October 2025 marked the eighth edition of the European Open Banking Expo; a two-day event filled with topical keynotes, spirited debates and enough free notepads to supply a small army.

But now, the booths have been dismantled and the AV teams have put their cables away. As the Product Manager for Payments and APIs at Moneyhub, I’m reflecting on the key discussions that I believe are defining the future of payments.

Here are the seven lessons from the event that every payments enthusiast should recognise to ensure their business remains competitive in this new era of intelligent payments:

- Pay-by-bank is here to stay

- VRP is (still!) on the horizon

- The ‘name game’ is too confusing

- Consumer protection must be proportionate

- Firms need to start going beyond ‘dumb’ payments

- Stronger collaboration is the answer to international fraud

- Nuanced lending is the key for helping vulnerable customers

Pay-by-bank is here to stay

Customer adoption of pay-by-bank is growing, particularly as an increasing number of household names now offer it as a complementary payment alternative to cards. At Moneyhub, we’re facilitating it for credit card repayments on behalf of one major high-street retailer. We also know that eBay is improving its own consumer payment experience using pay-by-bank technology.

There were some clear signs of this increased adoption at the expo. Virgin Money revealed that 96.2% of all repayments of their Virgin Money credit card were via Open Banking. HSBC also noted that 25% of their digitally enabled customers are making use of Open Banking payments, equivalent to 8% in payment volume.

Finally, in a use case we’re really excited about, HMRC reported that 1.7 billion self-assessment payments in January were completed using Pay-by-bank.

VRP is (still!) on the horizon

I attended several sessions focusing on the imminent arrival of VRP.

DejaVu!

I’ve heard the exact same statements at the previous two Open Banking Expos, and multiple other events.

Despite the Government’s National Payments vision including VRP as one of the key deliverables for economic growth, several industry experts expressed frustration at the pace (or lack of it!). That said, Moneyhub is a founding funder of the new industry-led entity to get commercial VRP finally live. Early use cases are a great step in the right direction, and I believe that we just need to keep the momentum going.

The ‘name game’ is too confusing

The ‘name game’ will be familiar to those inside the payments industry:

- Pay-by-bank

- A2A Payments

- Instant Bank Transfer

- cVRP

- Non-sweeping Variable Recurring Payments

- … the list goes on

As an industry, we really need to start getting behind standard terminology to create a trustmark. Consumers are craving easily identifiable payment methods that actually describe what they do.

Contactless and Direct Debit are two prime examples – people just ‘get it’.

By promoting standard naming across the various banks, third-party providers and merchants, Open Banking payments can gain more traction and higher customer adoption.

Proportionate consumer protection is a must

We know that there is a bit of a gap between industry and customer confidence when it comes to Open Banking payments. But for me, this expo made it obvious that payments will increase if consumers know that they are protected if things go wrong.

Having some form of guarantee was the topic of most of the discussions. This will help, but it must be proportionate. Buying a coffee doesn’t require the same level of protection as paying for a holiday, so we need smarter ways to manage payment risks.

Firms must start going beyond ‘dumb’ payments

Open Banking already supports straightforward payment journeys well. But coupling account information data, like balance checks and regular spending behaviour, alongside the transactions, makes for much smarter payments.

We need to find use cases that go beyond the minimum viable product. For example, helping people in financial distress to make payments,

For those in financial distress, two factors are important:

- Making their payment when there is enough money in their account

- Ensuring there is enough remaining balance to reach the next salary payment without going into further distress

Firms are starting to prioritise use cases like this to make payments a better and more equitable experience.

International fraud is ever-present, and requires international collaboration

The latest stats revealed at the Open Banking expo were that only 1 in 4 scams that target UK nationals actually originated in the UK. Scam centres in Southeast Asia and across Africa are forming the hubs of fraud initiation, enabled by good tech and low law enforcement activity.

But fraud accounts for 43% of all crime in the UK, and costs £219 billion per year in total, with £11 billion specifically from organised scams. We therefore need to do some work as a collective, enabling financial institutions to collaborate and share information with telcos and technology companies at a quicker pace than today.

While current regulations exist for protection, they can also slow down the rate of collaboration, and this will be a key step towards closing down fraud centres across the globe.

Finding ways to make lending more nuanced

I attended a passionate talk by Luke Charters MP about finding innovative ways to give more people access to Open Banking Products. For example, looking at ways to help financially excluded individuals to make use of VRPs, so that they can make more affordable payments.

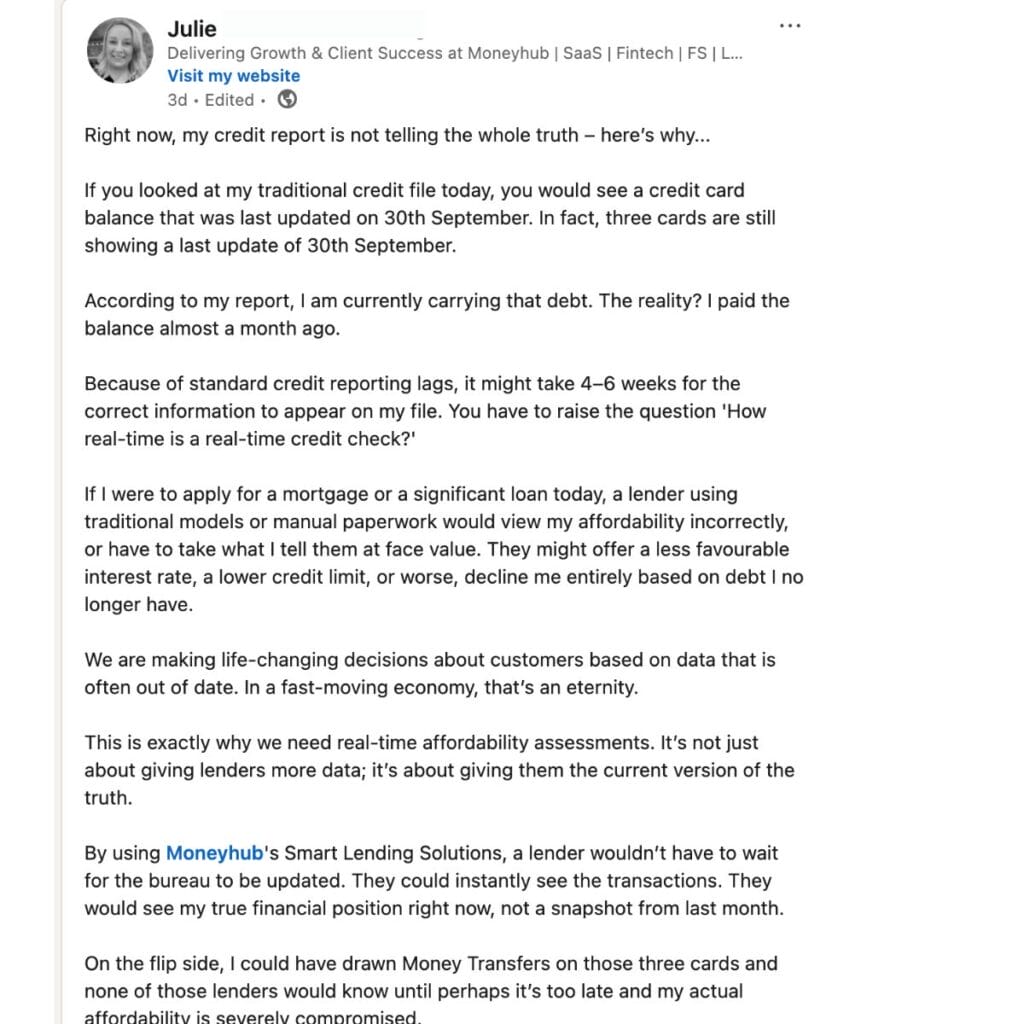

Another hot topic was ‘thin file’ and ‘credit invisible’ users that struggled to access finance from lenders relying solely on Credit Reference Agency data. My colleague Julie expands on this below with a great personal example of why the current system isn’t working:

Open Banking data provides a more real-time view of an applicant’s current spend and cashflow behaviour. Lenders who use this Smart Lending technology as part of their assessment can leverage a more nuanced lending position.

Reflecting on the Open Banking Expo for payments professionals

My reflections of the 2025 Open Banking Expo cover many areas inside payments, but the common theme is this: collaboration is key.

Lenders should collaborate with categorisation and enrichment providers to upgrade their outdated bureau data, banks should collaborate with telcos to solve fraud cases with speed. Moreover, financial institutions must collaborate with each other (and their customers) to standardise product names, offer more favourable payment flows and innovate more valuable use cases.

We’re looking forward to more of these collaborations coming to fruition, and are excited to be facilitating some ourselves. In the meantime, explore how you can implement better payment options with Moneyhub, including pay-by-bank, pay-by-link and Smart Payments (VRPs).

About the author

Paul Tutton is a payments and APIs expert from Bristol, UK. He’s been deeply engrained in the finance industry for nine years, including delivering payments capabilities at a CMA9 bank. Paul enjoys helping businesses to make the most out of payments capabilities with Moneyhub, with a keen focus on building better outcomes for end users. These days, you might find Paul participating in forming the new industry led entity for Variable Recurring Payments, where he influences policy and the rollout of new technology.

share