Banking app transaction disputes are costing UK banks an estimated £23.5 million to investigate. With 55% of UK cardholder customers saying that at least one banking app dispute stemmed from an unrecognised transaction in 2025, the root of the problem is clear.

Banks need to help customers recognise their spending in-app to cut the unnecessary calls and costs of disputes.

Here’s how the nightmare unfolds: upon seeing an unrecognised transaction, end users spiral straight into panic mode. They presume a fraudster has taken over the spending on their accounts, and are upset that banks don’t recognise this shady behaviour themselves.

But here’s the catch: the banks aren’t picking up fraudulent spending because, most of the time, there is no fraudulent spending. The ‘suspicious’ transactions are actually genuine purchases made by the end user. But fuzzy descriptions, confusing merchant names and a lack of contextual data all contribute to the lack of recognition, arousing levels of suspicion.

More accurate and detailed transaction displays are the answer to helping end users recognise their own spending behaviour in your online banking app. And they could eliminate around 20% of all customer calls to your service center.

Replace unrecognisable transaction descriptions with clear brand names. Integrate contextual information, like retail address maps or logos, and customers will more easily recognise what’s in their current accounts.

Close the recognition gap with more accurate and contextual transaction displays—a problem that’s currently eating away at the administrative and operational budgets. At a cost of approximately £7.20 per dispute, and 3 million disputes raised per year at banks in the UK, how much could you save?

How to help your banking customers recognise their spending:

- Convert unrecognisable transaction descriptions into clear brand names

- Get granular with your transaction categorisation

- Add visual information for better recognition

- Send spending notifications in real-time

1. Convert unrecognisable transaction descriptions into clear brand names

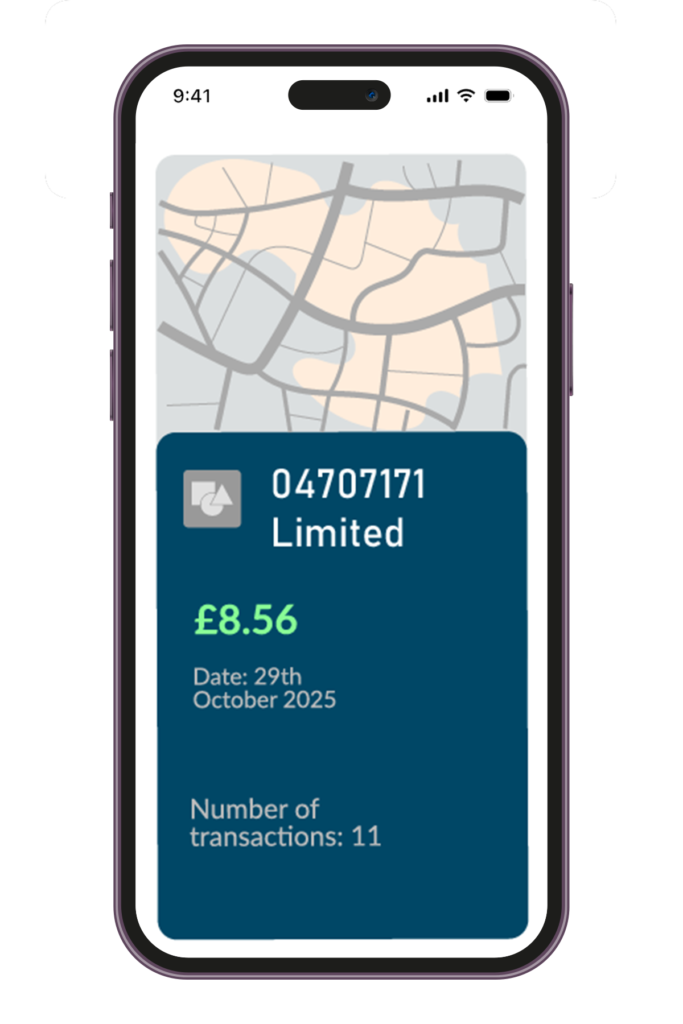

How many times are your customers logging into your mobile banking app to check their spending insights, and seeing something like this?

Every financial institution knows that to build a positive connection and create customer loyalty, transactions must be recognisable. Banks employ various solutions to avoid this problem, aiming to show the genuine retailer name instead. But for many, this random string of letters and numbers attached to the money shows up more often than they would like to admit.

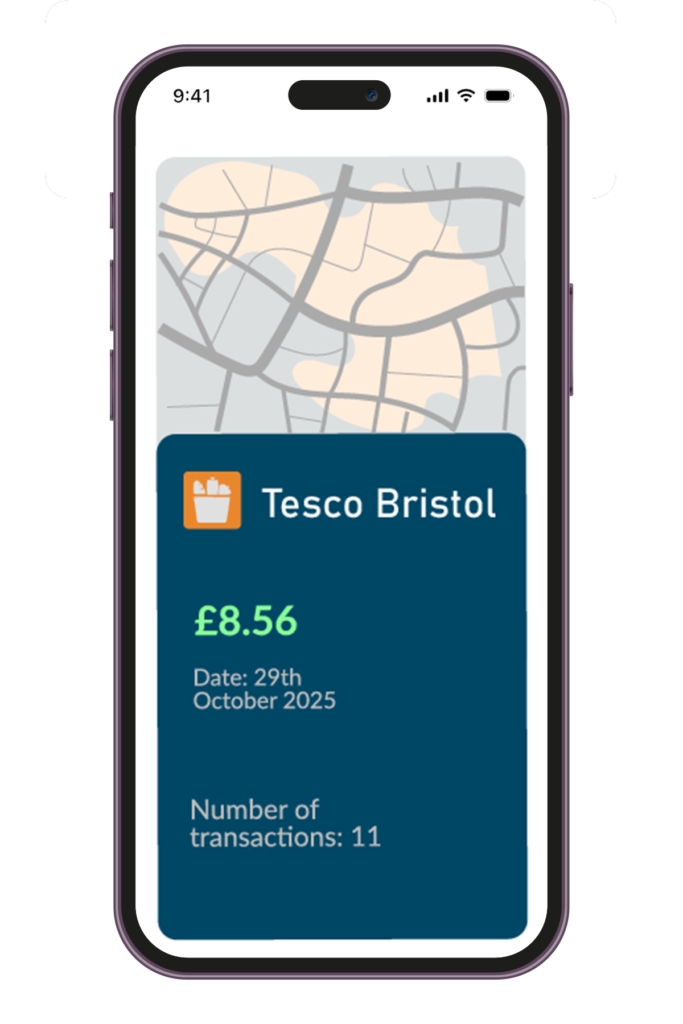

Instead, you will need a more reliable merchant identification (Merchant ID) conversion system to translate these opaque codes into the genuine business name, which would look something like this:

What does poor merchant ID actually come down to?

Moneyhub Head of Data Science, Daniel Cook, shares the two metrics to evaluate a merchant ID solution:

- Coverage: the frequency of identifying business names, “What percentage of the time can a merchant name be found?”

- Accuracy: the precision of the business names, “When a merchant is identified, what percentage of the business names are actually correct?”

Issues in either of these areas lead to the system failing at the crucial moment: when a customer needs to confirm their spending quickly.

Daniel tells us about one bank whose merchant data hasn’t been properly updated in the last five years. The thousands of businesses that have been established since then simply don’t get categorised correctly, leaving the bank exposed and at-risk of confusing their customers.

How to improve merchant identification?

Improving a weak in-house merchant ID system is a mammoth task. It requires an extensive, dedicated effort to create the logic, build the database, and implement continuous maintenance. Daniel shares:

“Fine-tuning a weak system takes 3-5 years, costing approximately £6 million and requiring hoards of dedicated Developers and Data Scientists. We’d know—it took us years to improve our own categorisation and enrichment accuracy from 55% to a market-leading 98%.”

For a bank, this means a major commitment of capital and human resources toward a non-core function. Your team will be consumed by data cleaning and maintenance rather than focusing on customer-facing innovation.

That’s exactly why more financial institutions are now choosing to outsource their categorisation and enrichment engine to partners like Moneyhub:

- It’s already built and market-leading: the Moneyhub Categorisation and Enrichment Engine is already tested and performing better than most (if not every) in-house legacy system

- Focus on innovation: outsourcing allows your in-house development teams to build on solid foundations. Instead of spending years matching merchant IDs, they can focus on leveraging the accurate, enriched data to create new, personalised services.

We can only speak from the perspective of Moneyhub, but our Tier 1 banking clients tell us they prefer to outsource because it immediately provides a data-intensive solution that is ready to go.

Our teams work collaboratively with the bank to understand the existing data structure and pain points, providing seamless integration to deliver frictionless, personalised, and optimised financial outcomes.

This means a rapid time-to-value, avoiding the long, expensive build-and-maintain cycle, so that internal teams can focus on leveraging the data, not cleaning it.

| Building in-house | Outsourcing | |

| Typical time | Multi-year (3-5 years) | 3-6 months for integration |

| Typical dev resource | 4 x Data Scientists

5-8 Software Engineers |

1 x Data Scientist

3-5 Software Engineers |

| Typical cost | £6 million | Vendor license fee + approximately £300,000 in employee costs |

| When issues arise | No reliability on outside vendors, giving full control over issues but no minimum standard, potentially derailing the project. | When issues arise, the response is fixed, as set by the Service Level Agreements with the vendor. |

2. Get granular with your transaction categorisation

Most financial institutions generate vast data sets, filled with advantageous insights that go beyond static, demographic checkboxes. But these data lakes often sit completely unused and unstructured, limiting its commercial value for decades to come.

“One common myth is that this is due to the huge volumes of data, but that’s not the issue. It’s the lack of structured insight. If transactions are labelled vaguely, that valuable data is almost useless for providing meaningful customer outcomes. What a waste!” – Daniel notes.

What does poor granularity look like?

(And why does it look a little like your data?) 👀

Granularity refers to the level of detail you can see within your data. It is the difference between seeing a transaction listed simply as ‘Shopping’ versus understanding it was ‘Online Clothing’ from a specific retailer. If your transaction taxonomy is too broad, the labels become vague, providing no actionable intelligence for either your customers or your teams.

A common example of poor granularity is a transaction being labelled only as ‘Retail’. This fails to tell the customer or the bank:

- Who the merchant was (solved by reliable merchant identification).

- What was purchased (e.g., groceries, electronics, clothing).

- Where it was purchased (the location, including the merchant or map view).

When the label is this vague, the customer cannot use it for budgeting, and your institution cannot use it to offer timely, personalised services. It undermines the goal of delivering frictionless, personalised financial outcomes.

But the heavy lifting is already complete – after all, you have the data. So how can you make it available for use?

How to improve transaction categorisation insights

In-house developer teams should focus on:

- Adding subcategories: expand your transaction taxonomy in the level 2 and 3 groups to ensure that transactions aren’t incorrectly dumped into generic ‘miscellaneous’ or ‘retail’ buckets.

- Improving the model: introduce machine learning to accurately map incoming transactions, preventing category drift.

- Measuring accuracy: implement rigorous, independent testing to measure the categorisation accuracy, potentially on a weekly or monthly basis.

“Doing this requires substantial effort in finding and cleaning vast training data, and continuous effort to iterate and maintain”, says Daniel. He is part of the team that trained the Moneyhub model on fifteen years of live transaction data across all of the major UK financial institutions. “This intensive work all contributed to our improved accuracy, a market-leading 98%”.

Transaction categorisation criteria

You already know the pros and cons of the build vs buy debate. So we’ll just show you what levels of accuracy, granularity and coverage you could achieve if you opt for Moneyhub, versus market alternatives:

| Factor | Market average provider | Moneyhub |

| Taxonomy | 3 levels | 3 levels for most categories

4 levels for lending |

| Merchant identification accuracy | 60-98% | 99% |

| Merchant identification coverage | 70-80% | 86% |

The Moneyhub Categorisation and Enrichment Engine provides confidence in accuracy and coverage across three levels of granularity.

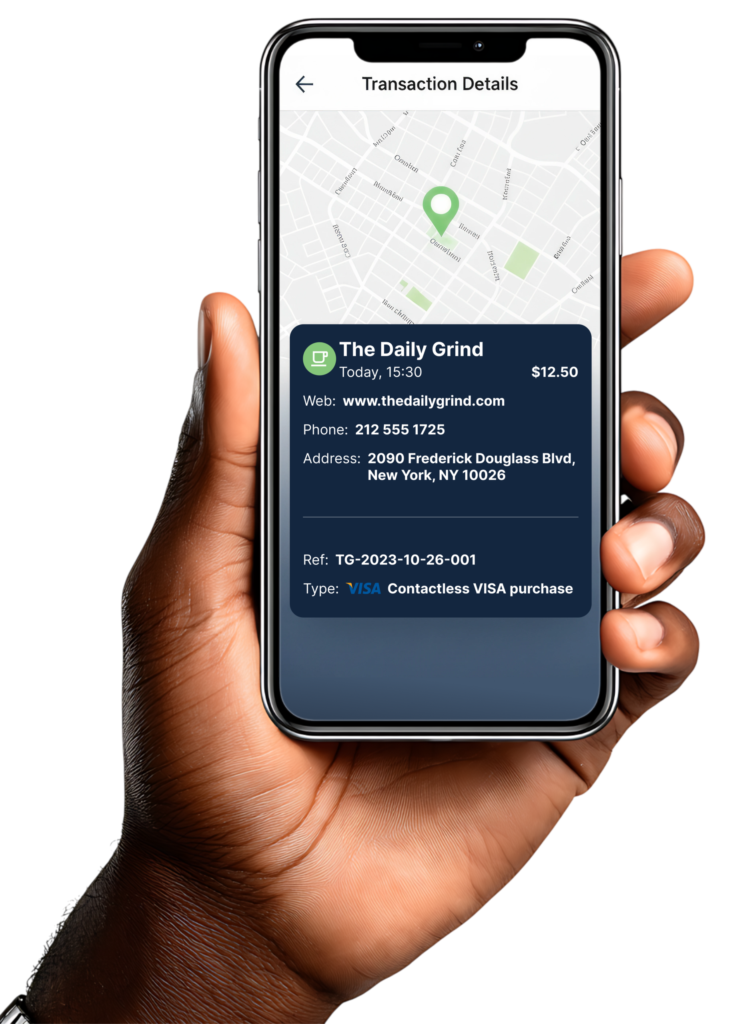

3. Add visual information for better recognition

If you’ve already achieved high merchant ID accuracy and transaction granularity, only one critical problem remains: cognitive load. Your customers don’t have the mental bandwidth, time or patience to cross-reference multiple lines of data to verify their purchase. When they open their digital banking app, they need instant clarity.

This is where enhanced enrichment – the addition of visual information for greater context – becomes the competitive advantage. Providing elements like merchant logos, map locations, and website addresses offers critical clues when the core transaction name is still slightly unfamiliar.

Our brains use context for visual object recognition. A financial transaction is an abstract event, but associating it with a geographical location on a map or a brand’s logo transforms it from an abstract, confusing string of text into a concrete, familiar memory. Even if a customer forgets the merchant’s name, seeing the location of the coffee shop or the business’s branding triggers rapid recognition, recovering the user experience.

How to integrate visual data into your model?

Visual data projects rely on geospatial mapping that most banks prefer to outsource, Daniel explains:

“The map part is easy, but figuring out the latitude and longitude, as well as the address where the merchant is located, is the hard part”.

Once completed, you can simply integrate this data with dynamic map displays that already exist through integration with platforms like Google Maps or Apple Maps. This offers a seamless and reliable view into the transaction location, without building, testing and iterating internal visualisation tools.

By providing this critical extra context, you’ll appeal to visual learners, help your customers to recognise their spending in your mobile app with ease, and reduce panicked calls to customer service.

4. Send real-time notifications

Finally, real-time in-app notifications is one of the best ways to help customers recognise their spending, because it should instantly align with their actions.

This is what we call the transaction-notification framework:

| Customer is shopping | Customer is not shopping | |

| Spending notification received | Customer is reaffirmed that you’re providing a high-quality service. | Customer suspects fraud and immediately raises a dispute – helpful for your team as the probability of false positives is low. |

| No spending notification received | No news is bad news. Customer is left to wonder when the transaction will clear their account, and doesn’t have a clear view on upcoming spending commitments, general budget or potential fraud. | Customer has an up-to-date view of their bank account and upcoming spending commitments. |

For most banks, sending real-time notifications is an easy win: you’re already processing transactions in real-time, so it’s not hard to share that data with your end users.

The result of spending recognition

When you implement reliable merchant identification and visual enrichment, the impact extends far beyond a cleaner transaction screen. “The ultimate result is that customers instantly recognise their spending, leading to immediate commercial benefits for your institution”, notes Daniel.

The core customer benefit is empowering better budgeting and financial control, but the ‘so what‘ for your business is a transformative change in efficiency and engagement.

Eliminate confusion, and its associated costs by solving problems at the data layer.

Increase productivity by reducing transaction dispute false positives.

And improve customer loyalty and growth with accurate personalised insights, driving deposits and your Net Promoter Score.

Moneyhub provides the framework for financial services customers to deliver frictionless, personalised, and optimised financial outcomes. Explore our Categorisation and Enrichment Engine to find the reliable data foundation you need to achieve these operational and customer loyalty gains.

Book a call to speak to a member of the team.

FAQs

Customer loyalty is built upon Communication, Choice, Control, and Connection. Focusing on proactive updates and transparent data usage will empower customers and foster an emotional link to your brand, and help you influence their money management.

Consumers struggle because banking apps display complex, raw Merchant IDs instead of recognisable business names. This high cognitive load creates anxiety, often leading the customer to fear fraud and call customer support.

The issue stems from the gap between the bank’s raw data and the customer’s mental model. Raw data contains strings of digits and abbreviations that hold no meaning for the user, resulting in a perceived risk. By failing to enrich this data with clear merchant names, logos, and locations, the bank forces the customer to do the verification work, creating a frustrating, high-friction experience.

Essential features blend seamless core functionality, such as instant balance checking and quick transfers, with robust, visible security measures like biometric login. Users consistently want clear transaction history, real-time transaction notifications and automated spending categorisation.

About Daniel Cook:

Daniel Cook is a data and analytics leader with a background in Software Engineering, Big Data, and Machine Learning. He really enjoys the intersection of Data Science and real-world impact. At Moneyhub, his team turns complex financial data into actionable insights and intelligence that help both businesses and consumers make better financial decisions.

Outside of the technical work, Daniel is passionate about cycling and has toured several countries including the full length of New Zealand.

share