TL;DR: Moneyhub has partnered with Nationwide Building Society to enhance customer financial wellbeing by providing AI-driven transaction categorisation and enrichment. This technology turns cryptic transaction data into clear, actionable insights for Nationwide’s 16 million customers across the UK, giving them greater clarity, context, and control over their finances. For Nationwide, this investment supports personalised products, reduces operational costs, and reinforces their mutual purpose by offering a genuinely helpful, digital-first banking experience.

At Moneyhub, our mission has always been clear: to drive better financial outcomes through responsible Smart Data and Open Finance. When we see a partner that shares those values, the potential for co-operation and industry-wide transformation is immense. That is why our recent partnership with Nationwide Building Society, the world’s largest building society, is such a pivotal moment for the UK financial landscape.

For Nationwide, a member-owned institution that prides itself on offering “a good way to bank“, data is the key to unlocking that promise at scale. By choosing Moneyhub as their data enrichment and categorisation partner, Nationwide is investing in the financial wellbeing of all 16 million of its customers.

Turning raw data into actionable insight

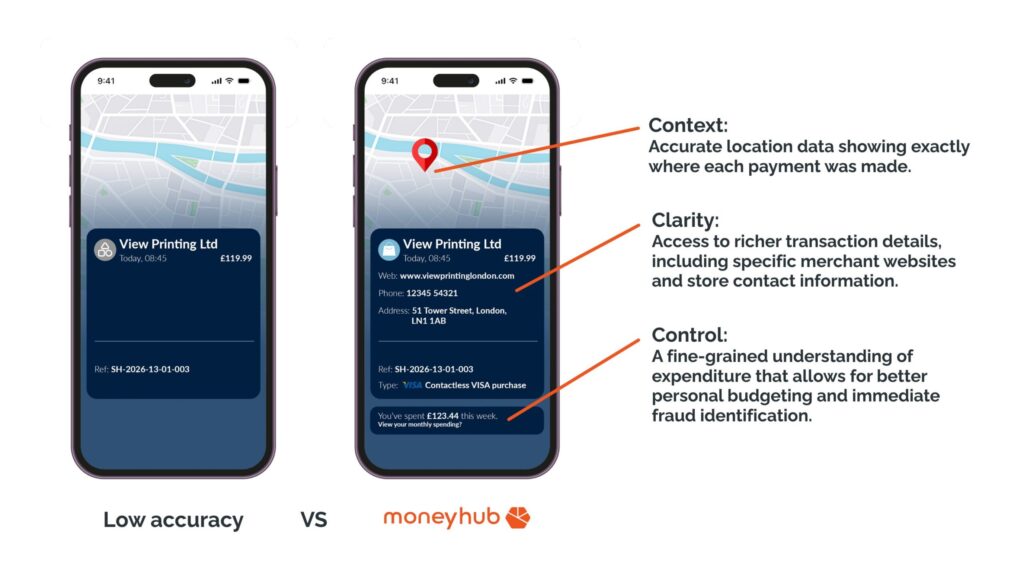

Traditionally, financial transactions have appeared as a list of cryptic codes and shorthand merchant names. This ambiguity doesn’t just frustrate customers, it creates a barrier to true financial understanding. Through the Moneyhub AI-driven Categorisation and Enrichment Engine, Nationwide is offering full transparency to customers.

Every transaction, from a morning coffee paid by card to a monthly direct debit and every type of income is now analysed and enriched. For Nationwide’s customers, this means:

- Clarity: access to richer transaction details, including specific merchant websites and store contact information.

- Context: accurate location data showing exactly where each payment was made.

- Control: a fine-grained understanding of their expenditure that allows for better personal budgeting and immediate fraud identification.

A foundation for fairness and innovation

Nationwide as an institution will also benefit greatly. In a competitive market, the ability to truly understand customer needs is a strategic differentiator. As Sri Kanisapakkam, Nationwide’s Chief Data and Analytics Officer, noted, this technology “sets us up for success with even more personalised products and services in the future.”

By leveraging our API-first platform, Nationwide can reduce operational costs and increase customer retention by delivering a digital experience that feels genuinely helpful rather than purely transactional. When a financial institution can proactively support a member because they have a holistic, granular view of that member’s financial journey, it isn’t just good business, it’s the embodiment of the mutual purpose.

Leading the Smart Data Revolution

This partnership is a testament to the power of our technology. We are not just providing a tool, we are providing the intelligence that powers a modern, digital-first banking experience. As we work alongside Nationwide, we are helping to pioneer a future where data and AI-driven technology serves the individual and builds long-term, trusting relationships.

I am delighted that Moneyhub is part of Nationwide’s journey to further enhance customer engagement and improve outcomes. Together, we are proving that when you put the right data in the hands of the right people, you don’t just change a bank statement, you change financial outcomes for the better.

To learn more about how Moneyhub can transform your customer engagement, visit our Categorisation and Enrichment solution page.

About Dan Scholey

Dan Scholey is the driving force behind the product strategy at Moneyhub. As Chief Product Officer, Dan is singularly focused on helping the world’s largest financial institutions to proactively deliver better financial outcomes for their customers. A true veteran of innovation, Dan previously pioneered the UK’s first Open Banking payment and steered a major fintech through its acquisition and growth at Experian.

share