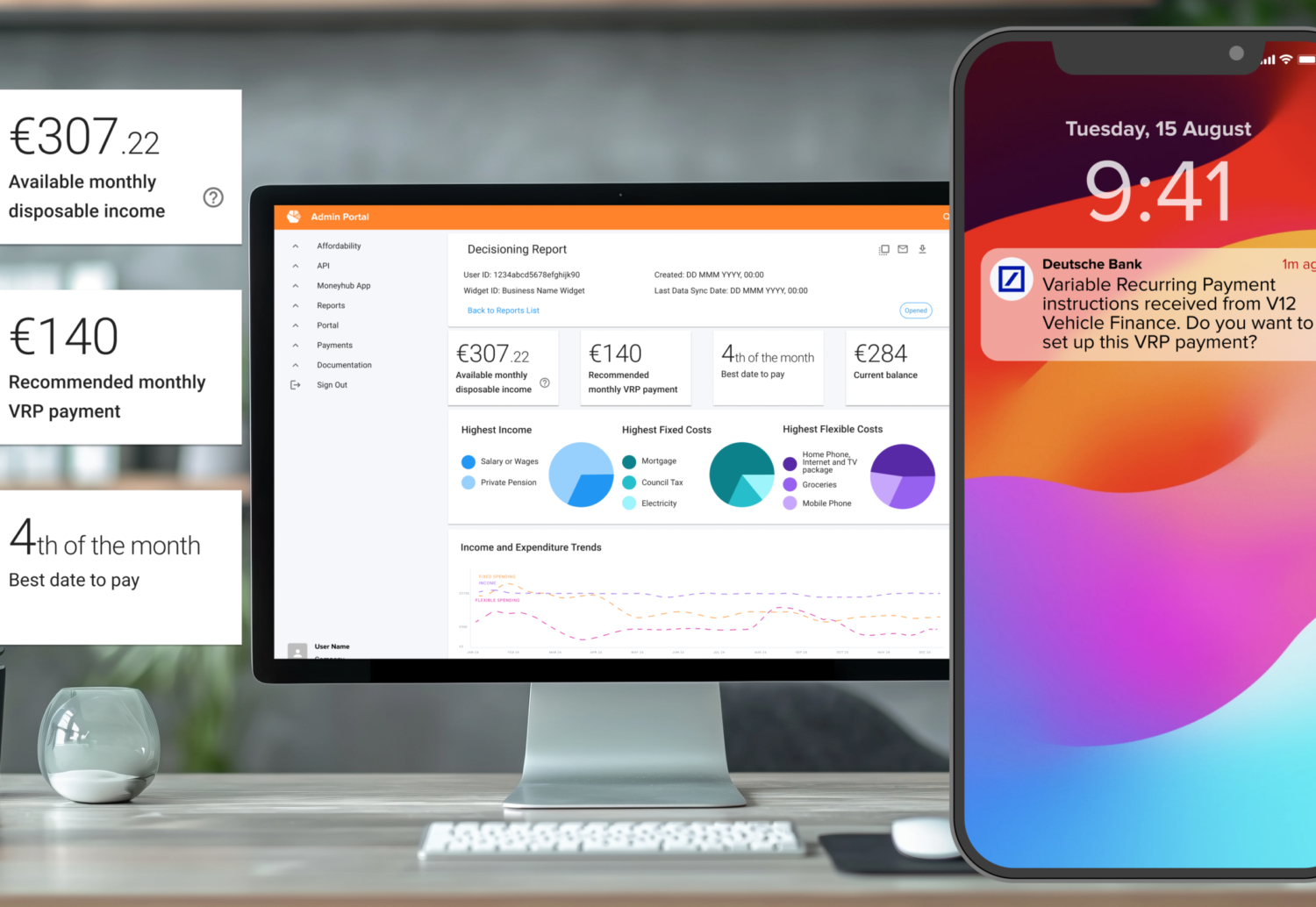

Moneyhub replaces cumbersome payment processes with intelligent, responsive technology. Smart Payments, also known as variable recurring payments (VRPs) delivers a modern, secure, and flexible payment solution.

Trigger with real-time events to fix costly money movement flows, and generate better outcomes with reduced friction. A dual focus on automation and control drastically reduces operational costs, protects against fraud, and ensures the highest first-time payment success rates in the market.

Achieve higher payment success rates

Smart Payments (VRPs) empower the customer with consent and control, while providing you with an exceptional level of flexibility in amount and frequency. This capability enables intelligent, data-driven payments triggered by real-time financial events, leading to fewer empty payment charges, securing your revenue stream.

Get a more reliable payment flow, eliminating traditional payment failure costs.

Reduce processing costs

Replace slow and costly card payments with a secure and instant alternative. Significantly reduce payment errors associated with manual data entry, and cut down the administrative overhead.

Choose to deliver Smart payments in either of the following ways to reduce processing costs:

Unattended payments

Initiate a payment event based on a mandate without further user involvement, as long as it is within the scope of the consent. Overcome efficiency bottlenecks by no longer relying on real-time payment initiation, with the ability to submit payments around the clock. Prevent the back-and-forth administration costs of failed payment attempts.

Attended payments

Confirm payments with payers but without the unnecessary friction of redirecting to their banking app for each payment, making attended Smart Payments fast and streamlined. Get confirmation tailored to you without redirecting the customer, so the attended payments process keeps users on your platform for continued engagement.

Integrate payments with collections

Moneyhub is a pioneer in introducing Smart Payments into the collections process, linking repayment directly to verified affordability data. This approach allows lenders to:

- Lend more and get more back: agree and set up compliant, flexible repayment terms upfront, lowering the cost to collect and reducing defaults

- Mitigate vulnerability risk: replace rigid, traditional repayment schedules with a sustainable flow that automatically adjusts to customer affordability, safeguarding vulnerable customers and securing revenue

- Reduce friction: empower overpayments when customers can afford it, accelerating debt reduction and improving the customer relationship

“This partnership has been transformational for our digital strategy. We’re not just digitising existing processes – we’re completely reimagining how customers interact with their finances.”

Guy Simmonds Head of Digital Proposition at Paragon Bank

- 65% of deposits by volume and 60% by value are made through Moneyhub (single immediate payments and VRPs)

- daily open banking payments have doubled month-on-month

- deposit times are 3x faster compared to traditional methods

- 99% customer satisfaction rating, with a customer effort score of 94%

- 4.9 Trustpilot score – customers are praising the ease of depositing through Spring