The banking industry faces an uphill battle in customer perceptions, with all 18 banks in this 2025 study receiving negative net operational sentiment scores.

But it might surprise you to find out that falling victim to fraud is not one of the leading causes of customer dissatisfaction for financial service providers. Low sentiment scores are actually driven by factors like poor response times (67 minute average) and unsympathetic call handlers in the aftermath of the suspected fraud.

It’s time for Tier 1 banks to unclog the call centres. Moneyhub has helped some of the UK’s leading highstreet banks to replace the frustrations of big batch transaction processing with a streamlined and efficient approach, stopping the fraudsters in their tracks. And Product Director, Matt Barr, is ready to share his guidance on how to implement the right tech to stream, monitor and react to the data.

Ready to achieve a vast improvement in both operational efficiency and customer experience?

It’s a (not-so-simple) three step process:

- Know your transactions

- Monitor in real-time to detect suspicious activity

- Automate your fraud controls

Step 1: Know Your Customer Transactions

A quick Google search will show you that most of the fraud-related advice for financial institutions never extends beyond Know Your Customer (KYC).

While KYC is integral for both regulatory and operational purposes, the majority of banks have the data and the technology to do so much more.

“We’re helping banks to use their transaction data to limit the frustrations around fraud, reducing false positive transaction disputes, and systematically intervening at the first signs of suspicious account activity”, says Matt.

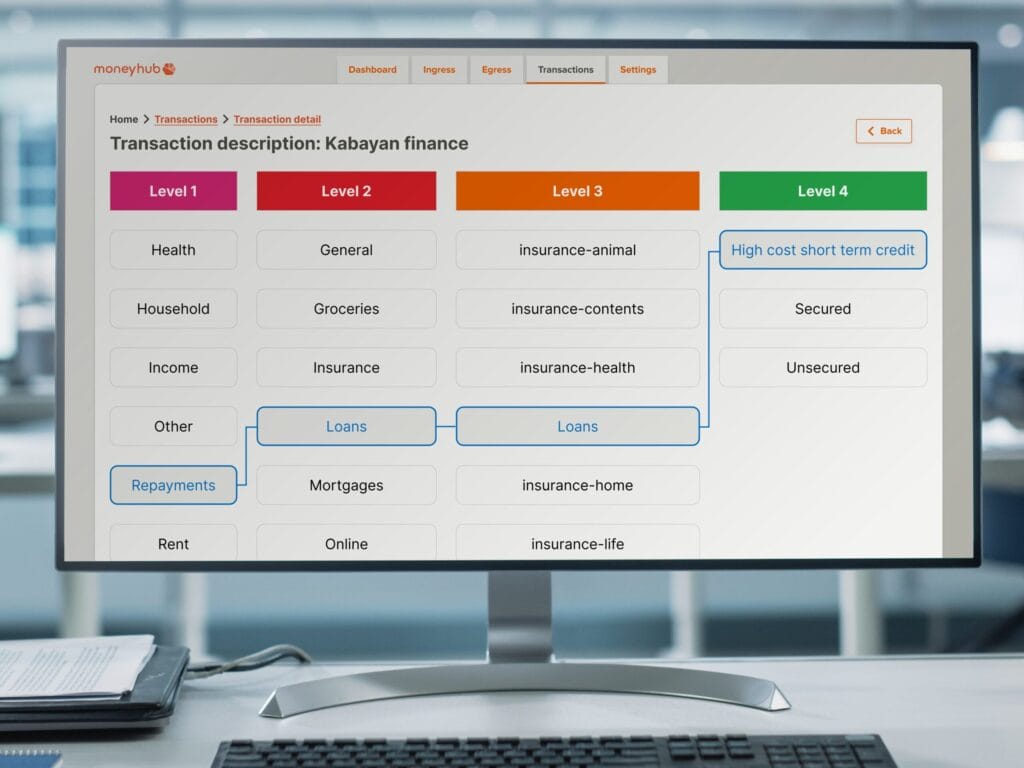

“This first step is about ensuring your foundations are steady: the ability to get granular with highly accurate transactions”

Go beyond personal details, proof of identity and due diligence checklists by mapping how your customers treat their finances:

- How much is typically spent

- When and where typically spending occurs

- What merchants (both by brand name and type) are typically spent with

This transaction monitoring system allows our clients to dive into the granular details and provides the insights to draw accurate conclusions, fast. By being able to build an idea of ‘normal’ behaviour, your analysts can confidently identify suspicious activity as it happens.

Hot take: transaction analysis is not worth doing if it’s not accurate

Transaction ingestion systems must cater for two sets of opposing needs: the ability to operate at scale, while also zooming into the detail of a single customer’s spending habits.

Internal categorisation and enrichment systems typically sit around the 70-80% accuracy level, which can leave a good portion of transaction descriptions still unrecognisable in your banking app. This is a problem in itself – with call centres at full occupancy because customers simply don’t recognise their own spending. Given frequent customer complaints about wait times and dropped calls, banks can’t afford to let poor transaction data further damage customer sentiment.

Moneyhub helps financial institutions to overcome this by categorising every transaction with granular detail, for both high coverage and high accuracy. We enrich 86% of transactions with merchant data that is 99% accurate. Beyond customer recognition, this data is reliable enough to feed into risk and fraud analytics, emitting results that analysts can act on, with confidence.

This data reliability is essential for confidently applying measures like payment blocking or account freezing. Only with this quality guarantee can banks risk these real-time intervention measures, because they contribute significantly to low sentiment scores when applied incorrectly.

How to improve transaction categorisation accuracy and coverage

To achieve the high accuracy and coverage needed for effective real-time fraud detection, financial institutions consider one of two paths:

Option 1: internal system improvement

You can choose to undergo a handful of cycles of significant effort to improve your existing internal transaction categorisation and enrichment system.

However, as Matt explains, building an effective machine learning model that is organically trained by millions of your customers, is incredibly difficult in the UK finance scene:

“It takes time to build up the feedback loop for the model to learn how customers are interacting with their enriched transactions. Are they accepting your model’s categorisation, or changing the category? Is your category taxonomy fit for purpose, or are users creating lots of custom categories to better manage their finances?”, he notes. ““Beyond that, engines need tuning to run at extremely high throughput.“

Tier 1 banks require thousands of transactions per second, 24/7, 365 days per year. But having a low latency option is also important, especially for transactions that need enriching on the fly – live in the hands of the user in their banking app.

Internal system improvement is therefore not just a data or financial fraud problem, but an engineering and architecture problem too.

Option 2: outsourcing to a specialist

The second option, which is often faster, more reliable, and ultimately more cost-effective, is to outsource your categorisation and enrichment engine to a specialist provider like Moneyhub.

| Internal system improvement | Outsource to Moneyhub | |

| Pros |

|

|

| Cons |

|

|

Empowering customers to recognise their transactions

Your default fraud detection system should be reliant on machine learning, rather than your customers.

Matt explains, “machine learning and AI excel at recognising complex patterns and spotting anomalies in massive datasets, enabling more accurate fraudulent activity detection in real-time. Customers, on the other hand, are often busy, may not check their balances frequently, and are prone to human error, meaning they are not a reliable primary defense.”

But as an extra layer of security, empowering your customers to recognise their transactions is still useful. If the transaction description is clear, customers can act as extra eyes for fraud detection. For instance, a customer who sees a suspicious but small charge pop up with a clear merchant name in their banking app can quickly flag it, potentially stopping a larger fraud attempt before it escalates.

If you want to learn more about this side of categorisation and enrichment, we’ve written a whole guide to helping customers recognise their transactions inside your online banking app here.

2. Monitor in real-time to detect suspicious activity

For decades, banks and payment providers have relied on batch processing for fraudulent transaction detection, collecting data over hours or even days before analysing it in one large batch. By the time this traditional method flags suspicious activity, the funds are already stolen and the damage is done.

Moneyhub helps banks change this outdated model by feeding the data, and the subsequent machine-learning analytical insights, into the financial institution’s fraud model in real-time.

Then, it’s up to our clients to automatically block payments or alert the customer when fraud patterns are spotted and intercept before the fraudulent act is complete.

The impact of ongoing monitoring: an example

Emma is a small business owner in Manchester with a business bank account at Evergreen Bank. All of her spending is clustered around business supplies, electronics and fuel in the North West.

Suddenly, a charge of £900 for a restaurant in London appears – likely a fraudster’s attempt to drain the account.

The key is the speed of the data and quality of the insights. Traditional batch-processing models would mean this £900 charge would have cleared hours before the spend shows up in Emma’s account. But with real-time Transaction Categorisation and Enrichment integrated into their fraud models, the bank can flag the behavioural and geographical drift as a fraud risk.

The fraudster is asked to provide extra authentication, either by providing a pin number or by authorising the purchase in-app. When this doesn’t happen, the risk scoring matrix increases, and the case immediately lands in an analysts dashboard, tagged as high-risk.

Fraud analysts no longer have to waste time investigating low-risk alerts in the customer data, as they see the full, enriched transaction history and risk score in one place. Instead of chasing the money trail after a fraudulent event, these team members become empowered to optimise the security response, finalising account lockdown and initiating the recovery process. It keeps the rest of the account funds safe, minimising financial loss.

Using machine learning and AI to detect suspicious spending

The key to effective real-time fraud detection is moving beyond traditional, rigid rule-based logic. While rule-based systems are simple, they are susceptible to errors and frequently miss sophisticated red flags, as fraudsters constantly evolve their tactics.

Here’s how our clients use AI powered fraud detection:

1. Pattern recognition

Machine-learning algorithms can pick out the subtle shifts within complex patterns and data points. For instance, seeing that a customer has spent money at Starbucks when they have previously only ever bought coffees at local, independent coffee shops. Not necessarily suspicious on its own, but a behavioural anomaly that should be flagged and monitored.

2. Adaptive learning

The key threat of fraud is that tactics are constantly changing and evolving, so you need a solution to match. Think about it: authorised push payment fraud and QR phishing have only existed in the last few years. We’re still just beginning to learn about deep fakes. Deploying AI means models dynamically adapt to new tactics and enhance their effectiveness over time, creating a constantly improving defence mechanism.

3. Scaling to rapid response

Unlike traditional batch processing methods, AI can scale to high volumes in real-time. The categorisation and enrichment engine at Moneyhub can comfortably process 48,000 transactions per second, which goes beyond even Amazon’s average of 29,000 product searches per second.

By integrating AI, financial institutions gain a proactive, intelligent system that drastically improves the speed and accuracy of fraud detection.

3. Automate your fraud controls

Detecting potential signs of fraud in customer accounts is only half the battle – the most crucial step is the ability to trigger an immediate, automated response.

The specific actions taken are determined by the financial institution, as banks have strict compliance obligations they must follow, and they know the best response for their specific risk profiles. Typical fraud controls may include:

- Payment blocks: instantly halting a suspicious transaction before it clears.

- Temporary account freezes: locking down the account if a series of high-risk transactions are detected.

- Card cancellation / replacement: automatically initiating the replacement of a compromised card.

Banks and financial institutions must choose to execute these controls at their own discretion. Partners like Moneyhub provide accurate and real-time data for actionable intelligence, and this integrates with our clients’ internal systems to take the actions themselves.

Nudging the customer

Imagine this: a purchase comes through on your customer Freddy’s account from ‘Maxima’, categorised and enriched as a supermarket in Lithuania, at a cost of £1. Then, ten minutes later another transaction from the same shop, this time for £2.

This ‘card testing’ (or card cracking) technique of small payments are supposed to go under the radar. But it’s typical behaviour for a fraudster, who is checking whether the card is valid before they attempt to make a larger purchase, or sell it on.

With the Categorisation and Enrichment Engine in play, you have the data to understand this customer’s spending patterns, and know that they haven’t recently bought from a flight operator, or spent anything else in Lithuania.

The transaction is instantly flagged and a velocity check takes place. You immediately send a notification to the Freddy’s banking app:

“Did you just spend £2 at Maxima? Click yes or no”

If the customer responds with no, you automatically execute a full payment block and initiate the next steps for account security. This swift interaction turns the customer from a passive victim to an active participant in the fraud prevention strategy, and stops the fraud before it can escalate.

Across a six month period in 2022, card processor Stripe tracked a wave of card testing attacks.

Fortunately, Stripe introduced their own transaction machine learning model to identify and block fraudulent card testing attacks, and they blocked an additional 400 million fraudulent transactions during the year.

“Fraudsters often make more than one card testing purchase before they go for the big purchases, so good quality data, in combination with nudging becomes even more crucial. If not, the consequences can be devastating, for the customer, the merchant and the banks”, said Matt.

This is just a single example, based on real fraudster behaviour, but nudges can be applied across a range of use cases to have their most impactful effects.

Identifying fraudulent spending in real-time is crucial for customer sentiment

The core challenge for financial institutions is no longer just preventing fraud, but preventing the customer frustration and reputational damage that results from slow, error-prone responses to it.

Empower your fraud analysts and improve the customer experience with the Moneyhub three-step approach: know your transactions, real-time monitoring, and automated controls. Implement the highly accurate and granular data that you need to produce a confident real-time fraud detection model, and shift your defence from slow and passive to proactive intervention.

If you’re ready to see how Moneyhub can integrate into your fraud model, explore the technology through a personalised demo with our team.

FAQs

Key fraud indicators are behavioural anomalies that deviate significantly from a customer’s established spending patterns. These often include small, rapid transactions (card testing), purchases made in new geographic locations, or spending at merchants that are completely new to the customer’s history.

AI and Machine Learning algorithms excel at recognising complex patterns and anomalies in large, streaming datasets, enabling far more accurate and faster fraud detection than traditional methods. These models use adaptive learning to continuously adjust to new fraud tactics as they evolve.

AI goes beyond simple rule-based logic by using sophisticated pattern recognition to spot subtle shifts in behaviour. Crucially, it allows for the real-time analysis of transactions, providing an instant risk assessment and rapid response to potential fraudulent activities before significant losses occur.

The most effective fraud detection solutions for banks are those that provide high-accuracy, real-time transaction enrichment combined with powerful, adaptive machine-learning capabilities. Banks should look for providers with industry-leading coverage and accuracy statistics.

To confidently apply fraud controls (like payment blocks or account freezes), banks need reliable data. The ‘best’ software must offer extremely granular transaction detail (e.g., four layers of granularity) to feed into the bank’s own risk analysis systems, allowing analysts to act with confidence. Banks must also ensure the solution integrates smoothly with their existing infrastructure to allow for the automated execution of their compliance-mandated controls.

Implementation requires establishing three core capabilities:

- the ability to ingest transaction streams instantly

- a system to analyse these transactions for potential fraud

- a mechanism to monitor and act on the analysis in real-time

Financial institutions must either undergo a resource-intensive internal improvement cycle or outsource this engine to a specialist.

About Matt Barr:

Matt Barr is a Product Director here at Moneyhub. He’s been working either with or for banks since the mid-00s, solving all manner of problems. From ISA transfers to corporate actions, Matt now focuses on transaction categorisation and enrichment. When he’s not solving client problems, you can find Matt buried under his children’s laundry or stomping through the Peak District.

share