Does it feel like you’re marketing in the dark?

Most product marketers are drowning in data, but it’s usually proxy data: what people claim they do. A lack of hard data, like knowing what people actually spend their money on, can leave you starving for real insights.

Can you really afford to keep guessing?

When your targeting is built on assumptions rather than actions, you aren’t just wasting budget, you are missing the intent windows that define your customers’ lives. Fortunately in the financial industry, the solution is already sitting in your data lake, you just need the tools to wake it up.

In this guide, Product Director Matt Barr walks you through maximising the data source you’re currently ignoring: transaction data. You’ll learn how to move beyond static demographics into dynamic spending personas, and use predictive analysis to act as a proactive financial coach for your customers.

Step 1: Gather customer transaction data

Right now, the data that informs your product marketing simply isn’t telling the whole story. That’s because intent is a poor predictor of revenue. A customer might tell a survey they are ‘environmentally conscious’, but if their transaction history shows 15 fast-fashion purchases and zero spend on renewable energy or ethical brands, a Green ISA campaign will fail.

This is known as the ‘say-do’ gap, and it leads to wasted budgets, irrelevant offers and low conversion. But the reality is that organisations leveraging actual behavioural insights outperform peers by 85% in sales growth and more than 25% in gross margin.

For product and proposition managers at banks and lenders, there’s no end to the actual behavioural insights you already collect, in the form of transaction data. Matt explains,

“Transaction data is superior because it captures revealed preference, bypassing aspirations to expose real actions. And by targeting this, rather than intentions, you eliminate wasted spend and align your offers with the verified reality.”

However, if you’ve ever tried to run a campaign on this data, you’ve likely hit these three specific walls:

- The ‘miscellaneous’ void

- Inaccuracy risks

- Navigating the scale

The miscellaneous void

Pulling a report just to find that 30% of transactions are labelled as ‘miscellaneous’, ‘pending’ or ‘other’ is frustrating. You can’t build a ‘high end diner’ segment if you’re trapped in a data black hole.

However you can rectify this by improving your internal categorisation and enrichment with a leading provider like Moneyhub. Offering a multi-layered enrichment engine that transforms messy and unrecognisable strings of information, it cleanses and accurately labels both income and spending types.

Across all of the current account and credit card transactions we have categorised on behalf of clients at Moneyhub in the last six months, only 3.2% were categorised as ‘other’.

With a granular, four-level taxonomy, you’ll automatically get access to the spending types and subcategories. And you’ll get the precision you need to target customers based on their real-time behaviour, achieving higher conversion rates than with historic data alone.

Inaccuracy risks

The majority of internal categorisation and enrichment systems hit a ceiling of 60-80% accuracy. The struggle with cryptic merchant IDs and messy strings leaves a huge percentage of your data unable to contribute towards your ideal customer profiling (ICP).

The Moneyhub Categorisation and Enrichment Engine delivers a market-leading 98% accuracy rate, far surpassing the 60-80% ceiling of most internal legacy systems. This precision is critical because it eliminates the risk of false positive targeting, which can alienate customers and drain marketing budgets.

By ensuring that every transaction is correctly mapped to a granular merchant and category, your data is validated. It ensures that you’ll run personalised campaigns based on true insights instead of betting your budget on skewed analysis that won’t result in the conversions you expect.

Navigating the scale

The sheer volume of raw financial data can lead to analysis paralysis. When faced with millions of data points, it’s difficult to know where to begin – often resulting in broad, diluted strategies that fail to move the needle on specific KPIs.

Instead of attempting to boil the ocean, you can accelerate your speed-to-market by using stratified sampling. By pulling a ‘gold set’ of enriched data from your highest-value or highest-churn segments, you can test theories and validate patterns in a controlled environment.

Once you have proven a correlation within this targeted sample, such as a specific spending shift that predicts churn, you can scale that logic across your entire data lake with total confidence. This approach ensures your targeting is rooted in proven behavioral science rather than overwhelming, unverified volume. This allows you to deploy high-impact campaigns in weeks rather than months, ensuring your budget is always backed by verified, scalable correlations.

Step 2: Segment your customer base

Achieving sales growth through segmentation means moving beyond age brackets and into behavioural personas.

The Mental Accounting Theory by Richard Thaler explains why people treat their ‘coffee money’ differently to their ‘rent money’, Matt explains.

A customer may be extremely price-sensitive in their ‘grocery’ budget category, but highly splurge-prone in their ‘entertainment’ pot.

“Most people don’t see every pound as having the same value. Instead, they psychologically file money into different levels, based on emotional friction. By understanding which mental account your product falls into, you can adjust your messaging to either minimise the pain of payment, or lean into the reward”, he adds.

Smart Segmentation: how granular can you go?

While traditional segments are frozen, based on account opening data, Smart Segmentation by Moneyhub is dynamic, evolving as the customer’s life does.

“Use your transaction data to identify life stage triggers, then adjust your marketing before the customer even thinks about looking for a new product”

Matt adds, “It’s like seeing a ‘young professional’ customer who suddenly starts spending at Mamas and Papas and receiving child benefit. Smart Segmentation enables you to move the customer into the ‘new parent’ segment in real-time”.

Step 3: Analyse spending patterns per segment

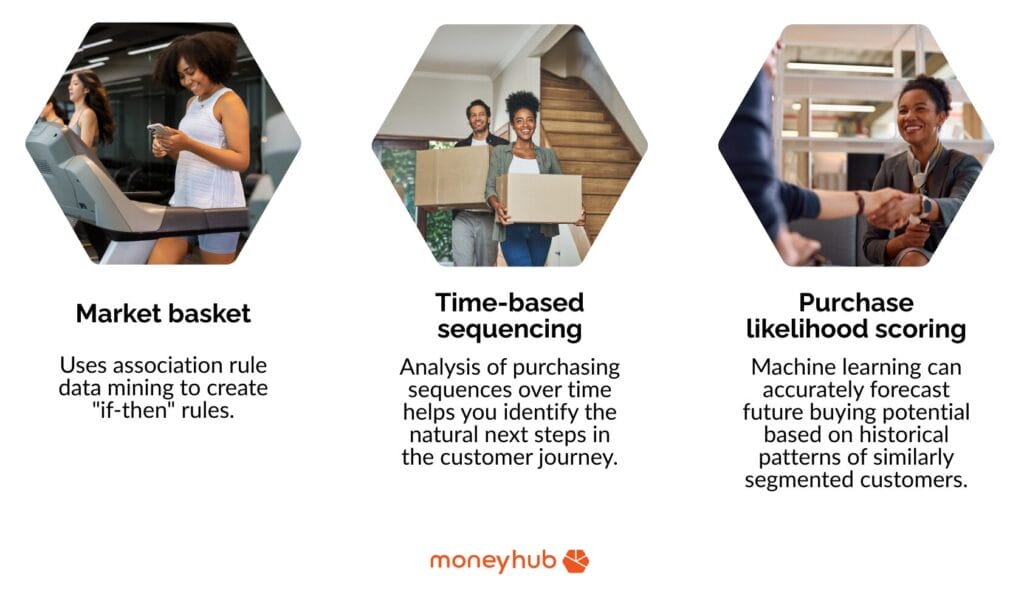

High-conversion targeting requires product affinity: the tendency to buy certain products together. With that in mind, the following techniques can help you identify which products or categories are naturally paired:

- Market basket: uses association rule data mining to create “if-then” rules. For example, IF a customer starts paying for a new premium gym membership, THEN they have a high attach rate for wearable health tech or specialist health insurance policies.

- Time-based sequencing: analysis of purchasing sequences over time helps you identify the natural next steps in the customer journey. Such as four weeks after a house deposit is spent, the customer will consider purchasing contents insurance, DIY items and broadband.

- Purchase likelihood scoring: machine learning can accurately forecast future buying potential based on historical patterns of similarly segmented customers. Assess each customer score and prioritise your marketing spend on the individuals most likely to convert.

By looking beyond what was bought, and into both cadence and context, you can perform propensity modelling at a far more accurate rate than standard banking algorithms. That’s because it includes the full financial picture – holistically – to ensure timely and effective targeting.

Don’t forget: wallet share

Matt explains, “one of the most powerful uses of transaction analysis is seeing where else customers spend. If your data shows a segment is spending £200 per month at a rival investment platform, for example, it’s a direct cross-sell signal for your own targeting. It’s been one of the biggest ‘aha’ moments for product marketers at Moneyhub.”

Step 4: Adjust your marketing messaging

You have the enriched data and the predictive scores, it’s now time to close the loop. The goal at this stage is to ensure your messaging doesn’t feel like a broadcast, but a consultation.

Hyper-personalisation means matching your value proposition to the customer’s revealed preferences. By getting your messaging right on the first try, you can reduce customer acquisition costs by up to 50%.

Matt details the practicalities of using personalisation in your messaging: “Adjust your creative and copy per segment to speak directly to the specific pain points or aspirations identified in the previous steps.”

“Of course, this isn’t a particularly scalable system. But by implementing AI into our clients’ workflows, we’ve been able to set up event-triggered messaging to target various groups at scale”, he adds.

Real life example: credit card offers

Analysis shows that a segment of 1000 customers are paying for three or more different streaming services, and have a credit card with one of your competitors.

You spot the opportunity to tweak one of your credit card products, offering cashback on streaming services or even free access to one of the services. This is something that no other provider offers, and will allow your customers to gain financial rewards when they purchase streaming services on the card.

So instead of a generic, ‘you meet our credit card criteria, why not apply?’ message, you send a targeted nudge:

‘We noticed you’re a big fan of streaming. Did you know you could get 5% cashback on your Netflix, Disney+, and Spotify subscriptions every month with our Digital Rewards Card? Click to make the switch.’

It results in higher engagement because you’ve found an offer that is relevant to the behaviour of the segment. And you could even leverage this in your cross-selling targeting, which we’ve written a whole guide on here.

Rely on the real deal: stop betting on guesswork

It’s time to stop marketing in the dark.

As we’ve explored, the ‘say-do’ gap is a key barrier to relevance, so relying on what people claim they do will always leave you starving for real insights.

Instead, behavioural insights through transaction categorisation and enrichment provide the high-voltage ‘hard data’ that you need.

By harnessing these insights, you stop wasting budget on proxy guesses and start acting like a proactive financial coach who understands a customer’s world before they even have to explain it.

Ready to wake up your data? See how the Moneyhub Categorisation and Enrichment Engine can transform your targeting.

FAQs

The most effective strategy is to use transaction history to identify high-affinity product pairings. By analyzing market baskets, such as the correlation between premium gym spends and private health insurance, you can ensure your offers reach customers with a verified behavioral predisposition to buy.

Product Marketers, Proposition Managers, Data Engineers, and the end customers all benefit from the transition from guesswork to high-fidelity insights. Marketers achieve higher conversion rates and lower acquisition costs, while customers receive a more empathetic, financial coach experience that feels like a partnership towards better financial outcomes rather than a series of cold pitches.

Optimisation is achieved by determining purchase likelihood scores, and prioritising high-profit opportunities. Instead of a broad ‘spray and pray’ campaign, your budget is focused exclusively on the top 10% of customers that the data proves are in an active intent window, significantly increasing engagement and reducing wasted spend.

About Matt Barr:

Matt Barr is a Product Director here at Moneyhub. He’s been working either with or for banks since the mid-00s, solving all manner of problems. From ISA transfers to corporate actions, Matt now focuses on transaction categorisation and enrichment. When he’s not solving client problems, you can find Matt buried under his children’s laundry or stomping through the Peak District.

share