The moment a customer opens a savings account, their financial intent is at its peak. Yet, for many, this spark fizzles; industry analysis shows it takes an average of four days to make a first deposit. At Nationwide, this friction caused 4% of new accounts to close monthly simply due to manual transfer hurdles.

Beyond the first deposit, barriers like fluctuating incomes and life priorities often stall progress. Moneyhub provides the technology to harness intent by replacing passive saving with the active pursuit of tangible goals.

By combining contextual guidance with frictionless payment rails, we ensure customers deposit more often and in higher volumes. Our framework helped Nationwide accelerate their deposit journey by 75% and enabled Paragon Bank customers to nearly double their average balances in under six months.

In this guide, Paul Tutton, Product Manager of Payments and APIs, explores how smart data and modern payment tech create a superior savings cycle.

Are you ready to build a more resilient deposit base?

- Establish the intelligent data layer

- Identify users with savings capacity

- Architect the goal-setting journey

- Send a nudge

But first…

Avoiding insensitive nudges

Most banks attempt to drive deposits by sending generic reminders on payday. But without categorisation and enrichment data, you are operating in a blind spot.

“You might be nudging a customer to save £200 just as they’ve been hit with an unexpected car repair bill that your system hasn’t identified”, notes Paul.

To guide a customer toward a goal, you first have to understand the journey they are already on; otherwise, your ‘helpful’ nudge is just noise. And a poorly timed nudge is worse than no nudge at all, it’s a brand withdrawal. It tells the customer that their bank is out of touch with their reality.

Step 1: Establish the intelligent data layer

Gathering intelligent data isn’t about collecting more information, it’s about refining the raw data you already have into strategic, actionable insights. To build a perfectly-timed deposit nudge engine, you must move through these two practical stages:

- Ingest wider data sources

- Categorise and enrich transactions accurately

Ingest wider data sources

In order to see the full financial picture, you must be able to see the idle savings sat inside your competitors’ accounts, the bills going out of secondary current accounts, and everything in between.

Bridge the visibility gap by implementing data aggregation – enabling your customers to connect all of their external accounts into your app. By integrating an API to normalise this data, you can provide your customers, and your data engine, with information from multiple providers in a single, unified schema.

Categorise and enrich transactions accurately

Once the data is flowing, you need to implement a deep-learning model that identifies merchants and the intent of the spend. Standard banking categories, such as ‘retail’ or ‘bills’ can sometimes be too broad for savings automations.

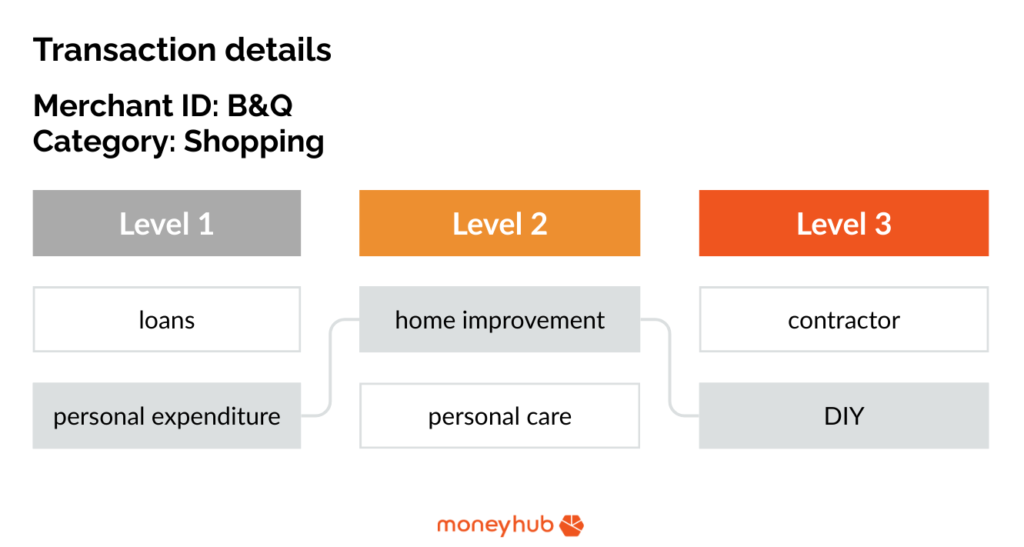

Achieve this by mapping your transactions to a multi-level taxonomy. For example, instead of labelling a payment to B&Q as ‘shopping’, it could be categorised as:

- Level 1: personal expenditure

- Level 2: home improvement

- Level 3: DIY

This level of granularity shows the bank that the customer isn’t only spending, they are investing in their home. It’s a prime indicator of a high-value savings goal, and an indication for you to nudge the customer into setting up a savings goal titled: home improvements.

Need a more intelligent data engine?

Achieving this level of precision requires complex data science that accounts for fluctuating dates and varying transaction descriptions. By working with Moneyhub, you can access an intelligence layer that is already tested and market-ready.

Our Categorisation and Enrichment Engine is already powering financial institutions including Lloyds Banking Group and Nationwide Building Society, providing the ironclad data logic required to build a strong foundation for savings nudges.

‘Standard’ categorisation is a blunt instrument, whereas Moneyhub provides a precision tool.

Step 2: Identify users with savings capacity

Once the data intelligence layer is active, customer and savings teams can move from broad buckets to fluid, granular segmentation. It’s about ensuring that any recommended transfer is ‘safe’, meaning it won’t push the customer into an accidental overdraft or a liquidity crunch, and it won’t cause negative brand sentiment.

Calculate savings capacity by finding the difference between essential and discretionary spend compared to income. Here are some segments that you may not have considered previously:

- Current account coasters: this term, coined by our client Paragon Bank, describes account holders that leave over £526 billion sitting in in low or no interest accounts (in this case low interest is classified as 1.5% or lower). It leaves approximately £20 billion in interest on the table, annually.

- New retirees: those who have just taken a lump sum from their pension and don’t spend it immediately, instead wanting to put the cash into a safe, high interest savings account.

- Final debt payments: describes account holders that have just made their final payment on a loan or finance deal, leading to a sudden, permanent drop in fixed outgoings and the opportunity to redirect those funds.

- Temporary surplus: describes account holders who typically spend a certain amount on groceries or dining out, which drops to zero at the same time as geolocation data shows a change in location. You could infer that the person is working away from home with their expenses covered, creating a temporary surplus of savings capacity.

Paul’s top tip:

“Static segments are the enemy of conversion. A customer who has savings capacity today might lose it tomorrow due to an unexpected bill. Your system must be architected to move users in and out of savings segments in real-time, using Smart Segmentation.”

Step 3: Architect the goal-setting journey

To maximise deposit growth, the goal-setting process must be integrated. Our own data shows that individuals who ‘actively work towards well-defined financial goals’ are around 10 times more likely to succeed.

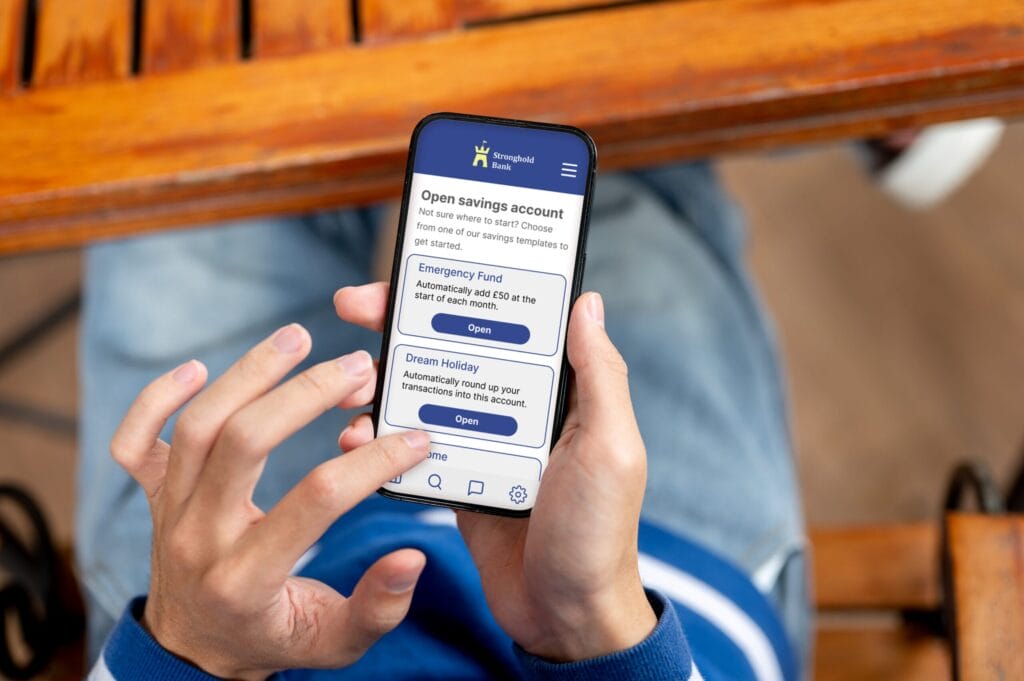

Reduce friction by making it easy to set up savings goals in-app. Offer quick-start templates based on common life stages, such as ‘Emergency Fund’, ‘First Home’, or ‘Dream Holiday’ to reduce cognitive load.

“A goal should feel alive”, Paul notes. “It needs to be a constant visual reminder within the banking app”. Therefore, implementing a progress bar that updates in real-time tells the customer exactly when they’ll hit it based on current savings velocity. This gamifies the process and leads to higher engagement rates.

Step 4: Send a nudge

Now to the moment of truth; where your data-driven insights transform into a customer experience.

“A nudge is any aspect of the choice architecture that alters people’s behaviour in a predictable way without forbidding any options or significantly changing their economic incentives.”, according to the book: Nudge.

We’ve done a lot of in-house testing working with clients like Mercer and Aon to determine the best types and timings of nudges, as well as the messages within them. Paul explains:

“In an account connections trial, we achieved a 75% open rate of nudges, with 44% of people going on to complete the intended action: connecting additional accounts. And in a separate lending trial, 69% of people opened a nudge that suggested a new card more suited to their spending and repayment habits, with 47% going on to investigate options and rates.”

Based on the extensive internal research, we’re sharing our framework to constructing a high-conversion nudge:

- Journey-Audience match:

Use metrics to build up context about a customer to get the best opportunity for interactions that are both relevant and timely.

What this looks like in practice: use behavioural signals to explain why you’re reaching out and build trust with your customer. For example, ‘we’ve noticed your car insurance was £40 cheaper this month than last year. Why not sweep that £40 into your ‘holiday’ fund?’

- Time your trigger:

The time that a nudge is sent is an essential factor in its success. Be primed for the next action in the journey but wait for the trigger to nudge the customer.

What this looks like in practice: use your intelligence layer to identify the liquidity peak – the point when the most cash is available. For example, within the first 24-48 hours of a salary deposit or expense reimbursement.

- Lead with the why

People don’t save for the sake of saving, they make deposits for what the money represents. Link your copy directly to the customer’s self-defined savings goal.

What this looks like in practice: replace: ‘want to move money to your savings?’ with: ‘you’re only £200 away from your New Kitchen milestone’.

| Framework step | Nudge | Customer action |

| Journey-Audience criteria match | “We’ve noticed your car insurance was £40 cheaper this month than last year. Why not sweep that £40 into your ‘holiday’ fund?’” | Customer sets up monthly VRP into their savings account on months when insurance is £40 less than the threshold amount. |

| Timely trigger | “You’ve just received £132 in expense reimbursements. Looks like your current account balance will cover upcoming bills for the month, would you like to add it to your savings?” | Customer agrees to a one-off savings sweep within 24-hours of receiving their extra income. |

| The ‘why’ | “You’re only £200 away from your New Kitchen milestone. Add money to reach your goal this month” | Customer is reminded of their goal (and why they initially set it up), leading to extra movement to reach savings goal. |

Step 5: Integrate convenient payments

The moment a customer clicks ‘yes, save my surplus’, the friction must be zero. This is where Variable Recurring Payments (VRPs), also known as Smart Payments, transform the deposit journey. Instead of a manual chore, it becomes an automated, high-velocity engine.

Paul explains the strategic shift:

“Traditional payment rails weren’t built for the Segment of One, they’re too rigid. Smart Payments allow us to set up automated sweeping rules that adapt to the customer’s real-time balance. It’s the difference between taking a fixed £100 every month and intelligently pulling the surplus £42.50 that the data identified.”

Implementing a zero-friction payment journey

To maximise your deposit growth, Paul recommends a two-pronged approach to integration:

- Pay-by-Bank for first-time deposits: bridge the 4-day funding gap by providing an instant deposit option during the onboarding flow. It’s how we worked with Nationwide to achieve a 75% reduction in time-to-first-deposit.

- Smart Payments for consistent, ongoing deposits: allow customers to set up sweeping rules, where consent is provided upfront. Gain an automated, predictable deposit stream with a set-and-forget path for the customer to reach their goals.

Doubling the average balance at Paragon Bank

Integrating convenient payment rails leads to technical elegance and bottom-line growth. In our work with Paragon Bank’s Spring Savings App, implementing Smart Payments from Moneyhub led to:

- 65% of all deposits made through frictionless Pay-by-Bank and Smart Payments (VRPs)

- Daily payment volumes doubling as the friction of manual saving was removed

- A 99% customer satisfaction rating, highlighting the ease of using and saving in the app

Increasing deposits with customer savings goals: your next steps

Transitioning to a data-led savings model doesn’t require a big-bang legacy overhaul. Most of our partners begin their journey through a phased approach that delivers measurable ROI quickly, allowing you to prove the concept before scaling across your entire book.

Start by assessing your vision for your current transaction categorisation and enrichment, auditing your time-to-first-deposit and the payment or transfer options that you currently offer.

The technology to automate your deposit growth is already here, but every institution’s roadmap is unique. Whether you want to dive deeper into the VRP technical specs or discuss how to refine your customer segmentation, our team is ready to help.

FAQs

Yes, transaction data allows banks to identify capacity for savings across internal and external accounts and move it into their own high-value products. By understanding a customer’s spending habits and life events through data, institutions can proactively offer relevant services like mortgages or investments at the exact moment of customer need.

Standing Orders and Direct Debits are traditionally rigid, fixed-amount payments, whereas VRPs are dynamic and can adjust to a customer’s fluctuating income and expenses. This intelligence ensures that deposits are only initiated when the data identifies a genuine capacity to save.

Banks can use enriched transaction data to identify a customer’s real-time discretionary surplus and trigger personalised nudges. This ensures every suggestion to save is based on the customer’s actual financial capacity rather than generic payday guesswork.

About Paul Tutton:

Paul Tutton is a payments and APIs expert from Bristol, UK. He’s been deeply ingrained in the finance industry for nine years, including delivering payments capabilities at a CMA9 bank. Paul enjoys helping businesses to make the most out of payments capabilities with Moneyhub, with a keen focus on building better outcomes for end users. These days, you might find Paul participating in forming the new industry led entity for Variable Recurring Payments, where he influences policy and the rollout of new technology.

share