Moneyhub, the award-winning data and payments platform built on the principles of Open Banking and Open Finance has welcomed the Joint Regulatory Oversight Committee’s latest recommendations for the future of Open Banking in the UK. Published on the 17th April 2023, the recommendations set out the next phase for Open Banking.

Moneyhub responds to ministerial statement on Pensions Dashboards

Moneyhub, the award-winning Open Data platform and alpha partner to the Pensions Dashboards Programme (PDP) has responded to today’s ministerial statement on pensions dashboards.

Multiple pensions dashboards already a reality says Moneyhub in FCA and PDP consultation response

Moneyhub is already working with firms to create white labeled dashboards for clients

FCA and PDP launch consultations on pensions dashboards, covering the regulatory framework for dashboard operators and the design standards to be used

Moneyhub is making its response public in advance of the 16th February deadline to encourage the wider community to add their voices to the consultations

Moneyhub, the award-winning Open Data platform and alpha partner to the Pensions Dashboards Programme (PDP) has highlighted the Financial Conduct Authority’s (FCA’s) support for multiple pensions dashboards saying this is already a reality, in its response to the FCA and PDP’s consultations.

Moneyhub has also called for a greater emphasis on taking action as part of its response.

In its response to the consultations ahead of the 16th February deadline, Moneyhub welcomed the FCA’s and PDP’s proposals, focusing in particular on the FCA’s enabling of industry collaboration. Multiple commercial pensions dashboards will enable consumers to encounter and utilise dashboards from trusted brands from banks to pension providers, whom they have already built a relationship with.

And Moneyhub is already seeing a high interest from the industry, with many planning to whitelabel Moneyhub’s own platform in order to seek authorisation from the FCA and then enter the market and support their customers.

In addition, Moneyhub particularly supports the FCA’s findings that a simple ‘find and view’ service would not be going far enough for consumers. Moneyhub strongly supports the FCA’s proposal to allow authorised Pensions Dashboard Service (PDS) firms to also offer “post-view services” (PVSs). This will enable customers once they see all their pensions in one place to understand the possible next steps. This, for example, could be exploring consolidating the pensions or arranging a conversation with the government’s free PensionWise service.

Dan Scholey, Chief Commercial Officer at Moneyhub said: “The most recent proposals make clear that it is not the pensions dashboard, but dashboards in the plural. Most have been in the habit of thinking of a single pensions dashboard, but in the UK, it’s clear that there will be multiple dashboards available for customers to choose from.

“At Moneyhub we’re already working with industry leaders wanting to create their own dashboard to ensure their customers benefit from the programme and achieve better outcomes. The FCA’s decision to encourage industry collaboration will have numerous benefits. Dashboards will be easily accessible where consumers already are and among financial products they understand. This allows customers a convenient touch point in apps they already use to check their potential retirement income, and importantly make informed decisions to benefit their later life.

“We have been impressed with the high bar set by the FCA’s and PDP’s extensive and detailed proposals. As market leaders, Moneyhub strongly supports the proposals, but we encourage others to also add their voices to these critical consultations – which is why we are publishing our detailed thoughts on the key topics now.”

Find out more about Moneyhub’s response to the FCA and PDP consultations.

ENDS

Contacts

Ingrid Anusic Eleanor Ross

Marketing Director, Moneyhub Senior Account Director, Teamspirit (PR Agency)

ingrid.anusic@moneyhub.com ERoss@teamspirit.uk.com

M: +44 783 722 6553 M: +44 7393 758 446

About Moneyhub

Moneyhub is a global ISO 27001 certified software developer of Open Banking, Open Finance, and Open Data applications. Its FCA-regulated Open Data platform enables companies to quickly and easily transform data into personalised digital experiences and initiate payments. Its APIs and fully customisable platform provide data aggregation, insights, notification nudges, and payment systems. As a result, clients have the consent-driven data and analytics they need to create super-personalised offers, products, and services. Hundreds of organisations, spanning finance to media and retail, rely on Moneyhub’s award-winning technology.

For more details, please visit www.moneyhub.com

Moneyhub completes £55 million funding round with an additional £15 million investment from the UK’s largest long-term savings and retirement business - Phoenix Group

Moneyhub, the market leading Open Finance, Open Data, and payments platform, today announces that it has secured a further £15 million in funding from leading savings and retirement business Phoenix Group. This funding now completes Moneyhub’s largest fundraise to date, totalling £55 million, following the £35 million in funding announced on 24 October 2022 from Legal & General and Lloyds Banking Group, with an additional £5m debt facility provided by Shawbrook Bank, partially subject to regulatory approval.

Innovative trials of retirement saving solutions for self-employed people show promise and will help to inform future solution design

Nest Insight, a public-benefit research and innovation centre, has today published the results of ground-breaking savings pilots testing new forms of flexible saving designed to fit with self-employed people’s needs and contexts. Forming the most recent stage of a multi-year research programme supported by the Department for Work and Pensions (DWP), Nest Insight collaborated on three trials: one with Penfold, a fintech pension provider; one with Moneyhub, an open data and payments platform; and another with the Nest pension scheme.

First two Unicorns revealed in Bristol to launch fundraising campaign in aid of Leukaemia Care

Unicornfest, run in aid of Leukaemia Care UK, is Bristol’s next arts trail planned for 2023. This week sees the start of its fundraising campaign to coincide with Giving Tuesday (Tuesday 29 November 2022).

Insurers least prepared sector for Consumer Duty regulations deadline

Only 8% of insurers are currently Consumer Duty compliant despite the first major deadline being just 9 months away, according to a new report from Open Data, Open Finance and payments platform Moneyhub. Indeed, Moneyhub’s research, undertaken by Opinium, showed that insurers are the least prepared for the incoming regulations compared to other sectors of the financial services industry.

Knowledge gap amongst investment, wealth and pensions industry as FCA Consumer Duty deadline looms

As the deadline for the FCA’s Consumer Duty regulations looms ever closer, concern amongst decision makers at investment, wealth and pension firms is growing, according to recent research from Moneyhub, the market-leading Open Data, Open Finance and payments platform.

Two thirds of banks and building societies are not yet Consumer Duty compliant

MorganAsh and Moneyhub join forces to address vulnerability and Consumer Duty

MorganAsh, the leading support services provider, and Moneyhub, the market leading Open Finance, Open Data, and payments platform, are working together to strengthen the ability of firms to understand, monitor and deliver good outcomes for vulnerable customers, in-line with the requirements of Consumer Duty.

Moneyhub kicks off current funding round with an initial £40 million from Legal & General, Lloyds Banking Group and Shawbrook Bank

Firms turn to tech and data to solve Consumer Duty woes as 38% admit limited knowledge of new regulation

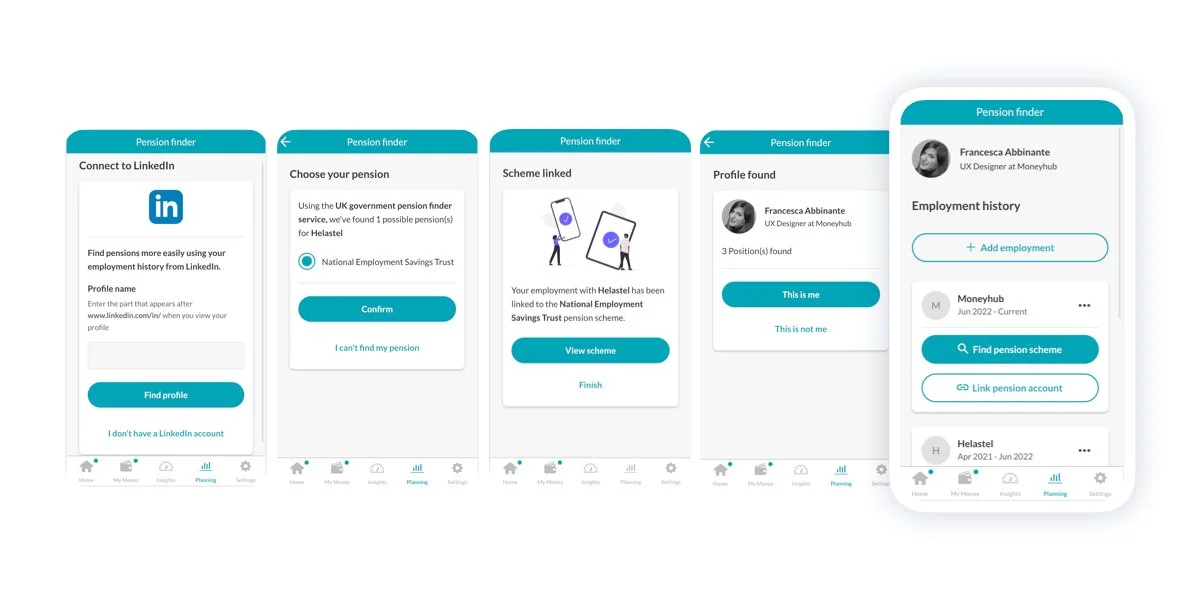

Moneyhub launches ‘Pension Finder’ that connects with LinkedIn profiles to find retirement savings gaps ahead of Pensions Dashboards

Moneyhub, the award-winning Open Data platform and alpha partner to the Pensions Dashboards Programme (PDP), has launched a new Pension Finder feature that can automatically identify gaps in retirement savings by analysing savers’ career histories on LinkedIn.

The UK government has calculated that people will have an average of 11 jobs in their career - each of which now results in them being auto-enrolled into a pension scheme. Participation levels were at 47% in 2012 and soared to 79% in April 2021. The rise in enrolment is also matched by an increase in old-age poverty which demonstrates the need for workers to take control of their pensions. One in five pensioners is now living in relative poverty in the UK, with the number of financially insecure pensioners increasing by 200,000 over the last year and soaring to more than two million.

The release of Pension Finder comes ahead of the launch of Moneyhub’s Pensions Dashboard, which is currently in alpha development and scheduled for early 2024, subject to FCA authorisation. Moneyhub felt an interim solution was required as savers still need and want to find their pensions.

Launched ahead of the Government’s Pensions Dashboards, which are expected to be introduced from 2024, Pension Finder is the world’s first extension of Open Finance using Open Data, allowing people to build a full picture of their pension and make crucial retirement plans by connecting the Moneyhub app with their LinkedIn profile.

Moneyhub’s Pension Finder is designed to help pension managers, workplace pension providers, trustees or advisors help their customers engage with their pensions, encourage them to save more cash for retirement and understand the long-term implications of their current financial situation and savings strategies.

Users can combine the pensions information found by analysing their career history with other information aggregated and calculated by Moneyhub in tools such as Moneyhub’s Lifestyle Modeller, which predicts people’s financial situation after a major event such as retirement to set lifestyle expectations.

Dan Scholey, Chief Commercial Officer of Moneyhub, said: “Too many people are failing to engage with their pensions meaning they are potentially missing out on a better retirement. In an era of inflation, it is important that savers take positive steps to guarantee their future financial wellness.

“When people have a complete financial picture they are able to make better decisions or get the help they need. The Pension Finder is an important addition to the capabilities of Moneyhub and will make financial admin easier and ultimately drive better outcomes for our clients and their customers.”

From April 2023, pension providers must make their data available to dashboards. It will revolutionise data providers’ customer service by enabling them to give savers the ability to securely search for all their pensions and see the wider context of all their financial assets including investments, savings, property, mortgages, and more.

In December 2021, PDP selected Moneyhub and two other potential commercial dashboard providers to work with the programme in an initial (alpha) six-month phase. In June 2022, Moneyhub’s dashboard became the first commercial dashboard to be successfully connected to the central architecture, in addition to the MoneyHelper non-commercial dashboard from the Money and Pensions Service.

Register to be the first to receive our Consumer Duty research white paper

Contacts

Ingrid Anusic

Marketing Director, Moneyhub

ingrid.anusic@moneyhub.com

M: +44 783 722 6553

Eleanor Ross

Account Director, Teamspirit (Moneyhub PR Agency)

ERoss@teamspirit.uk.com

M: +44 7393 758 446

About Moneyhub

Moneyhub is a global ISO 27001 certified software developer of Open Banking, Open Finance, and Open Data applications. Its FCA-regulated Open Data platform enables companies to quickly and easily transform data into personalised digital experiences and initiate payments. Its APIs and fully customisable platform provide data aggregation, insights, notification nudges, and payment systems. As a result, clients have the consent-driven data and analytics they need to create super-personalised offers, products, and services. Hundreds of organisations, spanning finance to media and retail, rely on Moneyhub’s award-winning technology.

For more details, please visit www.moneyhub.com