Pension and Wealth Solutions

Targeted Support: make personalised recommendations

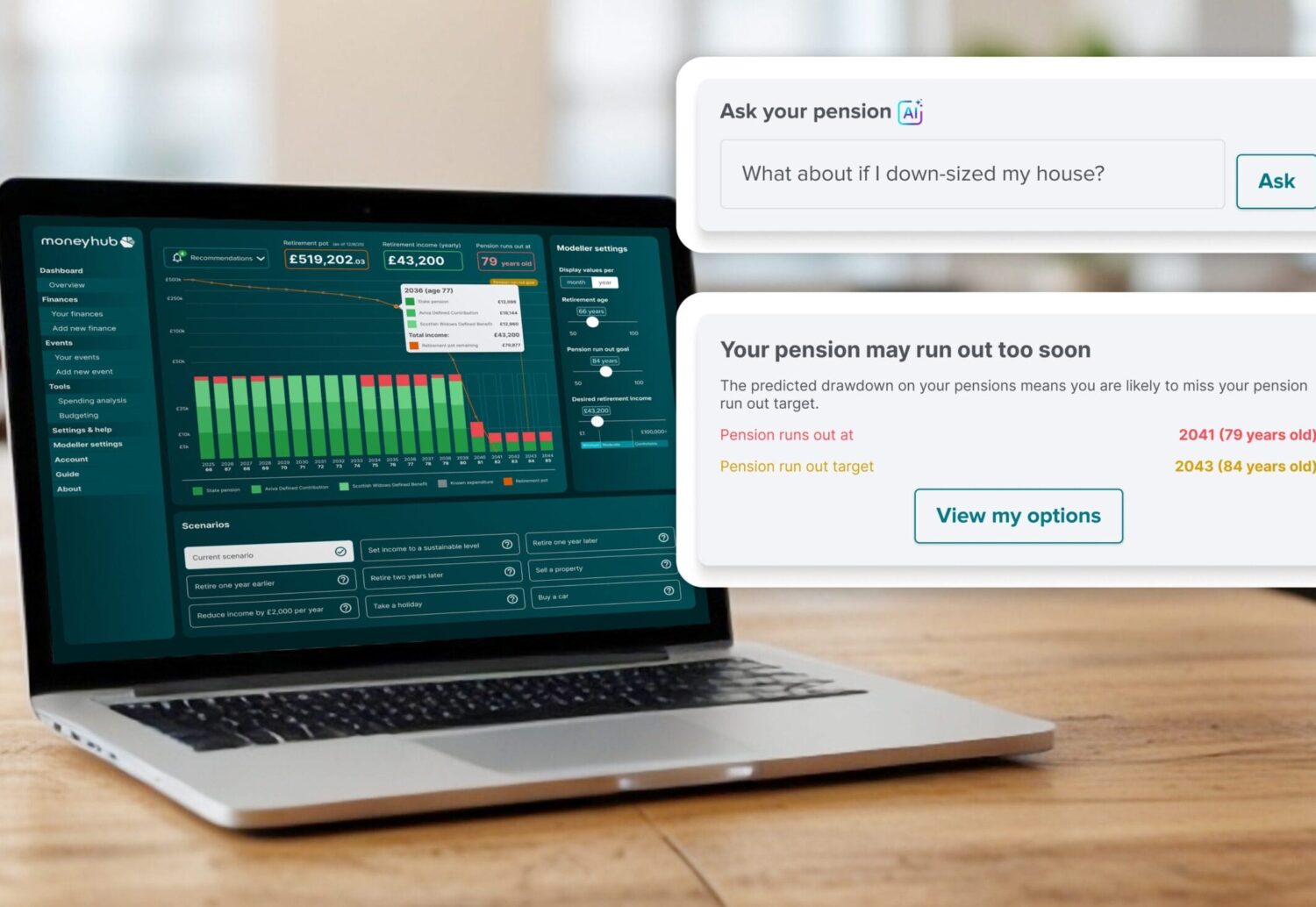

Confidently tread the line between 1-on-1 advice and generalised guidance to build better customer relationships. Win primacy, leading to greater lifetime value and consolidation onto your platform.

But without the right data and analytics capabilities to effectively segment users, it is almost impossible to provide this support in an auditable and consistent way at the level of granularity required. Yet, with the right technology, Targeted Support becomes an opportunity for growth.

As the compliance deadline approaches, 50% of wealth advice firms have already begun reviewing their client base for segments. Partner with Moneyhub to catch up on Targeted Support, and win back your members.

“As we continue our journey to equip Mercer Master Trust members to achieve the best possible pension savings outcomes, Moneyhub’s commitment and cutting-edge solutions remain integral to our success”

Tim Adams Head of Digital, Mercer

Plug and play

Firms need accurate segmentation to get their Targeted Support right. This extends far beyond pensions data, putting pressure on firms to access new sources of information they aren’t experienced in handling.

Access Moneyhub’s data analytics engine to receive quick and accurate segmentation across a wider range of data points. Our ready-made solution can get you up and running in as little as a month. Get rapid deployment and give your firm a clear differentiator in the bidding for employer mandates.

Boost user engagement by 62%

Cohort segmentation might feel like rocket science, but Moneyhub is already using it to create clear value for our clients. While the industry standard for pension app engagement is just 7%, integration with our platform encourages weekly logins, raising engagement to 69% for one client.

And in becoming the daily destination for money management, customers begin to trust you to guide them in making smarter financial decisions. Use the data to nudge customers, simplify decision-making, and see engagement rates grow.

Meet compliance requirements

Firms that proactively respond to Targeted Support will be held to high regulatory standards and must monitor the outcomes relating to Targeted Support messaging. Avoid financial and reputational damage by working with a highly-regulated provider that can get you the data you need.

Moneyhub operates with a clear, consent-driven process for accessing raw data, proven by initiatives such as the Data (Use and Access) Bill and co-founding the FDATA and financial grade API (FAPI spec).

Build new customer journeys fast and reap the early benefits of Targeted Support without increasing the risk of non-compliance penalties.