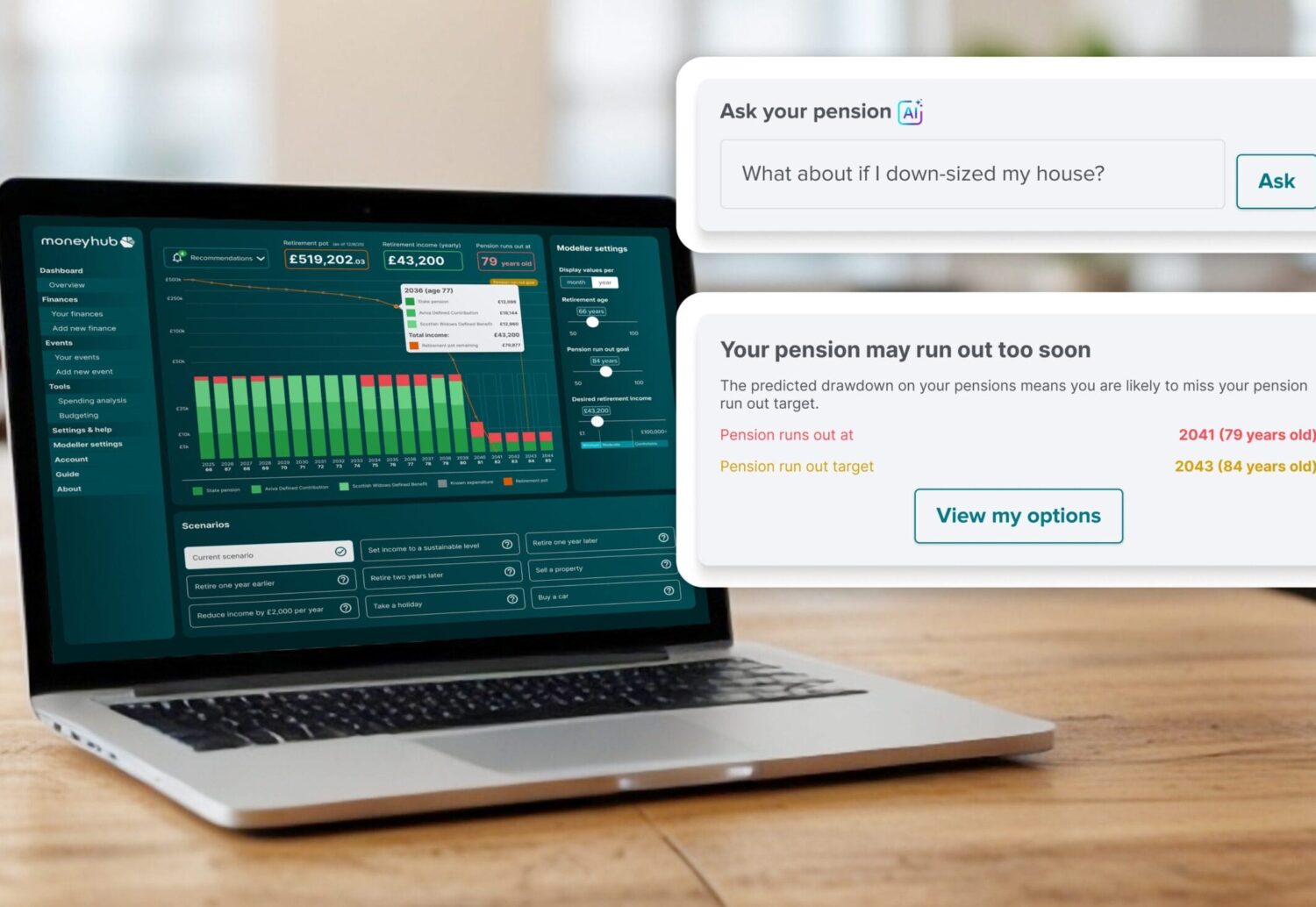

In retirement: optimise drawdowns with contextual data

Stem the outbound tide of asset leakage by helping your members holistically understand their financial needs and alternative options. To achieve this, you must become more than just another pension app. Earn trust with members by creating meaningful value, and become the go-to financial provider.

Access financial and non-financial data to help customers make sustainable drawdown decisions, and plug the leak.

Win customer primacy

Winning primacy across the customer lifecycle ensures you are top-of-mind when members are ready to engage. By building modelling, sweeping, and drawdown tools into your app, you can help customers make informed financial decisions and make drawdown sustainable, preventing them from going to a third-party wealth manager.

Moneyhub has developed modelling that’s proven to increase engagement. At Mercer, it led to 52% of members completing a full retirement calculator, and pension visibility rose from 5% to 65%. Become the go-to long-term financial provider because engaged members don’t leave.

Plug the leak

Confidently tread the line between advice and guidance. Segment your customers and provide Targeted Support to efficiently and effectively communicate with the mass market.

Half of wealth advisory firms are already reviewing their client base for potential segmentation, and providers that fail to respond will only see their leakage intensify.

Use data to spot members who start looking at their pensions more often and those who are doing more asset and retirement modelling. Identify retention risks and work to engage customers with personalised, data-driven recommendations.

Help your members to make smarter financial decisions when it really matters.

Become the destination for consolidation

Small pensions lead to small decisions, and the more that customers have, the less weight each decision carries. Individuals with more pension pots are more likely to take lump sum withdrawals.

Encourage consolidation to keep assets longer and partner with the clear industry leader in Pension Dashboards. As the first and only provider to deploy an end-to-end platform during beta testing, Moneyhub exceeds the minimum regulatory requirements and adds capability for engagement and consolidation.

Show customers that your dashboard is the place to be, and become the destination for consolidation.

“Developing the Money Mindset app with Moneyhub has been a game changer for us in the market. Pensions are one piece of the financial puzzle, and by providing a holistic view of their finances alongside educational content and tools, we’re empowering our members to make smart and confident decisions about their money.”

Neil Hugh Head of Workplace Proposition, Standard Life