Bank loyalty isn’t what it once was. With over 11.6 million account switches between April 2024 and 2025 alone, customers are proving that they are more willing than ever to move their financial relationships around.

But this leaves banks relentlessly fighting for market share, with the pressure on to continuously build better experiences, and to offer the most suitable products at the right time.

The only way to retain your clients is by moving beyond vague guesswork and secure a competitive advantage by leveraging predictive intelligence. Moneyhub is already empowering Tier 1 banks to use their full aggregated datasets, accurately predicting what the customer needs and enabling these institutions to make the right offers.

Debbie Airey, Strategic Account Director at Moneyhub, is sharing exactly how we work with clients to target the five most common problems of poor cross-selling in banking:

1. If your problem is vague targeting, go to: Using all of the customer data available

2. If your problem is low engagement with product offers, go to: Smart Segmentation

3. If there is a gap between the data you have, and knowing the products your customer may need, go to: Assess buying patterns

4. If you don’t know how, when and through which channel to communicate with your customers, go to: Creating your offer

5. If you’ve done all of that and it’s still not working (!), go to: Closing the feedback loop

1. Using all of the customer data available

“If you don’t yet have a solid idea of customer behaviour, then you probably have a data problem”, notes Debbie.

Not necessarily in collecting the right information, as most banks already have vast data lakes with gigabytes of input. But financial institutions are not typically using all of the data available – this coveted and highly-valuable data either sits gathering dust, or is taken simply at face value rather than being used intelligently.

Removing data fragmentation silos

In current day systems, while each team might have accurate and high-quality data within its own domain, the data rarely ‘talks’ to the others. The data insights are eroded as information is passed between departments, if these insights are ever passed on at all.

Consider a highly profitable customer who has a premium current account. The Premier Banking Team sees consistent high balances, and regular spending on flights, hotels and restaurants abroad. This data is not shared outside of the Premier Banking Team. Crucially, the Credit Card Division misses the opportunity to offer a high-rewards travel credit card to a prime candidate before a competitor does.

Debbie explains, “because the data isn’t unified or normalised, it’s difficult to apply sophisticated Customer Lifetime Value models or segment customers effectively. Overcoming this issue requires a single customer view platform that centralises and reconciles data from across the business.”

In order to use all of the data available, banking firms can:

- Establish a universal identifier: customer numbers must be the same across all lines of business to link all of the accounts that belong to a single user

- Integrate real-time APIs: ensure that updates in one silo are immediately reflected in the central database

- Apply categorisation and enrichment across all data lakes: ingest the raw data from all sources and standardise it

Debbie adds that compliance should still be the top priority:

“Any solution touching customer data or core systems naturally triggers red flags. But using this approach derives meaningful customer insights while still minimising the risk of misclassification, toeing the compliance line. Bank departments should work with compliance teams, demonstrating that the security of new or upgraded technology is less risky than legacy systems.”

2. Smart Segmentation

If your current product offers are leading to low engagement or high switch rates, you’re likely to find a diagnosis somewhere around your segmentation process. Debbie explains,

“Traditional segmentation is limiting, and it’s really as simple as that. Most banks don’t have the technology to go beyond broad, demographic criteria or simple product ownership.”

But this leads to groups that are too large and too diverse to offer meaningful personalisation.

‘Millennials in urban areas’ can span a recent graduate with high student debt, or a successful entrepreneur with a high-risk investment portfolio. Offering the same product, like a basic savings account, is going to be irrelevant to at least one of them.

What’s worse, the wrong offers actually annoy your customers and damage brand perception. Poor customer experiences leads to 39% of all churn in the sector.

Following the ‘Segment of One’ concept

The ‘Segment of One’ is a concept that refers to the ultimate level of customer hyper-personalisation, treating every individual customer as their own unique market segment.

Smart Segmentation is the solution designed by Moneyhub to achieve this. It describes how financial institutions can separate individuals based on more than just demographics; by looking at their financial behaviours and real life events.

Key characteristics of the Segment of One

The Smart Segmentation solution at Moneyhub enables hyper-personalisation down to a segment of one. The solution works through the following features:

- Individual focus: your strategy should be built around an individual’s unique financial context

- Real-time context: low latency is key for determining the next best action or offer

- Predictivity: leverage machine learning to foresee future needs based on historic transactions and similar segment behaviours

Here’s an example:

A large bank has a segment of customers with high-interest savings accounts, but no borrowing products like mortgages, loans or credit cards.

Traditional segmentation would simply identify these customers as high-value savers.

Smart Segmentation would check their transaction history, including for accounts held outside of this bank. They might see that some of the customers are making consistently large monthly payments to external mortgage companies, as well as high-value payments to their credit card.

New segment identified: high-net-worth external borrowers.

The bank can then shift its communication from generic savings product offers to highly-personalised pre-approved mortgage refinancing and premium credit card offers.

There really is no limit to the level of detail and hyper-personalisation within your segmentation with the Moneyhub Smart Segmentation solution.

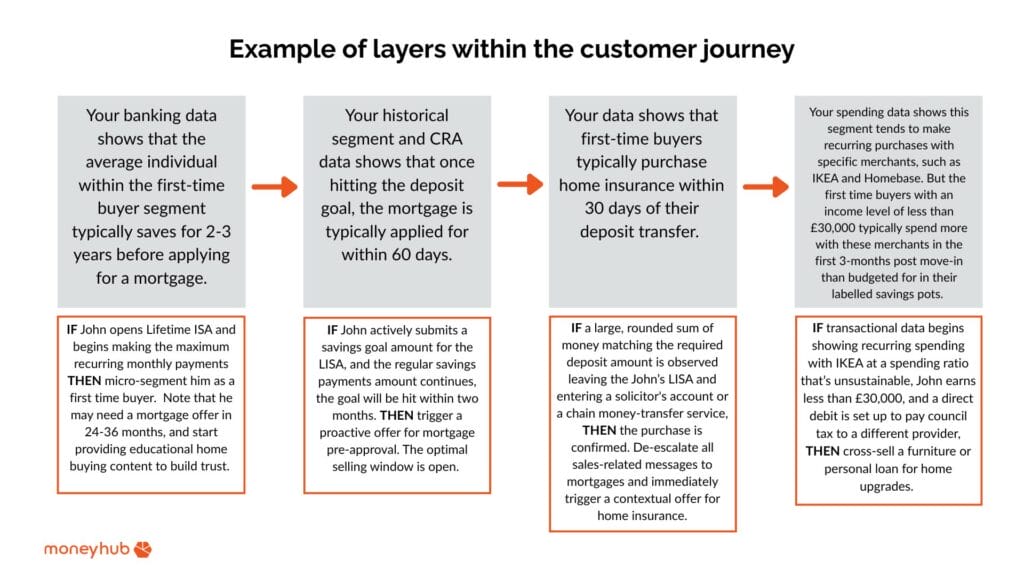

3. Assess buying patterns

If there is a gap between the data you have, and knowing the products your customer may need, you should delve deeper into buying patterns.

Take a look at the historical information of each segment and analyse the data factors to get as granular as possible. The goal is to gain a better understanding of the specific behaviours of each group, so that you can predict your customers’ next steps with ease.

Once you know what financial behaviour signals are likely to indicate an upcoming purchase for each segment, you can automate the offer cycle to trigger automatically.

At Moneyhub, we work with banking clients to process these segmented behaviours and financial institutions can choose to assign a propensity score: the probability that a customer will buy a specific product. This allows the bank to trigger an offer at the optimal moment.

4. Creating your offer

Once your predictive analytics identifies a customer’s specific need, the final step is to automate the delivery of the product offer. Your systems will need to be set up to let the outcomes of your smart segmentation guide the automation, triggering the right offer at the right time. This maximises the likelihood of conversion, ensuring the offer is hyper-relevant.

A note on communication channels

In the banking industry, it’s widely accepted that different customer segments like to communicate in different ways.

“You should always match the channel to the segment and consider the transaction and risk values”, notes Debbie.

For example, four in ten elderly people do not manage any of their money online. With many in this group preferring to go in-branch for all banking experiences – sending emails and texts are unlikely to yield much ROI. What’s more, limiting communication to in-app notifications will see financial institutions fail to comply with regulations like Consumer Duty, missing key financial accessibility and inclusion opportunities.

Despite all of this, internet-savvy university students who use your account to receive and spend student loans tend to keep everything in-app, opting out of paper statements.

It’s therefore important to integrate CMS behaviour data with your transactional information, doubling down on historic patterns before creating your offer.

A note on pricing

The goal for many banks is to secure market share from competitors. But simply providing introductory bonus rates for savings accounts isn’t a particularly viable strategy; with ‘rate switchers’ rarely resulting in long-term profitability.

Fortunately, with the steps completed so far, you have something better: insight into your competitor’s pricing for high-value products. Smart transaction categorisation and enrichment can reveal:

- Type of insurance and monthly premium amount

- Monthly mortgage payments

- Type of loan and regular loan repayment amounts

- Credit card repayments and much more

This information in particular is incredibly useful for informing your own pricing strategy, ensuring you’re offering competitive rates within the market.

A note on timing

The frequency and duration of payments are also factors to analyse.

Insurance products are one example of a financial product that usually lasts for 12-months before contracts are renewed. Proactive buyers tend to shop around between a few weeks and a few months before this.

Time your offer to automatically trigger at this opportunity window to maximise the chance of conversions.

What the logic could look like:

-

- IF 10 transactions categorised as ‘home insurance’ are paid monthly, THEN trigger a pre-approval check for our home insurance

-

- IF the customer passes the check, THEN send an offer within the same week as their 11th payment

Implementing event-driven triggers with Smart Product Match

All of the examples we’ve used so far only work if you have the right technology in place. While the foundation of strong categorisation and enrichment must be in place, banks must also leverage rules-based software in order to truly scale their offer capabilities.

Smart Product Match is a solution that provides this scalability, indicating the right products at the right time. Using machine-learning AI, we’re able to zoom into the granular data, ensuring the products are matched with nuanced financial and behavioural insights.

For example, we can detect that your customer has spent money on trains for three weeks in a row. Their credit rating is 600 with TransUnion. They are pre-approved for your new credit card, which offers cashback rewards for train travel.

| Factor | Key info | Example |

| Communication channels | Different customer segments respond to different communication channels | IF a customer is a digitally-engaged saver, THEN send an in-app nudge to set up savings round-ups |

| Pricing | Use your insight into competitor product prices to inform your own strategy | IF a customer’s transaction history shows regular monthly payments to a competitor’s credit card with a £29.9% interest rate (APR), THEN trigger a low-interest credit card offer at £18.9% APR, ensuring immediate, demonstrable value. |

| Timing | Use historical and frequency of payment data to triggers offers during the opportunity window | IF a customer is paying an annual membership fee of £120 to a fitness company every January, THEN trigger a personal loan offer for a home gym upgrade in December, before the renewal fee is due. |

5. Close the feedback loop

Implementing a successful cross-sell and upsell strategy demands a continuous, closed-loop system where outcomes inform future strategy. Your institution will need to allow transactional and behavioural insights to feed directly back into your core processes, ensuring that your models remain intelligent and relevant.

But, there’s a right way, and a very wrong way to do this.

“Have you heard about the Oxpecker on the Rhino’s back?”, Debbie asks.

“Rhinos are often targeted by poachers. Because they’re high up in the food chain, they don’t possess many of the evolutionary features needed to evade human hunters, like amazing eyesight or a keen sense of smell. But Oxpecker birds do have such skills.”

“The Rhino and the Oxpecker have created a symbiotic relationship – one that’s mutually beneficial for them both. The Oxpecker gets to ride on the Rhino’s back, gaining safety against predators and regular feeding, in the form of the ticks and insects on the skin of their host. And the Rhino gets an early warning system, a sharp trill from the bird at the first sign of humans, enabling them to get away in time.”

Customers are expecting banks to bring that same level of partnership, and the continuous feedback of app journeys, financial insights and behavioural data should all feed into the loop.

Practical tips on using your data to cross-sell and upsell:

- Validate the propensity score: if a high-propensity customer fails to convert, the model’s assumptions need immediate refinement.

- A/B testing, often referred to as Champion/Challenge: continuously test different variables within your automated offers, such as the timing, the messaging, and the communication channel. Test your triggers to understand whether an in-app nudge is more effective than an email when a certain event occurs, for example.

- Improve model accuracy: continuous iteration prevents model drift, which is the decay in accuracy that occurs when a model is left static. By feeding new conversion data back in, you ensure that your next round of offers is even more precise and effective.

Like the Oxpecker, banks should always be there, bringing value at the right moment. Testing and iterating to get this right will enable financial institutions to move beyond intrusive or transactional relationships. By using feedback to get it right, you gain trust, long-term loyalty, and higher cross-sell and upsell rates.

Treating cross and upselling as a long-term loyalty strategy

Debbie leaves you with this thought:

“The most successful cross-sells and upsells aren’t just recurring initiatives, but key components in a broader motion that makes any client feel like a real person rather than a faceless account.”

At Moneyhub, we know that the key to high conversion rates is the smarter usage of high-quality data. With a market-leading Categorisation and Enrichment Engine, we have the technology to make this happen. With Smart Segmentation and Smart Product Match integrated directly into this system, customer relationship managers are empowered to make the right offer, of the right value, at the right time.

Discover how quickly you can put these systems in place to improve your conversion rates – contact Moneyhub.

FAQs

Leverage AI by using machine learning models to analyse historical and real-time transaction data to calculate a customer’s propensity score for a specific product. This allows you to predict their future needs, ensuring the offer is timely and highly relevant.

Implement event-driven triggers (also known as nudges) by defining a precise data threshold, based on categorisation and enrichment outcomes, that automatically activates an offer sequence. This system ensures your product recommendation is delivered at the exact moment a customer’s behaviour signals a high propensity to buy.

One use case that we enjoy implementing at Moneyhub is giving banks and lenders the power to pre-approve loans using microsegmentation with a high degree of certainty. This enables institutions to meet their Consumer Duty requirements around suitability while also opening up new segments to their lending products.

The 25% rule of thumb limits the cost of new products to no more than a quarter than the current price they pay. This targets the customer’s psychology, ensuring that they are more likely to accept the offer.

About Debbie Airey:

Debbie Airey is a highly experienced Client Account Director with a 27-year+ career defined by expertise in data services, information technology, and financial services. Today, she leverages that extensive background to lead strategic relationships at Moneyhub, helping organisations navigate the shift towards a more transparent, data-driven financial future.

She now finds great reward in sharing this wealth of experience to mentor others in the industry and guide major institutions through the complex transition from legacy data models to the agile, live, and consented data ecosystems of tomorrow.

share