Moneyhub has connected its potential pensions dashboard with the central digital architecture developed by the Government’s Pensions Dashboards Programme (PDP)

Moneyhub CEO Samantha Seaton joins FDATA Global board as a Non-Executive Director

Moneyhub partners with Envizage for financial planning first

Moneyhub teams up with Wyzr to automate financial planning

Vodafone offers new social tariff for those experiencing financial hardship

Moneyhub presents potential pensions dashboard capabilities and possibilities

Moneyhub partners with Samsung for world-first Open Banking self-service payments

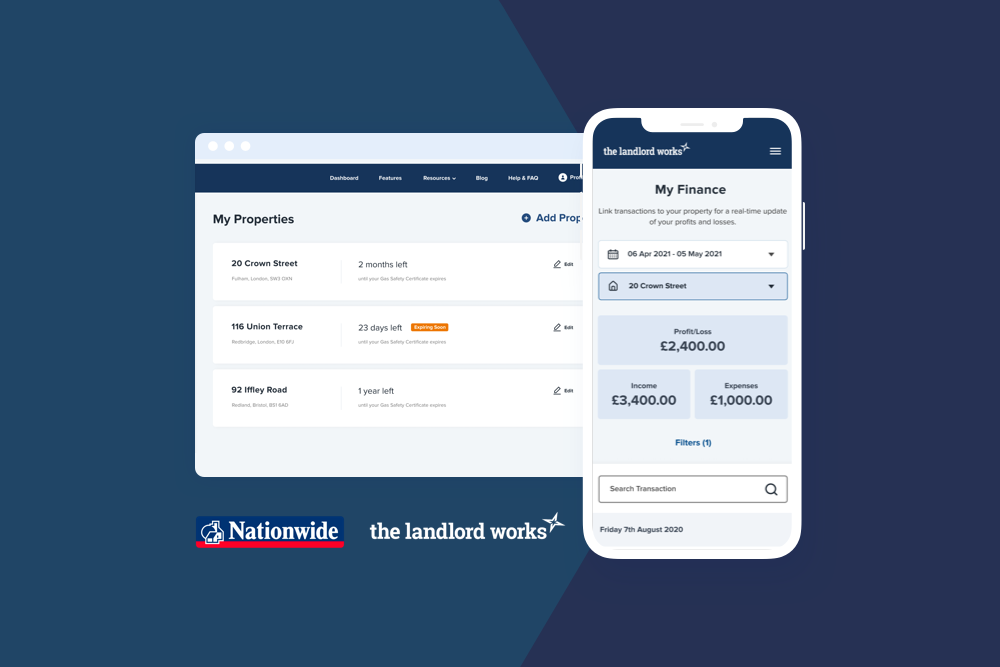

Moneyhub develops ground-breaking tool that allows landlords to manage portfolios for Nationwide’s The Landlord Works

Moneyhub calls for greater data-sharing among financial firms to support FCA Consumer Duty Proposals

Mouseprice and Moneyhub announce Automated Home Valuation Model partnership

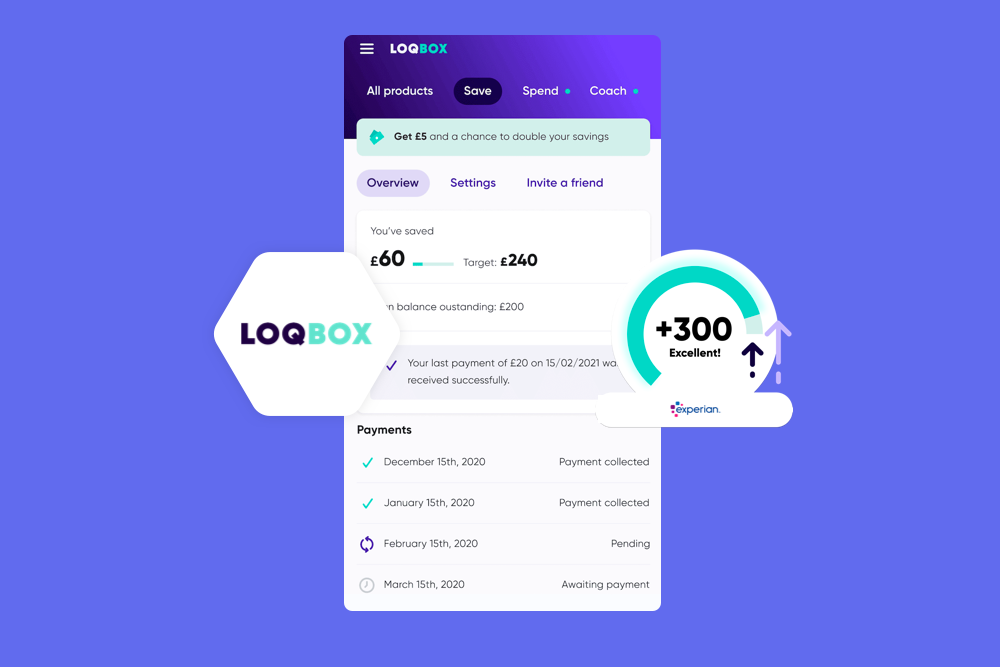

LOQBOX and Moneyhub give renters the opportunity to build credit worthiness

92% of LOQBOX members who currently rent, want to own their own home, according to a recent survey. To help them achieve their goal, LOQBOX has launched a brand new feature, LOQBOX Rent, allowing members to use Moneyhub!s open banking technology to track and report rent payment behaviour to Ex perian. This will help renters to build their credit worthiness, making them more eligible for a mortgage in the future.

Moneyhub hands trust and control over to consumers through move to Open Data

Moneyhub continues growth with senior hires

Moneyhub, the market-leading Open Data and payments platform, today announces that Paul Tutton has joined the team from NatWest as Product Owner- API and Connections. Cath Walls also joined the team as Product Owner- Platform Clients. Paul and Cath’s arrivals are the latest in a series of new senior hires as the business continues its strong growth going into 2022.

Moneyhub launches world’s first Open Banking and Open Finance front line support service

Moneyhub partners with Mutual Vision to bring Open Banking leadership to building societies

Moneyhub, the market-leading Open Finance data, intelligence and payments platform, is partnering with financial technology platform Mutual Vision to harness the power of Open Banking and Open Finance for the benefit of UK building societies.

Pensions Dashboards Programme announces potential pensions dashboards providers that will support service development

The Pensions Dashboards Programme (PDP) has selected three potential pensions dashboards providers to take part in initial development of the pensions dashboards ecosystem. In addition to the Money and Pensions Service’s non-commercial dashboard, PDP looks forward to working with the following organisations:

Innovative pilots explore flexible ways for self-employed people to save for retirement

Today, ground-breaking savings pilots have been announced to test new forms of flexible saving that are designed to fit with self-employed people’s often variable and uncertain incomes. Nest Insight, a public-benefit research and innovation hub, is collaborating on two research trials: one with Penfold, a fintech pension provider; and one with Moneyhub, an open data and payments platform.

BR-DGE and Moneyhub join forces to make open banking a mainstream payment option

Moneyhub partners with Expense Once for Open Banking-enabled card payment reconciliation

Moneyhub, the market-leading Open Finance data, intelligence and payments platform, is partnering with expense management software provider Expense Once to bring the benefits and efficiencies of Open Banking to the often cumbersome process of reconciling credit card payments.

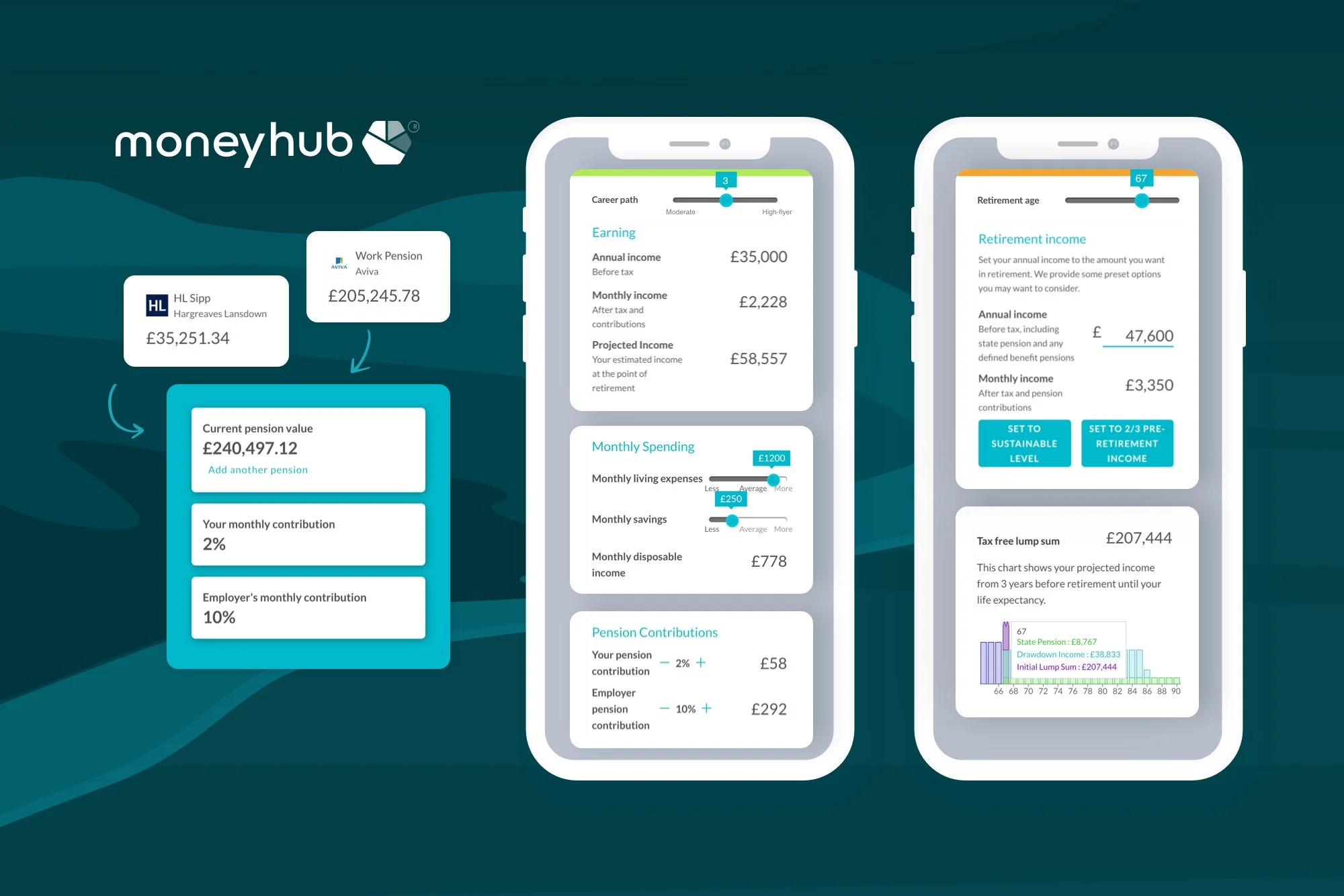

World’s First ‘Retirement Modeller’ Calculates Pension Income From Current Lifestyle

Moneyhub, the market-leading Open Finance data, intelligence, and payments platform, has launched a new “Lifestyle Retirement Modeller” which shows people how much income their pension will provide in old age and encourages them to start saving now. This feature is available to Moneyhub enterprise clients, who can customise it to their own needs.