Merchant identification is the process of finding out the name of the business associated with the transaction. Sounds simple – but it provides the foundation for a better customer experience, fraud identification and optimising the customer’s next best action. It’s even helpful for regulatory compliance.

Also known as merchant ID, this information (and process) is not standardised between providers, the payment gateway, or the bank. So while each institution aims to get the brand name as their output, it doesn’t always work.

This causes a problem, because it means that merchant identification varies from bank to bank, and can be shrouded in a little bit of mystery. So let’s pull back the curtain on the role of merchant identification in the wider categorisation and enrichment process, and help you understand more about why not all merchant identification is the same.

Key Takeaways on merchant identification:

- Merchant identification involves attaching the name of the business to the transaction within a banking app, as part of transaction enrichment

- Merchant ID plays an important role because it impacts customer experience, fraud identification, suggesting next user steps and compliance

- Coverage and accuracy are the two most important features of merchant identification

- When choosing a merchant ID and enrichment provider, banks should evaluate format, coverage, accuracy, technology type, customer service and experience levels

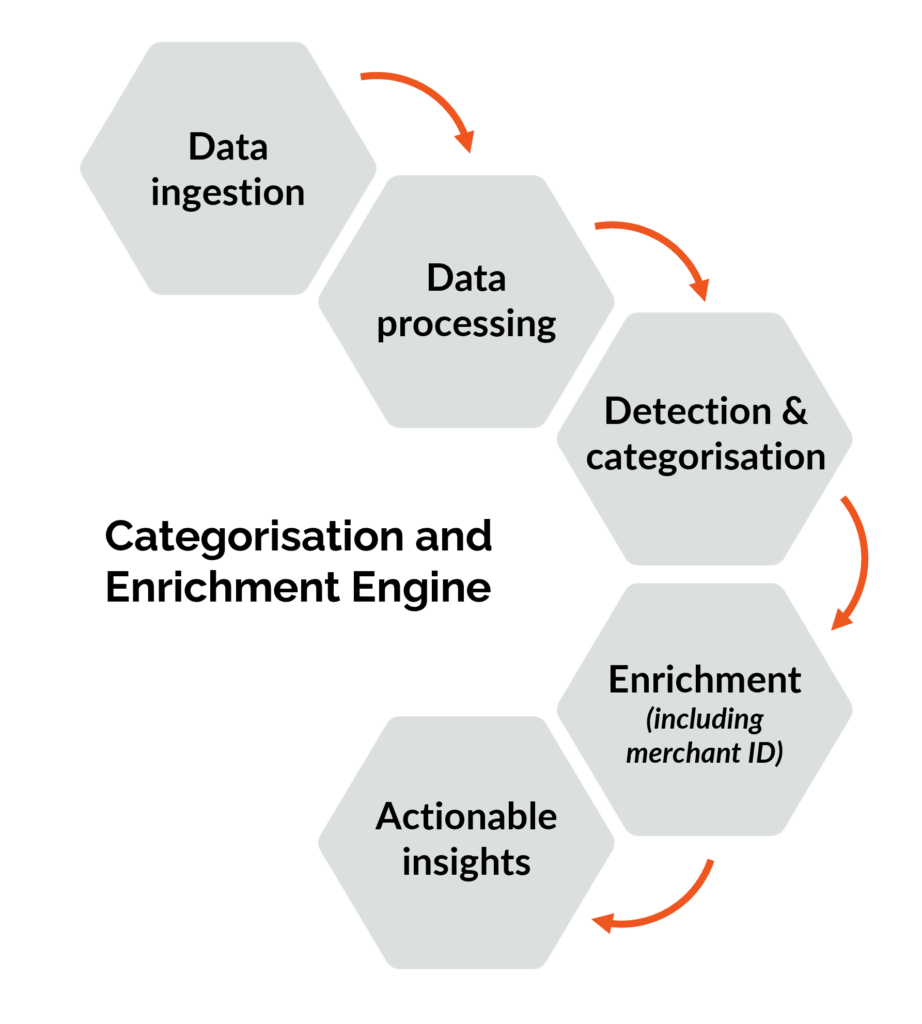

Where does merchant identification fit into categorisation and enrichment?

Merchant identification is an integral part of categorisation and enrichment, sitting concretely in the enrichment layer of the technology. It’s an essential process for obtaining accurate data labels for income and spending, beneficial for both financial institutions and their end users.

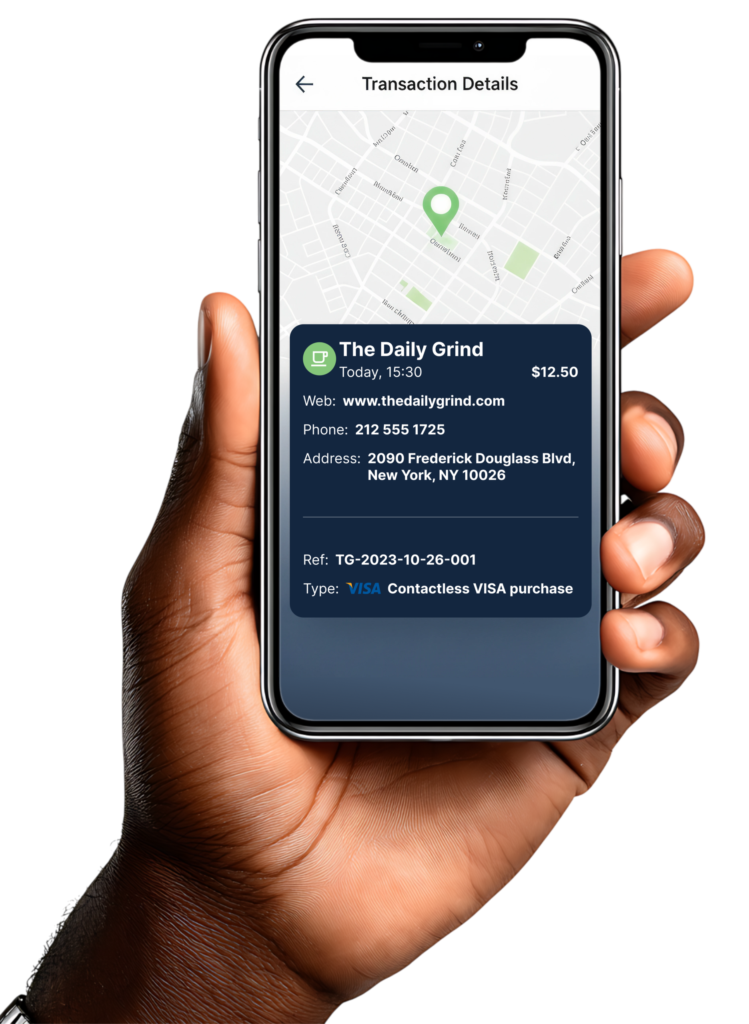

At Moneyhub, merchant identification includes:

- Merchant name: such as WM Morrisons

- Merchant category: such as Supermarket

- Merchant website: such as groceries.morrisons.com

- Merchant phone number: such as 0345 611 6111

- Merchant logo

Breaking down the categorisation and enrichment process

Part 1: categorisation

Because merchant identification happens during the latter stages of the categorisation and enrichment process, we must start by looking at what happens before it.

To begin with, the transaction information is ingested into the system and processed. At this stage, each transaction is categorised into several groups (broader and more specific), dependent on its purpose.

Here are some examples of payment descriptions, and their possible categorisation labels:

- GOVT SSA: Income, benefits

- FREELANCE PROJECT: Income, other

- HMRC TAX REFUND: Income, tax refund

- SPOTIFY PREMIUM: Subscriptions, entertainment

- NUMBER 9 RENT: Housing

Two important factors of success are granularity, which refers to the level of detail, and taxonomy, the structure of categories and subcategories, vary depending on the provider you choose.

Part 2: enrichment

After transaction categorisation, it’s time for enrichment. At Moneyhub, this involves several steps, including:

- Merchant identification: naming the business where the transaction took place.

- Merchant metadata: such as logos, phone numbers and website addresses.

- Optional geolocational data: (this is a separate module) such as address verification services to pinpoint the store where the spending took place, presented in a map format. This is a unique identifier for the specific store, clarifying spending at companies with multiple store locations.

What’s the importance of merchant identification?

Merchant identification is a fundamental part of categorisation and enrichment, because it provides the following benefits:

- Improving the customer experience

- Fraud prevention and early detection

- Optimising user journeys for revenue

- Ensuring compliant partnerships

Without an accurate merchant ID, banks, their third-party partners and customers all suffer. It adds vital context to general spending data, even providing the detail when other information is missing.

Improving the customer experience

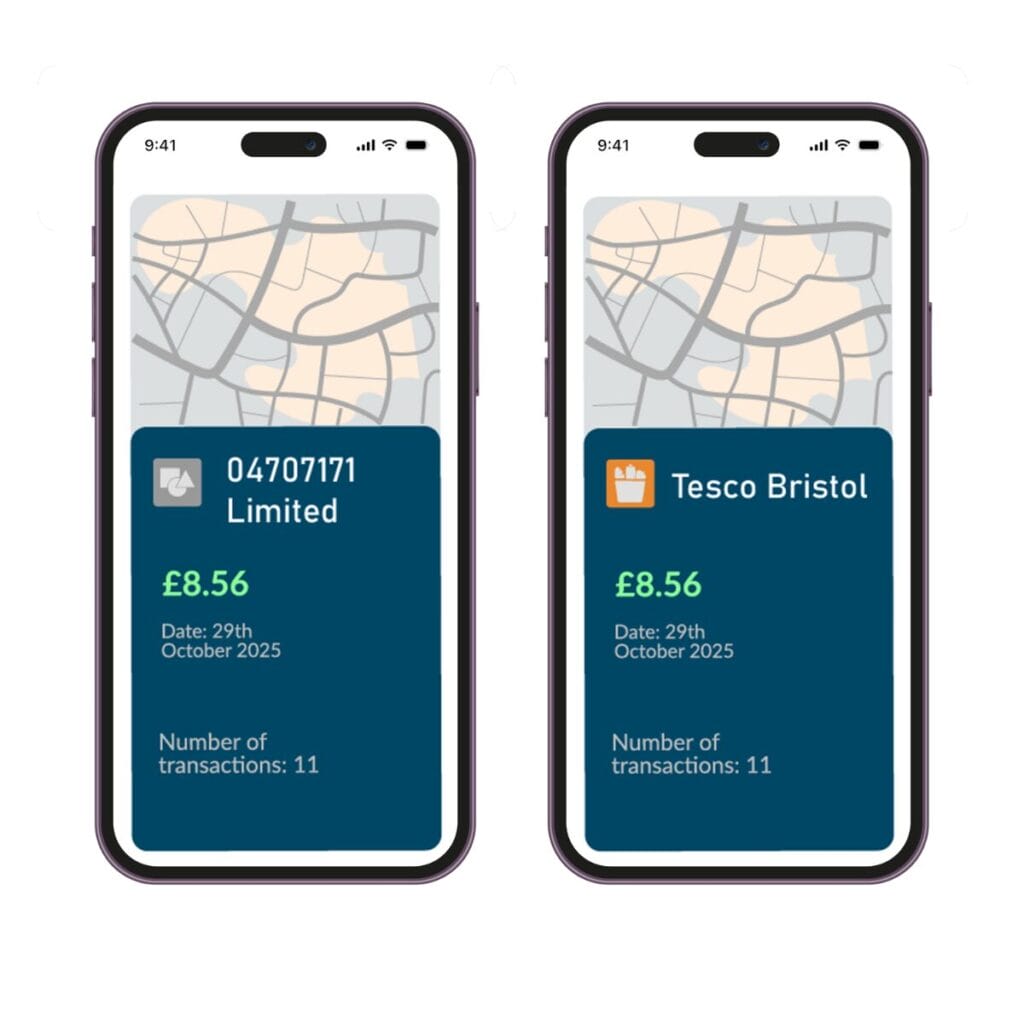

For banks and lenders, the payment provider and bank merchant ID plays an important role in the customer experience, helping end users to recognise where they have spent their money. Clear retailer labels help account holders to better manage their budgeting and plans for future spending.

In fact, accurate merchant identification can be the difference between a customer seeing the correct store name in their banking app, such as ‘Tesco Bristol’ and a random chain of letters: ‘04707171 Limited’ (yes, that was taken from a real transaction description from one of our competitors’, sigh).

It therefore significantly decreases customer confusion – the direct cause of an estimated 20% of phone calls to Tier 1 banks today. Each disputed transaction is estimated to cost the issuing financial institution the equivalent of £7.25 (an average of $9.70).

Eliminating just 50 of these calls per day would enable institutions to save £132,000 annually. More accurate merchant identification therefore leads to lower administrative costs, enabling institutions to work in a lean and efficient manner.

Identifying and preventing fraud

Similarly, clear labelling can make it smoother for analysts and account holders to spot cases of spending fraud.

It’s easy to mistake poor labelling for spending by somebody else, and for end users, the realisation that your account may have been taken over by a fraudster can induce panic. Instead of allowing this to chip away at customer loyalty (and processing fees, which are still charged in the event of a dispute or refund), accurate merchant detection is an easy fix.

Not only do you save your customers from the anxiety of false account takeover, but it’ll help your fraud analysts spot the genuine cases more quickly, when they occur. The reality is that no bank is immune to fraud – but organisations that accept this fact and empower their fraud teams with better data will come out on top.

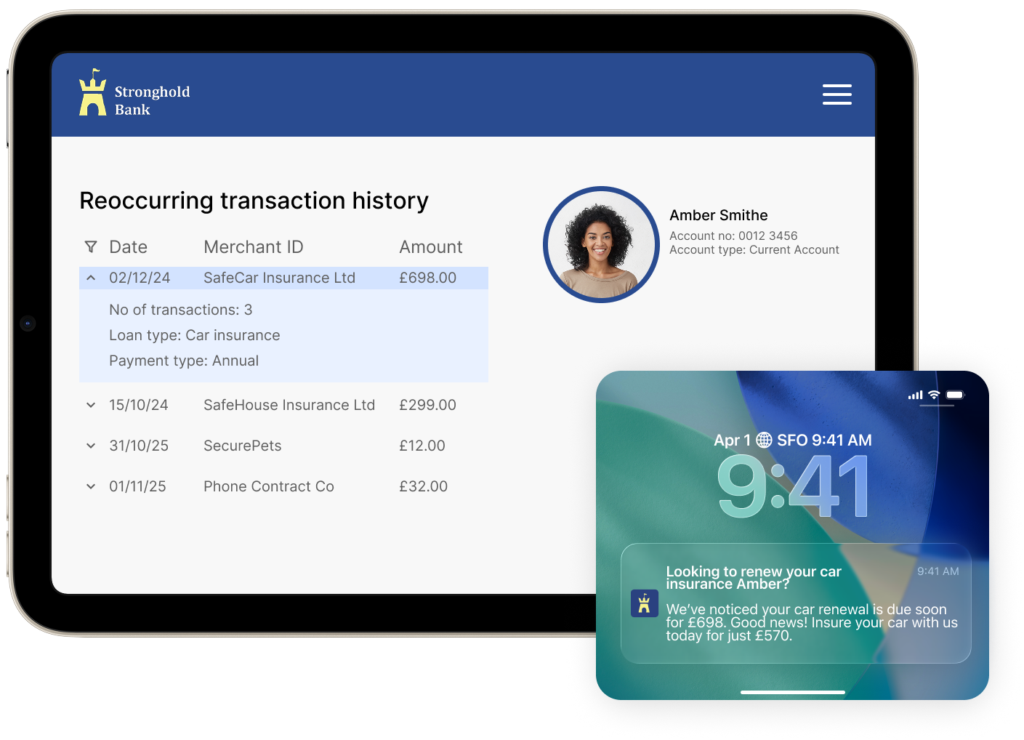

Optimising user journeys for revenue

Digital leadership can leverage merchant identification in their analysis of customer spending behaviour, identifying better opportunities for cross and upselling. This can enable institutions to lay the groundwork into new areas of the financial and payment ecosystem.

One example that Moneyhub powers for its customers is in the insurance space. When providers have the ability to identify merchants accurately, they can spot which customers have taken out policies with their competitors.

Seeing the names of your competitors in the merchant identification field doesn’t have to be demoralising though, it can provide competitive insights that these institutions would struggle to find elsewhere, including:

- Product pricing: the value of transactions associated with this competitor merchant can inform the provider’s own pricing strategy

- Number of payments over time: payment history can indicate renewal dates, and therefore signal the best window to make an offer

This takes advantage of the huge data lakes that institutions already hold, ensuring that they are both optimising and maximising their digital offerings.

Compliant partnerships

For risk and partnerships managers, accurate merchant identification can help to go beyond the standard due diligence procedures like Know Your Customer (KYC). Helpful in providing extra, verified data about potential new customers or third parties, this use case for merchant identification is incredibly underutilised in banking and lending.

The standard new account opening process in the UK involves:

- Users fill out the application form

- The user will documents for proof of identify and proof of address

- The bank will verify the user’s identity (and may also require an in-branch visit)

- The bank will accept or reject the account opening request

But banks can enrich this process, further reducing risk around new account opening to prevent the likes of money laundering and terrorist financing. Merchant identification data, used as part of wider categorisation and enrichment outputs, can reveal the income and spending patterns of an individual, including any suspicious behaviour.

In the B2B merchant onboarding process, accurate categorisation and enrichment should uncover risks and threats, and crucially, before you share your systems with potentially harmful third parties. The strategic use of merchant identification data can help to expand a bank’s digital footprint, creating new and varied streams of revenue.

What are the important features of merchant identification?

Two main features of merchant identification indicate its quality:

- Coverage

- Accuracy

Coverage

Coverage refers to the frequency of identifying business names. What percentage of the time can a merchant name be found during the payment process?

Accuracy

Accuracy refers to the precision of the business names. When a merchant is identified, what percentage of the business names are actually correct?

Broad coverage is necessary for the reliability of your categorisation and enrichment engine – as it needs to make sense of all the data, no matter how new or obscure.

Open banking providers’ coverage varies from around 70% to 80% generally. At Moneyhub, we offer 86% merchant coverage.

Better merchant identification accuracy is equivalent to fewer errors, but it also leads to higher levels of trust in your categorisation and enrichment system. This way, it’s easier for:

- end users to recognise their transactions

- end users to budget more effectively

- analysts to identify fraud

- analysts to understand spending patterns, and next best steps

In 2025, over 40% of cardholders still find their bank statements confusing. Moneyhub offers merchant ID accuracy at a guaranteed rate of 99%, building trust on behalf of our clients and their end users.

How to choose the right merchant ID technology?

When comparing merchant identification providers as part of a larger categorisation and enrichment suite, our Head of Data Science, Daniel Cook recommends that you:

- Don’t just take a supplier’s word for it

“Be wary of vendors that make claims like ‘<5ms latency’ for transaction enrichment when the physical act of data being moved between two data centres takes that long (and doesn’t include any actual processing).

We’ve completed many enrichment exercises for large and small financial institutions between 1 million and 1 billion transactions. We can help guide you through the entire process, including what format to send the data in, and thoroughly break down what we produce.”

- Take a random sample

“A good way to get reliable results is by taking a random sample, such as 2,000 transactions, from a larger set that you’ve asked to be enriched. Check the accuracy and coverage metrics by hand. We’ve also known a client to complete an enrichment exercise with many vendors on a dataset greater than 1 million, and they eliminated all the transactions that every vendor agreed on. This left only the more challenging transactions to be hand labelled, revealing the most accurate suppliers.”

Here is Daniel’s recommended merchant identification criteria:

| Criteria | Why? | What does “good” look like? |

| Format | The business name is far more valuable for both financial institutions and their end users. It needs to be pulled from the reference or description, and is typically surrounded by the ‘noise’ of seemingly random letters and numbers. | The exact merchant name within the banking app transaction.

For example: Kina Pilates Studio. |

| Coverage | High coverage means that merchant identification is reliable across the market. Low coverage means you can’t display detailed in-app information on where a purchase was made, thus increasing call volumes from users querying transactions. | Coverage levels of at least 70% are considered ‘good’. |

| Accuracy | High accuracy means that merchant identification is correct. Low accuracy means users may report valid transactions as fraudulent due to the incorrect merchant being displayed. | Accuracy levels of at least 98% are considered ‘good’. |

| Scale | Can the solution keep up with your anticipated transaction rate and enrich with merchant IDs in real time? | An average of 4,000 transactions per second (equivalent to 350 million per day and 126 billion per year). |

| Enrichment engine technology | The type of technology can be a limiting factor, especially because legacy systems may require significant manual corrections or upkeep. | Engines powered by machine learning or AI that can learn and adapt as they go. |

| Customer service | Being able to get in touch with your provider at a moment’s notice is imperative, especially with the level of risk around banking transactions. | 24/7 support is offered by the best providers, alongside a commitment to same-day issue resolution and a full, tested fix implemented within five days (for critical issues). |

| Experience | Previous experience with Tier 1 banks is important so that expectations are aligned on uptime, scalability and service levels. | Experience with two Tier 1 banks is generally considered good. |

Daniel notes, “Assessment should cover more than basic enrichment. How rich is the vendor’s ecosystem?”

At Moneyhub, merchant ID enrichment is just the beginning and an enabler for the rest of our ecosystem, including:

- Smart Lending affordability checking for approval and pre-approval

- Regular series detection for better budgeting

- Embedded journeys to deliver these insights into consumer-facing apps

Recapping merchant identification’s role in categorisation and enrichment

Merchant identification plays an integral role in the categorisation and enrichment process, and providers should be carefully evaluated in the way they perform it.

This card transaction data is incredibly valuable, providing the foundation for optimised user journeys and in building positive experiences for the customer. Therefore, financial institutions must ensure that merchant ID labels are accurate and reliable.

Moneyhub offers 99% accuracy and 86% coverage in merchant identification, as part of our industry-leading categorisation and enrichment engine. To learn more about exactly how it fits with the wider technology, explore the Moneyhub transaction categorisation and enrichment solution.

FAQs

Merchant identification is the process of finding out the name of the business where a transaction took place. Every business has a unique merchant identification number, from ‘Sainsburys’ to ‘Primark’ or even ‘Jennings Bet’.

At Moneyhub, we convert the merchant identification number to the merchant name, known as merchant detection. This information is then attached to other transaction data like payment amount and time of purchase in the banking apps that we service for ease of recognition and further analysis.

Not all categorisation and enrichment providers arrive at their merchant identifier in the same way, which means that the outcome of a brand name isn’t guaranteed. When providers can’t identify exact merchant names, it’s more difficult for customers to recognise transactions, and for financial institutions to perform further analysis.

Wait… so a merchant identification number isn’t the same as merchant identification?

The short answer: no, they’re different.

The longer explanation: a raw 15-digit string of numbers is the merchant ID number. Some banks and lenders will find this data sufficient and include it in its raw form in transaction descriptions, confusing end users and making it harder for employees to analyse. Unfortunately there’s no universal merchant identification number lookup service to bypass this obscure output, either.

However, most categorisation and enrichment systems transform this merchant number into the merchant’s trading name after a customer payment. This process of determining the merchant name from the numbers is the merchant identification (or detection) process.

No, there’s no standardised merchant account number list. It’s up to the banks to create their own system with the data, which can be confusing when you have multiple merchant accounts with similar names. It’s why building in-house for this feature is heavily resource-intensive and expensive (in the millions), and most financial institutions prefer to outsource it to a dedicated merchant account provider.

Merchant Category Codes (MCCs) were introduced by the International Organization for Standardization (ISO), and are now maintained by card payments networks like Visa and Mastercard. They’re a global categorisation system for merchants, using 4-digit codes to signal the type of merchant.

However, relying solely on merchant category codes in payment processing continues to limit the ability to recognise and analyse transactions, because the merchant name isn’t necessarily provided. This is especially the case for business bank account transfers, where the name of a sole trader might not obviously indicate the merchant services because it doesn’t necessarily match the trading name or merchant statement documents.

Historically, these codes were introduced to help with expense claims, so in categories like airlines or hotels, each provider has their own code. In categories that are less common for expenses, though, such as groceries, every supermarket shares the same code. This limits usefulness and transparency.

Leading banks and lenders overcome the challenges of silo’d merchant ID number or MCC data by performing the merchant identification process as part of their categorisation and enrichment.

Yes, different branches of the same business will usually have their own merchant account ID, as it helps the business with tracking and analytics. This is, however, typically more complicated for banks and their customers, as it can be confusing when more than one store exists in the same area.

Banks need to identify the exact store within their merchant ID process. Moneyhub is one of only a few providers to do this as standard, using address data and map visualisations.

Written by a human:

Daniel Cook is a data and analytics leader with a background in Software Engineering, Big Data, and Machine Learning. He really enjoys the intersection of Data Science and real-world impact. At Moneyhub, his team turns complex financial data into actionable insights and intelligence that help both businesses and consumers make better financial decisions.

Outside of the technical work, Daniel is passionate about cycling and has toured several countries including the full length of New Zealand.

share